- Canada

- /

- Oil and Gas

- /

- TSX:AAV

Advantage Energy (TSX:AAV) Valuation in Focus After Revenue Growth and Operational Gains

Reviewed by Simply Wall St

Advantage Energy (TSX:AAV) just shared its third quarter and year-to-date results, highlighting rising revenues and improved net income figures. The update also included stronger year-to-date production, which points to some operational momentum.

See our latest analysis for Advantage Energy.

After delivering stronger revenue and reversing last year's net loss, Advantage Energy has seen renewed interest from investors. The share price is now at $12.12, with a year-to-date price return of 20.72%. The recent gains have contributed to a notable 32.03% total shareholder return over the past year, suggesting momentum continues to build as operations improve.

If you’re curious about what else is moving, this is a perfect time to broaden your search and discover fast growing stocks with high insider ownership

With these strong numbers and the stock still trading below analyst targets, is Advantage Energy now an undervalued opportunity, or is the market already anticipating continued growth in its share price?

Most Popular Narrative: 14% Undervalued

Advantage Energy's current share price is trading below the fair value highlighted by the most widely followed narrative, which sees further upside if growth targets materialize. This sets up an interesting dynamic between the present momentum and potential for future gains, with much riding on the company's operational execution.

The anticipated ramp-up of LNG Canada export capacity is expected to ease oversupply and improve regional natural gas pricing for Western Canadian producers. This could meaningfully increase realized revenues and enhance earnings for Advantage Energy. The international transition from coal to cleaner-burning natural gas, particularly across developing markets, is likely to provide sustained demand growth and pricing support. This may drive long-term revenue and free cash flow growth potential.

Curious just how bold the projections behind this valuation really are? The entire price target hinges on a dramatic transformation of cash flows and profit margins, unlike anything in the company’s recent past. Which assumptions are powering this outlook, and could they reshape perceptions of what's possible here? See how all the pieces fit together inside the full narrative.

Result: Fair Value of $14.16 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent infrastructure issues or unexpected volatility in natural gas prices could sharply limit Advantage Energy’s growth and challenge the current optimistic outlook.

Find out about the key risks to this Advantage Energy narrative.

Another View: Price-Based Valuation Paints a Cautious Picture

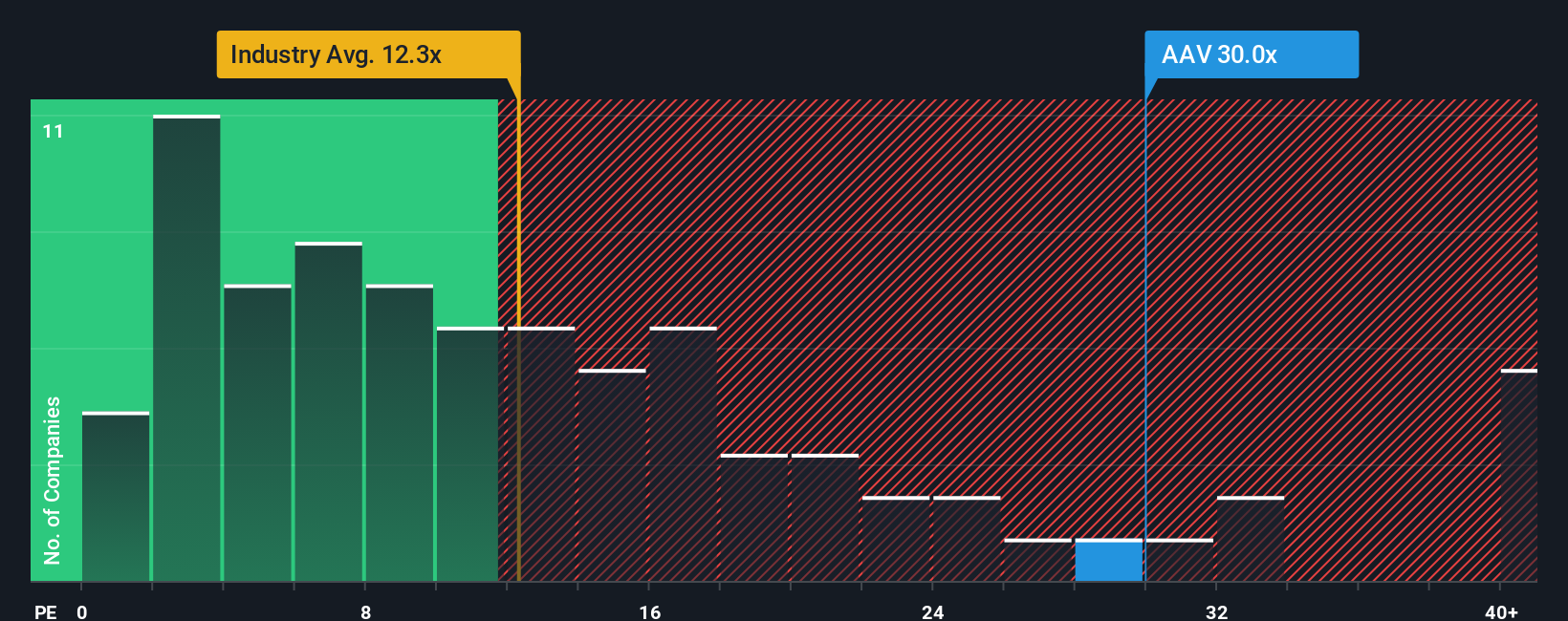

While the most optimistic outlook suggests Advantage Energy is undervalued, comparing its price-to-earnings ratio reveals it is trading at 33.4x. This is well above both its industry peers at 13.9x and what would be considered a fair ratio based on fundamentals at 19.7x. This premium might reflect faith in future growth, but it also raises questions about valuation risk if targets are not met. Is the market getting ahead of itself, or is there something the multiple is missing?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Advantage Energy Narrative

If you’d like to take a different approach or have your own perspective on Advantage Energy’s outlook, try building your own analysis directly. It’s quick and insightful. Do it your way

A great starting point for your Advantage Energy research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don't settle for just one promising stock when there are dozens of opportunities waiting for you. Your next winning idea could be just a click away. Why wait?

- Kickstart your search for cash-flow bargains by tapping into these 871 undervalued stocks based on cash flows, where under-the-radar stocks may be primed for a rebound.

- Boost your potential income by checking out these 16 dividend stocks with yields > 3% that are handing out yields above 3% to patient shareholders.

- Catch the next wave of tech innovation by uncovering breakthrough companies among these 24 AI penny stocks disrupting industries with artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AAV

Advantage Energy

Engages in the acquisition, exploitation, development, and production natural gas, crude oil, and natural gas liquids (NGLs) in the Province of Alberta, Canada.

Solid track record with reasonable growth potential.

Market Insights

Community Narratives