- Canada

- /

- Energy Services

- /

- TSX:ACX

TSX Penny Stocks To Watch In September 2025

Reviewed by Simply Wall St

In Canada, recent economic indicators show a steadying labor market and inflation rates within the Bank of Canada's target range, contributing to a remarkable rebound in the stock market. As investors navigate this landscape, penny stocks—often representing smaller or newer companies—continue to offer intriguing opportunities for those seeking potential growth at an affordable entry point. Despite their historical connotations, these stocks remain relevant today by combining affordability with strong financials that can lead to significant returns.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$3.35 | CA$84.69M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.50 | CA$22.73M | ✅ 2 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.30 | CA$2.51M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.365 | CA$54.82M | ✅ 2 ⚠️ 1 View Analysis > |

| Zedcor (TSXV:ZDC) | CA$4.84 | CA$510.85M | ✅ 3 ⚠️ 2 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.24 | CA$824.97M | ✅ 3 ⚠️ 2 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$2.65 | CA$427.95M | ✅ 3 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.61 | CA$183.23M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.22 | CA$210.75M | ✅ 3 ⚠️ 1 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.75 | CA$9.33M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 417 stocks from our TSX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

ACT Energy Technologies (TSX:ACX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: ACT Energy Technologies Ltd., with a market cap of CA$165.87 million, offers directional drilling services to oil and natural gas companies in Canada and the United States.

Operations: The company generates CA$523.90 million in revenue from its directional drilling services provided to the oil and natural gas sectors across Canada and the United States.

