- Canada

- /

- Capital Markets

- /

- TSX:SII

Why Sprott (TSX:SII) Is Up 9.9% After Boosting Dividend 33 Percent on Record Asset Inflows

Reviewed by Sasha Jovanovic

- Sprott Inc. recently announced a 33% increase in its quarterly dividend to US$0.40 per share, payable on December 2, 2025, following strong third-quarter financial results and record-high inflows across its investment strategies.

- The company’s assets under management grew by 23% compared to the prior quarter, reflecting heightened demand for precious metals and diversified equity products.

- With Sprott’s substantial dividend increase underscoring management’s confidence, we’ll examine how these developments shape the company’s investment narrative.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Sprott's Investment Narrative?

Owning shares in Sprott Inc. means believing in the value of alternative assets, particularly precious metals and mining, as both a source of investor demand and a buffer during market stress. The company’s latest 33% dividend increase and record asset inflows reinforce a narrative of resilience amid ongoing uncertainty. These results could strengthen short-term catalysts, such as heightened interest in Sprott’s specialized products, while giving management fresh momentum with its product launches and expansion efforts. At the same time, the rapid appreciation in share price and rising premium to industry peers amplifies ongoing valuation concerns, especially as Sprott’s price-to-earnings ratio remains much higher than sector averages. This new dividend and AUM surge may temporarily ease questions about profit growth and payout sustainability, but risks like unpredictable precious metals prices and an expensive valuation remain closely tied to the story.

However, stretched valuations could pose challenges if market conditions shift unexpectedly.

Exploring Other Perspectives

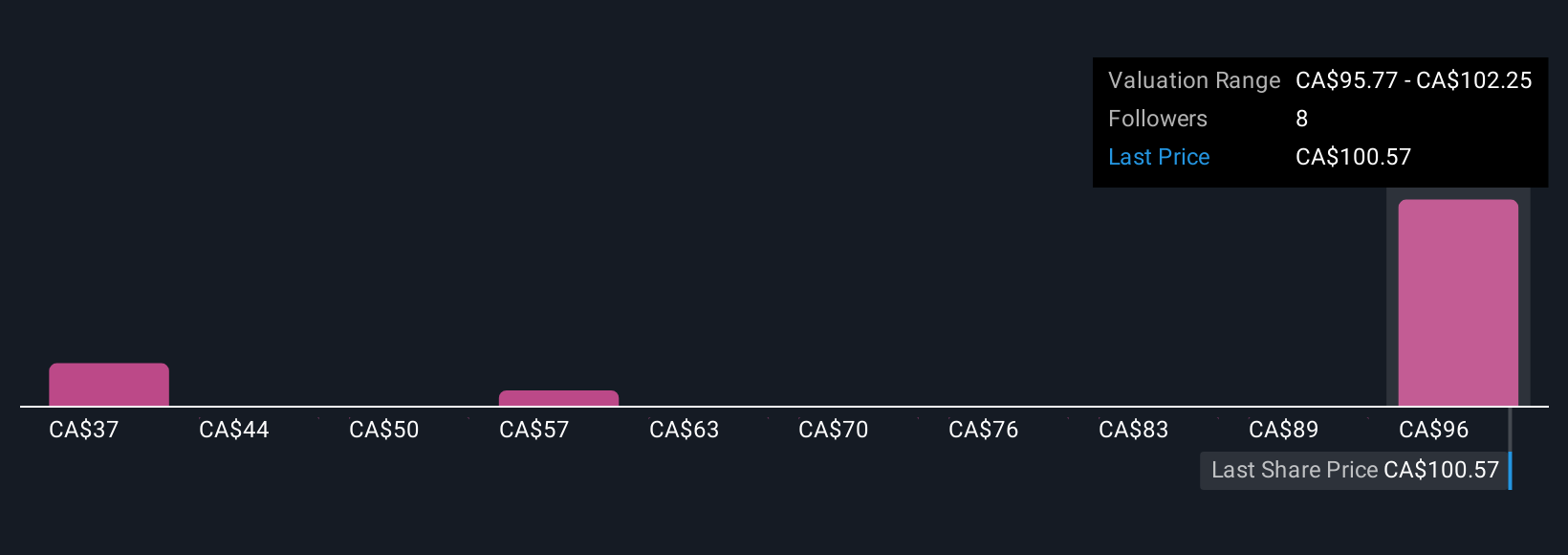

Explore 3 other fair value estimates on Sprott - why the stock might be worth less than half the current price!

Build Your Own Sprott Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sprott research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Sprott research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sprott's overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SII

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives