- Canada

- /

- Oil and Gas

- /

- TSX:MEG

Assessing MEG Energy (TSX:MEG) Valuation After Recent Steady Share Price Performance

Reviewed by Simply Wall St

MEG Energy (TSX:MEG) shares have moved just over 1% in the past week, catching the eye of investors looking for steady performers in the energy space. With year-to-date gains at 26%, its latest moves invite a closer look.

See our latest analysis for MEG Energy.

MEG Energy has shown growing momentum, with the share price up 17.3% over the last 90 days and a 25.5% gain so far this year. Its longer-term results are even more striking, as it boasts a 941% total shareholder return over five years. This highlights robust growth potential.

If resource sector gains have sparked your interest, this could be the ideal time to broaden your search and discover fast growing stocks with high insider ownership

With the stock posting impressive returns but trading slightly above analyst price targets, the question remains: is MEG Energy undervalued at these levels, or has the market already priced in its next wave of growth?

Most Popular Narrative: Fairly Valued

At CA$30.11, MEG Energy’s share price sits just above the narrative fair value of CA$29.90. The narrative suggests investors are watching a delicate balance between deal risks and fundamental strengths.

Recent analyst activity around MEG Energy reflects diverging views on the outlook for the company, driven largely by heightened deal risk and transaction-related uncertainties. The following summarizes key perspectives currently shaping sentiment.

The real engine behind these numbers? It's not just another sector story. Massive expansion projects, new efficiencies, and bold profit forecasts are at the heart of what analysts see, but which figure truly tips the scales? Only the full narrative reveals how tightly those numbers are wound into today’s price.

Result: Fair Value of $29.90 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained high capital costs or setbacks at MEG Energy's core Christina Lake project could quickly disrupt the projected narrative of stable growth.

Find out about the key risks to this MEG Energy narrative.

Another View: Looking Beyond Multiples

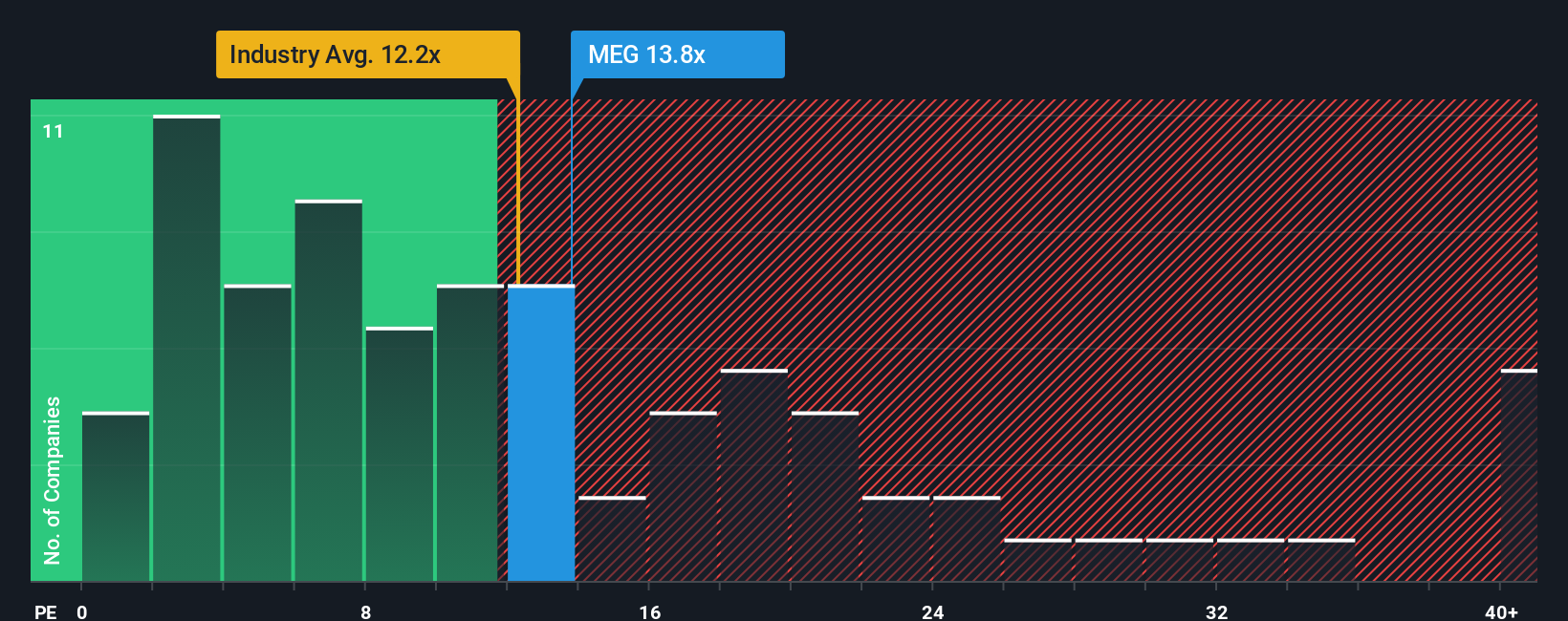

While MEG Energy’s price-to-earnings ratio is in line with sector averages and much lower than similar peers, it trades well above its fair ratio of 11.7x. This gap suggests the market could reprice if expectations shift. Are investors focused on recent strength, or overlooking valuation risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MEG Energy Narrative

If you think the story goes deeper or want to shape your own perspective, you can dive into the data and craft your own narrative in just a few minutes. Do it your way

A great starting point for your MEG Energy research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Unlock your next big win with advanced stock screens designed for smarter decisions and hidden gems you might otherwise overlook.

- Tap into high yields by checking out these 16 dividend stocks with yields > 3% that consistently reward shareholders and outperform traditional savings.

- Jump ahead of digital trends with these 25 AI penny stocks setting new standards in artificial intelligence, automation, and next-generation computing.

- Catch what's undervalued before the market wakes up by putting these 876 undervalued stocks based on cash flows on your radar for compelling growth at attractive prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:MEG

MEG Energy

An energy company, focuses on in situ thermal oil production in its Christina Lake Project in the southern Athabasca oil region of Alberta, Canada.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives