- Canada

- /

- Metals and Mining

- /

- TSX:ELO

TSX Penny Stocks To Watch In October 2024

Reviewed by Simply Wall St

The Canadian market has seen a notable increase, climbing 1.4% over the last week and rising 28% over the past year, with earnings expected to grow by 16% annually. For those interested in investing in smaller or newer companies, penny stocks—despite their somewhat outdated name—can still offer surprising value when backed by strong financials. This article will explore several penny stocks that stand out for their financial strength and potential for long-term growth.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| PetroTal (TSX:TAL) | CA$0.68 | CA$620.88M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.41 | CA$11.75M | ★★★★★☆ |

| Winshear Gold (TSXV:WINS) | CA$0.165 | CA$4.4M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.24 | CA$297.04M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.29 | CA$119.71M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.80 | CA$303.72M | ★★★★★☆ |

| Foraco International (TSX:FAR) | CA$2.40 | CA$221.84M | ★★★★★☆ |

| East West Petroleum (TSXV:EW) | CA$0.035 | CA$3.17M | ★★★★★★ |

| Newport Exploration (TSXV:NWX) | CA$0.115 | CA$12.14M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.11 | CA$30.89M | ★★★★★★ |

Click here to see the full list of 947 stocks from our TSX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Dundee (TSX:DC.A)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Dundee Corporation is a publicly owned investment manager with a market cap of CA$150.99 million.

Operations: The company's revenue is primarily derived from its Mining Services segment, which generated CA$3.72 million, along with contributions from Corporate and Others amounting to CA$4.00 million.

Market Cap: CA$150.99M

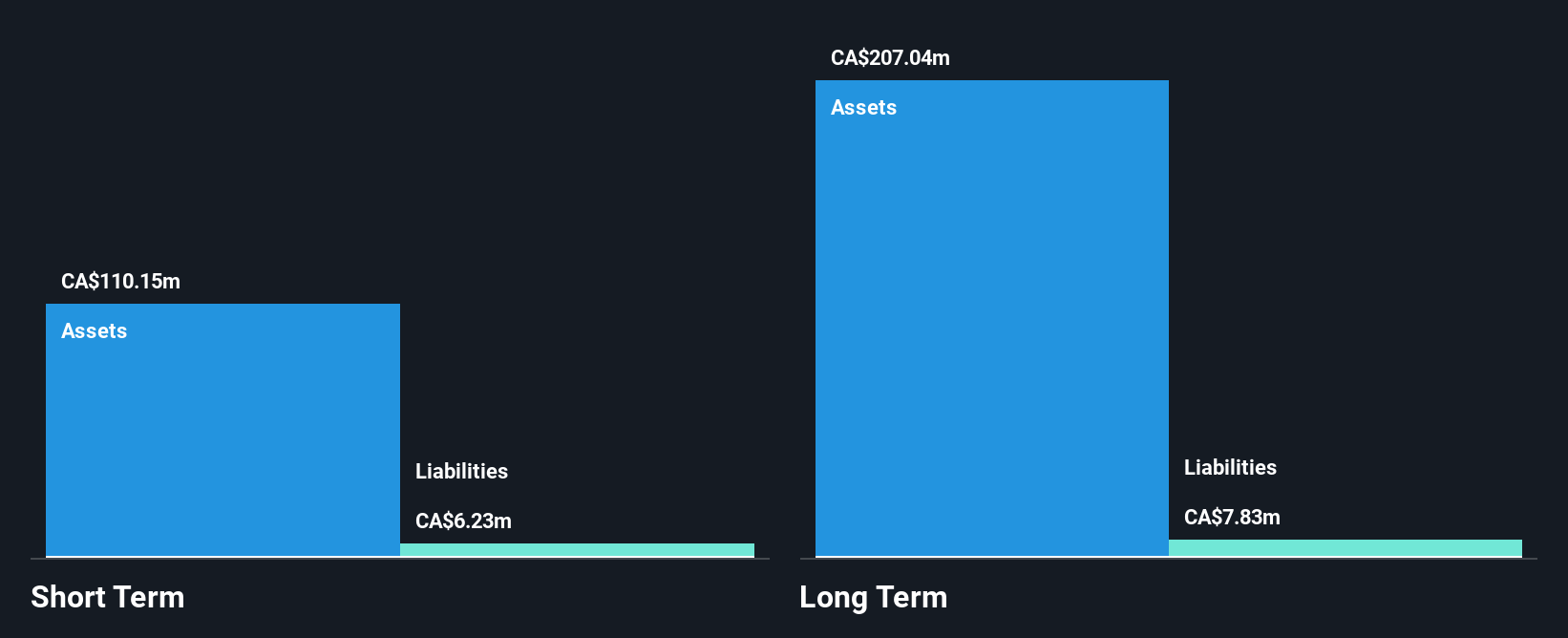

Dundee Corporation, with a market cap of CA$150.99 million, primarily derives its revenue from its Mining Services segment. The company has recently completed the redemption of preferred shares, which may improve financial flexibility. Despite lacking significant revenue streams (CA$6 million), Dundee reported substantial net income gains due to large one-off items impacting results. While the company's debt levels are satisfactory and short-term assets cover liabilities comfortably, operating cash flow remains negative. The management and board are experienced, but the Return on Equity is low at 9.3%. Its Price-To-Earnings ratio suggests it might be undervalued compared to the broader Canadian market.

- Click here and access our complete financial health analysis report to understand the dynamics of Dundee.

- Examine Dundee's past performance report to understand how it has performed in prior years.

Eloro Resources (TSX:ELO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Eloro Resources Ltd. is involved in the exploration and development of mineral properties in Bolivia and Peru, with a market cap of CA$93.14 million.

Operations: Eloro Resources Ltd. currently does not report any revenue segments.

Market Cap: CA$93.14M

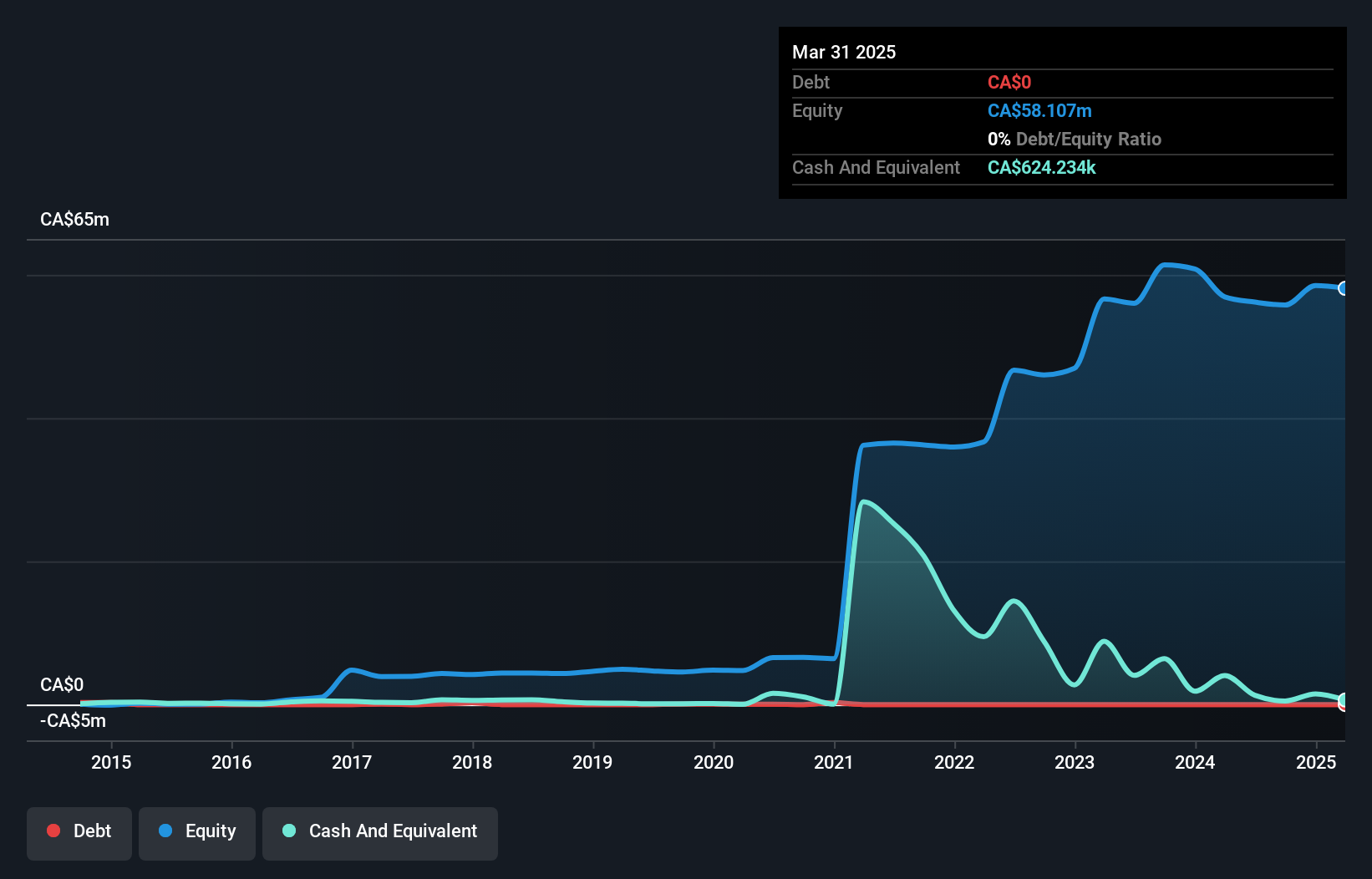

Eloro Resources Ltd., with a market cap of CA$93.14 million, focuses on mineral exploration in Bolivia and Peru but remains pre-revenue. Recent developments include a private placement to raise CA$2.7 million, potentially extending its cash runway beyond the current seven months forecasted under free cash flow estimates. The company is debt-free and has sufficient short-term assets to cover liabilities, though it faces ongoing losses without profitability expected in the near term. Management changes aim to bolster strategic direction as Eloro advances its Iska Iska project, emphasizing increased drilling density for better resource definition and potential economic viability assessments.

- Jump into the full analysis health report here for a deeper understanding of Eloro Resources.

- Assess Eloro Resources' future earnings estimates with our detailed growth reports.

Forsys Metals (TSX:FSY)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Forsys Metals Corp., with a market cap of CA$147.65 million, is involved in the acquisition, exploration, and development of mineral properties in Africa through its subsidiaries.

Operations: Forsys Metals Corp. currently does not have any reported revenue segments.

Market Cap: CA$147.65M

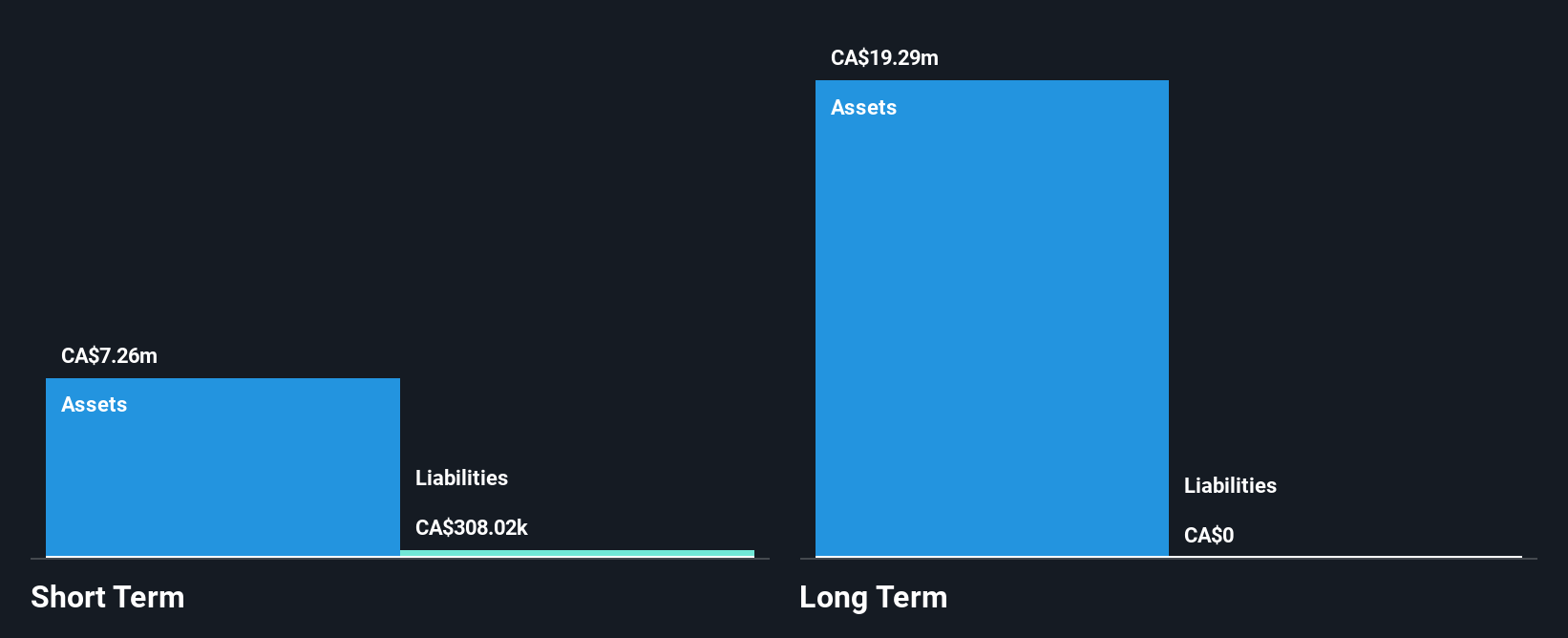

Forsys Metals Corp., with a market cap of CA$147.65 million, is pre-revenue and engaged in mineral exploration in Africa. The company recently reported significant interim drilling results from its Norasa Uranium project, indicating potential resource expansion at the Valencia site. Despite having no long-term liabilities and being debt-free, Forsys faces financial challenges with less than a year of cash runway based on current free cash flow trends. Additionally, there has been significant insider selling over the past three months. Recent management changes include the appointment of Pierfranco Malpenga to strengthen strategic oversight.

- Click here to discover the nuances of Forsys Metals with our detailed analytical financial health report.

- Examine Forsys Metals' earnings growth report to understand how analysts expect it to perform.

Make It Happen

- Jump into our full catalog of 947 TSX Penny Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eloro Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ELO

Eloro Resources

Engages in the exploration and development of mineral properties in Bolivia and Peru.

Flawless balance sheet slight.