- Canada

- /

- Capital Markets

- /

- TSX:BAM

Brookfield Asset Management (TSX:BAM): Is the Current Valuation Supported After Recent Slowdown?

Reviewed by Simply Wall St

Brookfield Asset Management (TSX:BAM) shares have seen modest fluctuations over the past month, and investors are weighing the company's recent performance trends. The stock finished yesterday at CA$76.19, reflecting muted price action as the start of summer approaches.

See our latest analysis for Brookfield Asset Management.

Brookfield Asset Management has seen its share price start to cool off, with a 5.4% dip over the past month and total shareholder return edging down 1.1% in the last year. This recent pullback comes after steady gains earlier in the year, and suggests momentum has faded as investors await a stronger catalyst or clarity on future growth drivers.

If you’re sizing up where money might move next, it is a smart time to cast a wider net and discover fast growing stocks with high insider ownership.

With shares pulling back despite solid earnings growth, the key question now is whether Brookfield Asset Management is trading below its true value, or if the market has already accounted for future catalysts and potential upside.

Price-to-Earnings of 35.8x: Is it justified?

Brookfield Asset Management currently trades at a price-to-earnings ratio of 35.8x, placing a premium on its recent strong earnings growth and future expectations. With a last close price of CA$76.19, investors are paying up for the company's robust performance compared to some industry benchmarks.

The price-to-earnings (P/E) ratio measures what investors are willing to pay for each dollar of current earnings. This makes it a powerful metric for asset managers like Brookfield Asset Management. In capital markets, a higher P/E can reflect expectations of outsized growth or quality of earnings. Conversely, a lower P/E may indicate market skepticism.

Compared to the Canadian Capital Markets industry average of just 9.6x, Brookfield Asset Management’s valuation stands out as especially high. However, our analysis signals that this premium is strongly tied to Brookfield's record of high-quality, accelerating earnings and growth that exceed both market and industry averages. For further perspective, the estimated fair price-to-earnings ratio for the company is 36.5x. This suggests the market’s current level is close to what fundamentals might justify if growth continues at its current pace.

Explore the SWS fair ratio for Brookfield Asset Management

Result: Price-to-Earnings of 35.8x (ABOUT RIGHT)

However, slowing recent returns and valuations that already price in strong growth could limit upside if future earnings momentum does not persist.

Find out about the key risks to this Brookfield Asset Management narrative.

Another View: Discounted Cash Flow Tells a Different Story

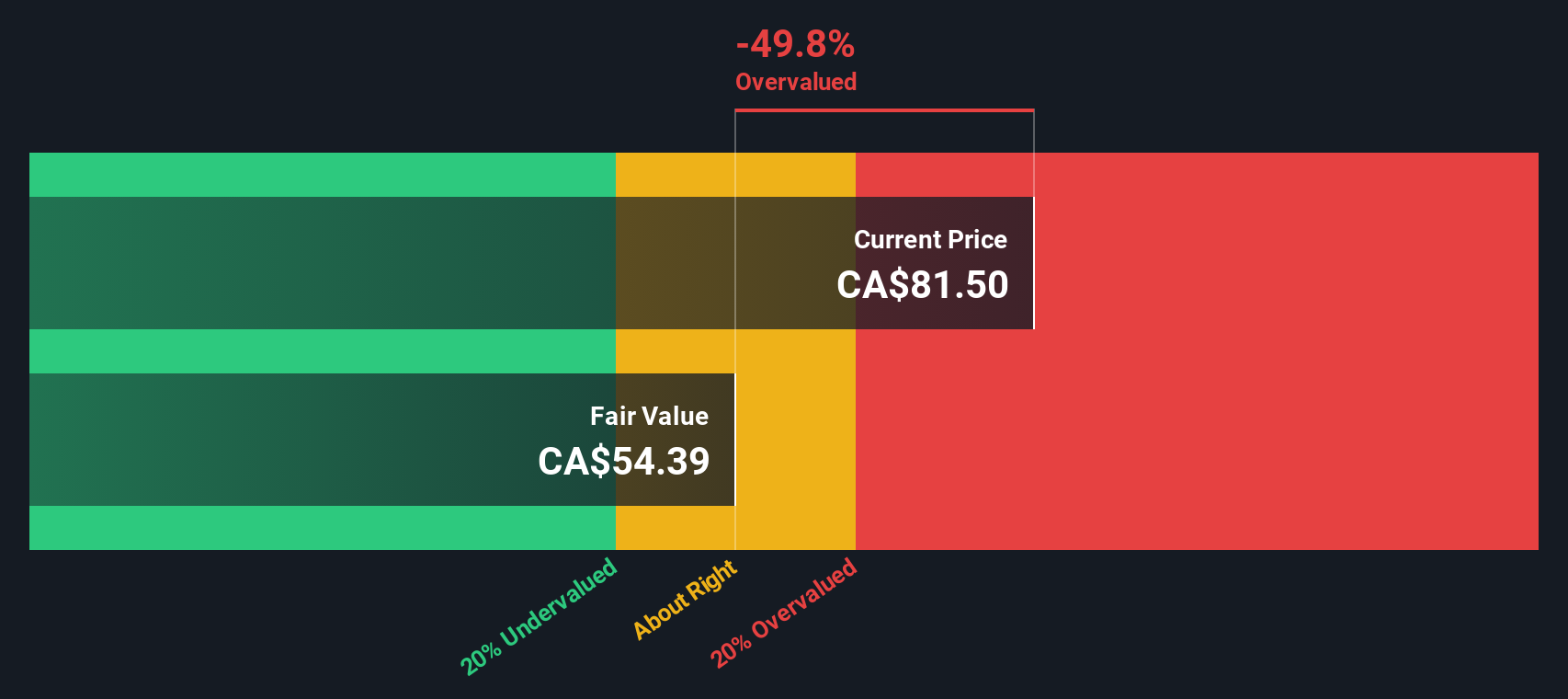

While the recent price-to-earnings ratio points to Brookfield Asset Management trading at about fair value, the SWS DCF model offers a different perspective. This approach values the company at CA$51.77, which is well below its current price and suggests the shares might actually be overvalued. Can a model focused on long-term cash flows challenge today's high expectations?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Brookfield Asset Management for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 849 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Brookfield Asset Management Narrative

Keep in mind, if you see things differently or want to dive into the details yourself, you can quickly build your own view from scratch in minutes, and Do it your way.

A great starting point for your Brookfield Asset Management research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Expand your investment horizons with unique opportunities you might be missing. Seize the moment to get ahead of the curve and uncover new potential winners today.

- Tap into tomorrow's technological shifts by checking out these 26 AI penny stocks, which offer outstanding potential in artificial intelligence and automation.

- Secure growing, reliable cash flow for your portfolio by finding these 20 dividend stocks with yields > 3% that provide attractive dividend yields above 3%.

- Capitalize on value opportunities with these 849 undervalued stocks based on cash flows, identified as trading below their intrinsic worth based on cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brookfield Asset Management might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BAM

Brookfield Asset Management

A private equity firm specializing in acquisitions and growth capital investments.

Outstanding track record with high growth potential.

Market Insights

Community Narratives