Market Cap: CA$165.87M

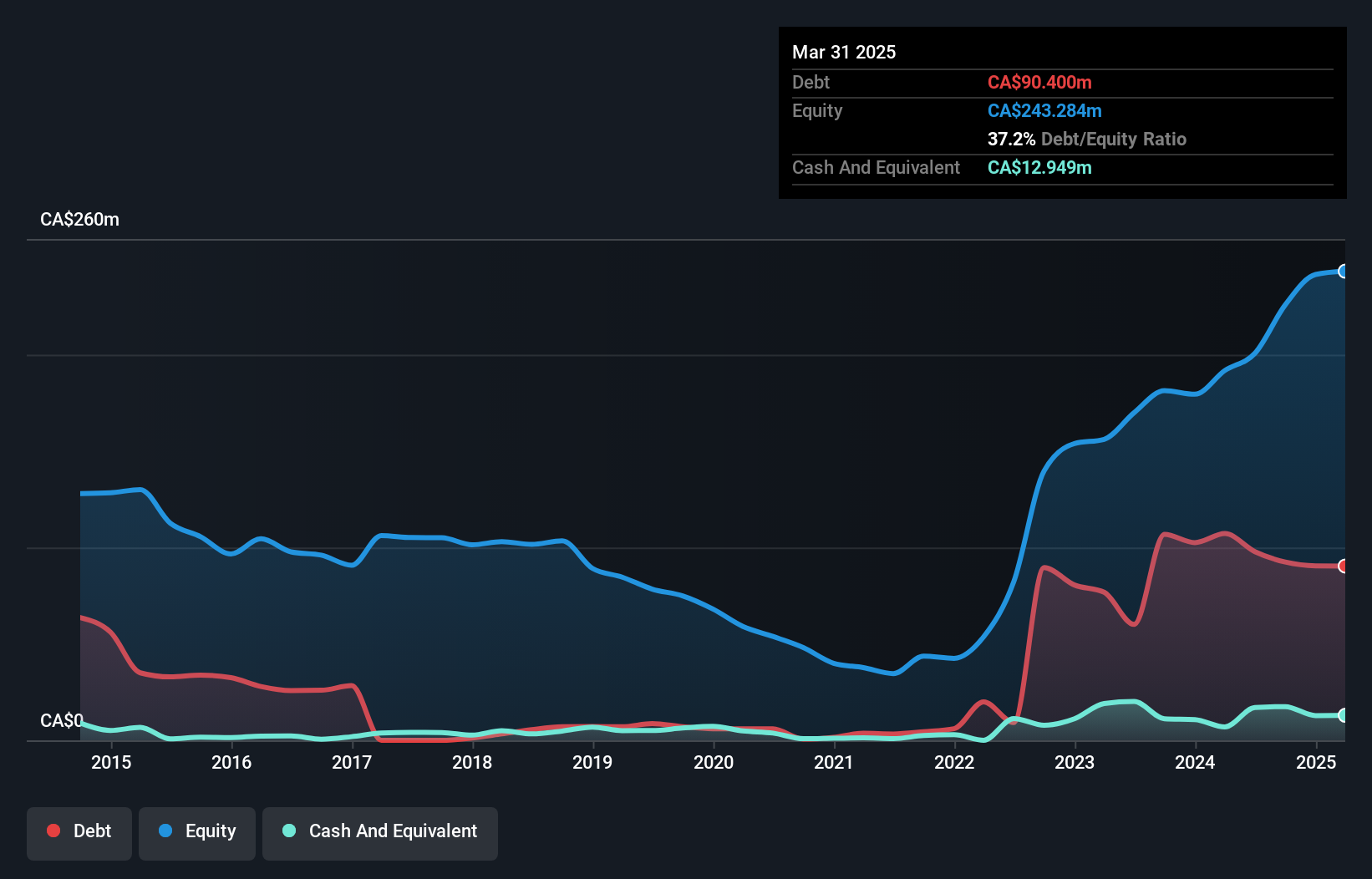

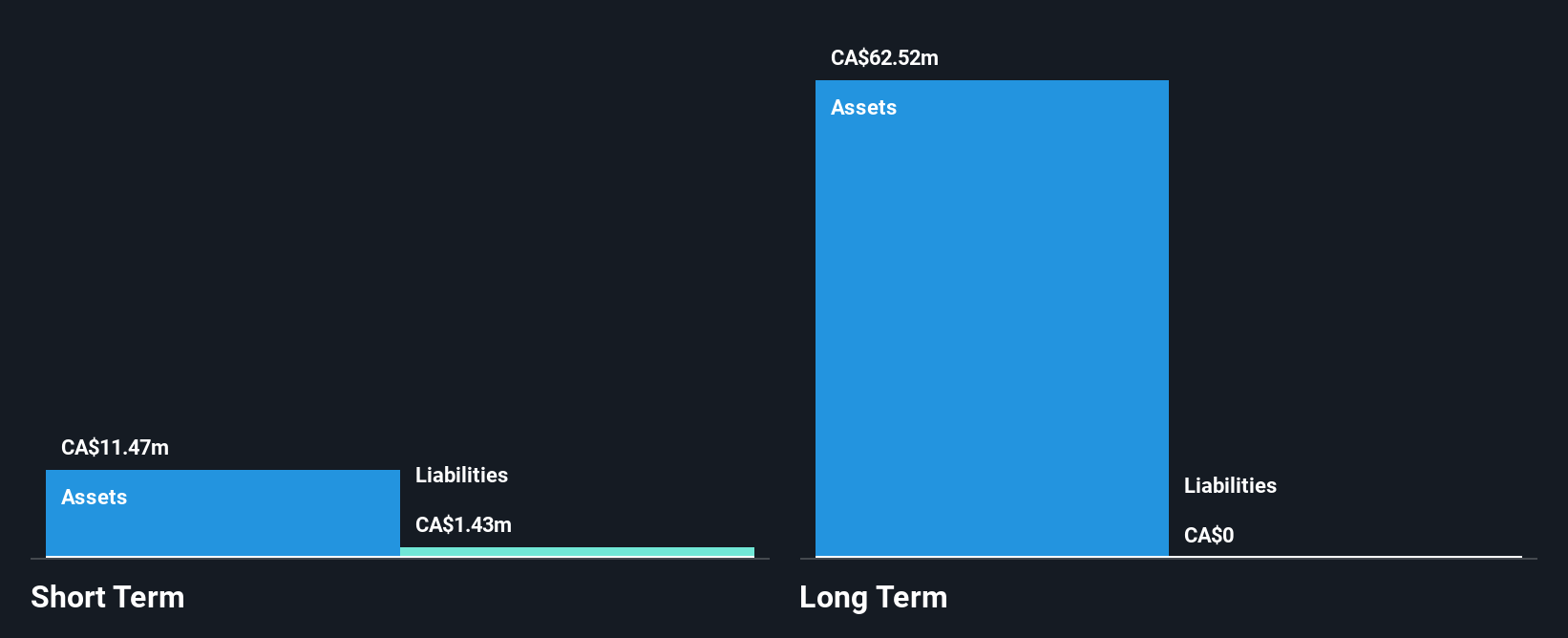

ACT Energy Technologies Ltd. has shown resilience despite recent challenges, including a net loss of CA$9.96 million for the second quarter of 2025 and significant write-offs. The company is trading at a substantial discount to its estimated fair value, with analysts projecting potential price appreciation. Its debt is well-managed, covered by operating cash flow and EBIT, while short-term assets exceed liabilities. Despite increased debt levels over five years, ACT maintains satisfactory net debt to equity ratios and high-quality earnings growth outpacing the industry average in recent years. The management team and board are experienced, enhancing operational stability amidst market volatility.

- Unlock comprehensive insights into our analysis of ACT Energy Technologies stock in this financial health report.

- Evaluate ACT Energy Technologies' prospects by accessing our earnings growth report.

Nations Royalty (TSXV:NRC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Nations Royalty Corp. is a royalty company that acquires royalties in the Canadian resource sector, with a market cap of CA$134.62 million.

Operations: The company generates revenue from the acquisition, exploration, and development of mineral properties amounting to CA$0.91 million.

Market Cap: CA$134.62M

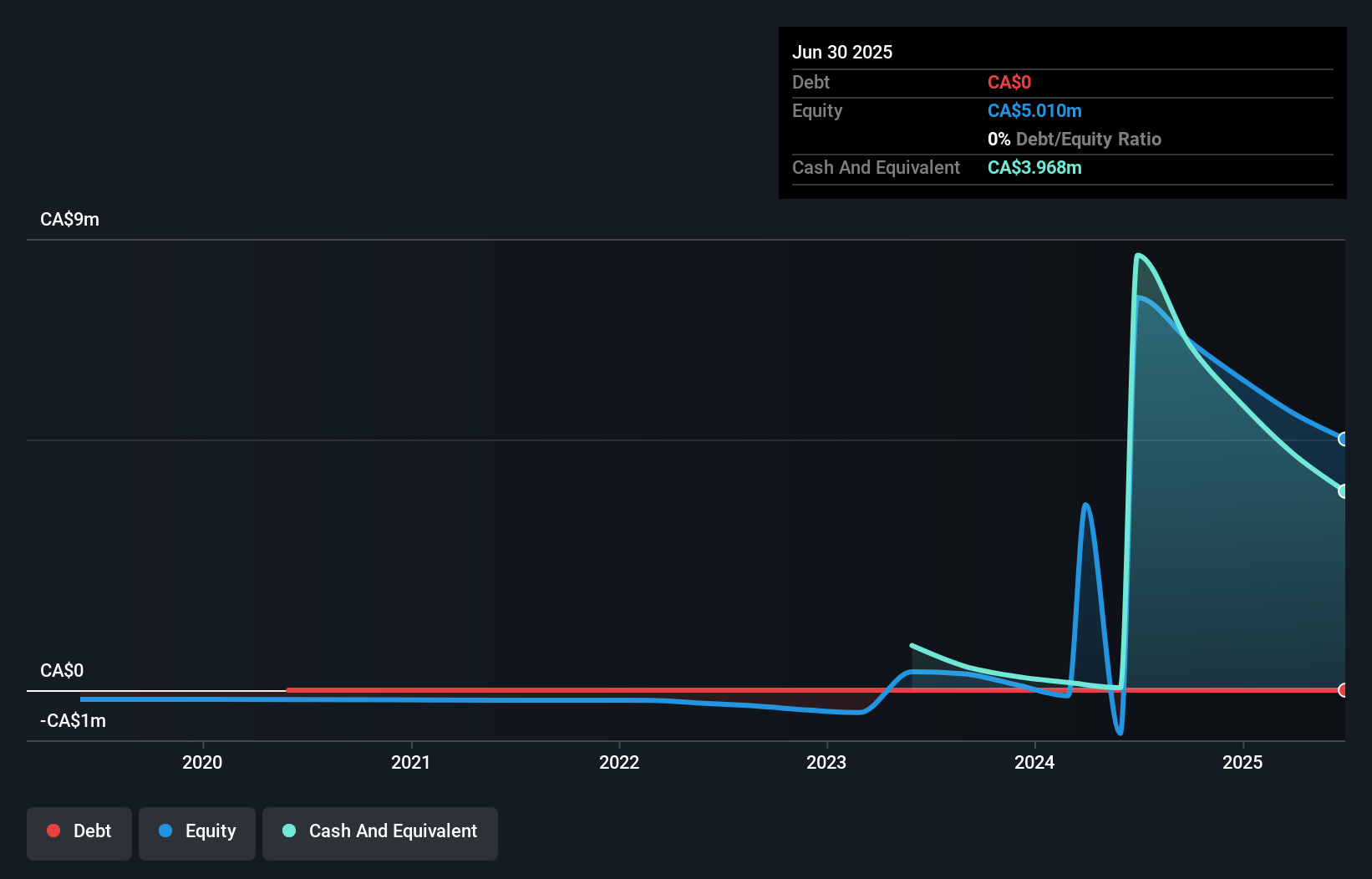

Nations Royalty Corp., a pre-revenue company in the Canadian resource sector, faces challenges with its unprofitability and a short cash runway of less than a year. Despite being debt-free and having short-term assets (CA$5.1 million) that surpass its liabilities (CA$115.2K), the company reported significant net losses, narrowing from CA$24.46 million to CA$1.06 million in its latest quarter ending June 2025. The management team and board are relatively new, with an average tenure of 1.3 years, which may impact strategic direction as they navigate financial constraints and aim for growth amidst declining earnings over five years by 80.2% annually.

- Jump into the full analysis health report here for a deeper understanding of Nations Royalty.

- Review our historical performance report to gain insights into Nations Royalty's track record.

Regulus Resources (TSXV:REG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Regulus Resources Inc. is a mineral exploration company operating in Canada and Peru, with a market cap of CA$291.10 million.

Operations: Regulus Resources Inc. does not report any revenue segments.

Market Cap: CA$291.1M

Regulus Resources Inc., a pre-revenue mineral exploration company, maintains a stable financial position with no debt and short-term assets of CA$9.7 million exceeding liabilities of CA$1.6 million. Despite being unprofitable, the company has reduced losses by 14.2% annually over five years and boasts an experienced management team with an average tenure of 12.2 years. Recent earnings reports show increased net losses for the third quarter ending June 2025 at CA$2.06 million compared to CA$1.5 million the previous year, but shareholders have not faced dilution in the past year, indicating potential stability amidst ongoing challenges in profitability.

- Click here to discover the nuances of Regulus Resources with our detailed analytical financial health report.

- Examine Regulus Resources' past performance report to understand how it has performed in prior years.

Summing It All Up

- Get an in-depth perspective on all 417 TSX Penny Stocks by using our screener here.

- Seeking Other Investments? Uncover 12 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ACX

ACT Energy Technologies

Provides directional drilling services to oil and natural gas companies in Canada and the United States.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives