- Canada

- /

- Oil and Gas

- /

- TSX:AAV

How Investors May Respond To Advantage Energy (TSX:AAV) Strong Nine-Month Earnings Amid Quarterly Volatility

Reviewed by Sasha Jovanovic

- Advantage Energy Ltd. recently reported its third quarter and nine-month results for 2025, showing revenue of CA$149.35 million in Q3 and CA$514.79 million for the nine months, with net income significantly increasing for the year to date.

- The company posted higher year-to-date production and earnings compared to last year, while quarterly production and net loss figures highlight some quarterly volatility.

- We’ll explore how robust nine-month earnings growth shapes the investment narrative for Advantage Energy going forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Advantage Energy Investment Narrative Recap

To be a shareholder in Advantage Energy, one must believe in the company’s ability to convert strong earnings growth and disciplined capital allocation into sustainable value, despite exposure to volatile natural gas prices and infrastructure headwinds. The latest quarterly results, with elevated nine-month net income and revenue, reinforce the importance of cash flow generation as a near-term catalyst, while persistent regional market risks remain top of mind. For now, this news does not materially shift the most pressing risks or catalysts for the business.

Among recent announcements, Advantage Energy’s updates on production volumes provide meaningful context. Although Q3 production was slightly lower year-over-year, the overall nine-month totals marked a solid increase, supporting the company’s narrative of operational improvement and expanded well productivity. This ongoing production performance directly contributes to the near-term outlook as higher volumes can help drive improved cash flow, especially amid fluctuating prices.

But while recent earnings highlight progress, investors should be aware that ongoing infrastructure constraints...

Read the full narrative on Advantage Energy (it's free!)

Advantage Energy's outlook anticipates CA$1.1 billion in revenue and CA$331.3 million in earnings by 2028. This scenario assumes a 20.5% annual revenue growth rate and a CA$277.2 million increase in earnings from today's CA$54.1 million.

Uncover how Advantage Energy's forecasts yield a CA$14.16 fair value, a 18% upside to its current price.

Exploring Other Perspectives

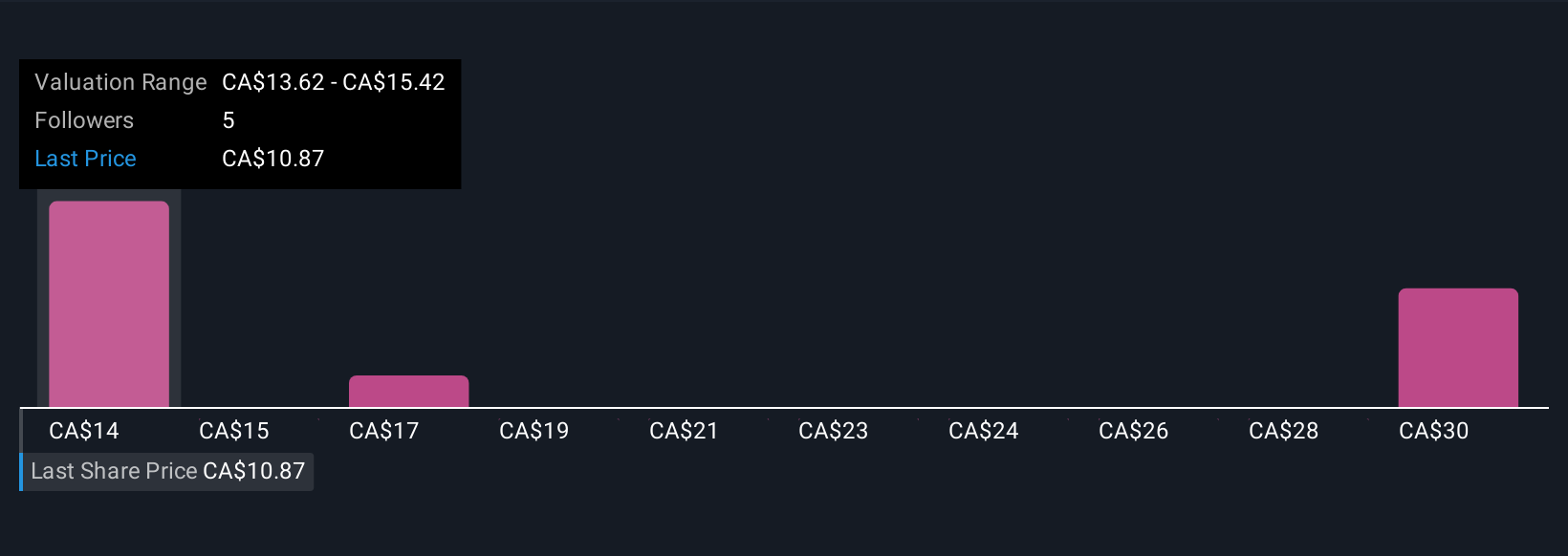

Four community members place Advantage Energy’s fair value between CA$13.62 and CA$35.13, with most estimates skewed above analyst price targets. As you weigh these diverse opinions, consider that infrastructure bottlenecks and price volatility continue to influence the company’s ability to convert growth into lasting returns.

Explore 4 other fair value estimates on Advantage Energy - why the stock might be worth just CA$13.62!

Build Your Own Advantage Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Advantage Energy research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Advantage Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Advantage Energy's overall financial health at a glance.

No Opportunity In Advantage Energy?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AAV

Advantage Energy

Engages in the acquisition, exploitation, development, and production natural gas, crude oil, and natural gas liquids (NGLs) in the Province of Alberta, Canada.

Solid track record with reasonable growth potential.

Market Insights

Community Narratives