- Canada

- /

- Food and Staples Retail

- /

- TSX:NWC

Will North West’s (TSX:NWC) Consistent Updates Reveal a Competitive Edge in Remote Retail Markets?

Reviewed by Simply Wall St

- North West Company Inc. announced that it will report its second quarter results after market hours on September 8, 2025, followed by an investor conference call the next morning.

- This regular financial update is significant as the company operates 229 stores across Canada, Alaska, the South Pacific, and the Caribbean under recognized banners.

- We’ll explore how anticipation around the upcoming earnings release could shape the investment narrative for North West Company Inc.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is North West's Investment Narrative?

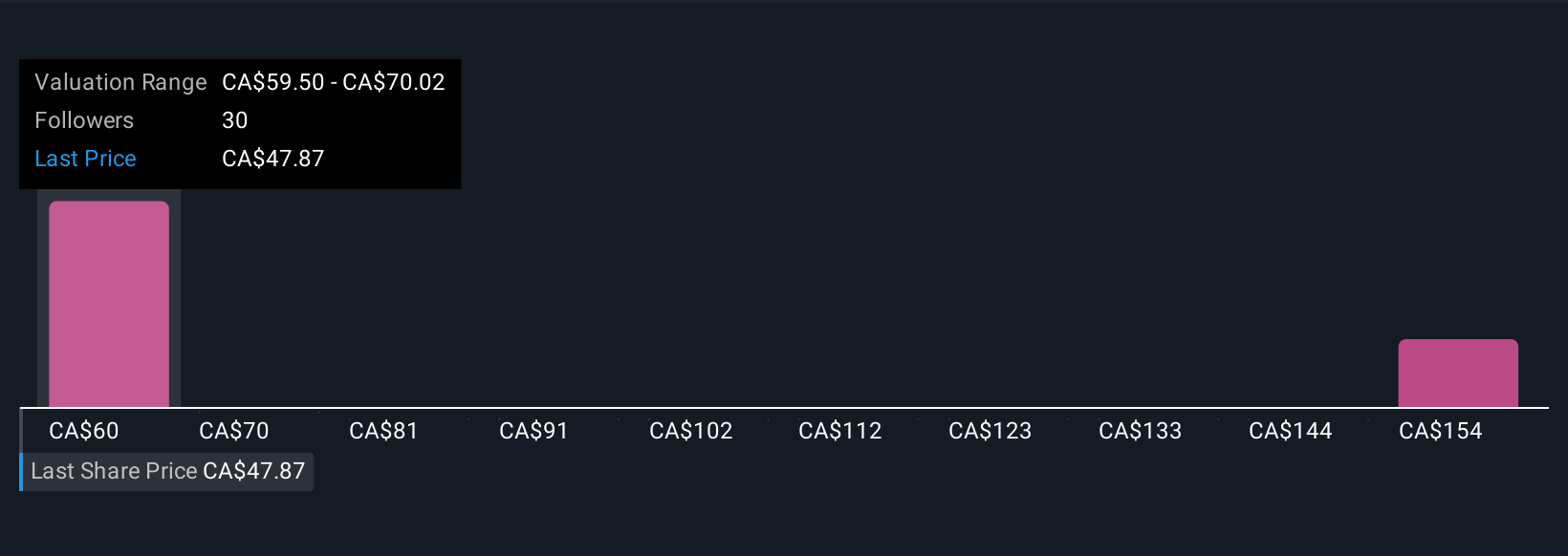

Being a shareholder in North West Company Inc. means believing in the resilience of its unique retail model, which serves remote and underserved communities across Canada, Alaska, the Caribbean, and the South Pacific. The upcoming earnings release, scheduled for September 8, offers a fresh point of reference but is not expected to meaningfully alter the most important catalysts or risks in the short term. Recent updates confirm solid revenue and earnings growth, reliable dividend payouts, and a consistent board and management team, all of which continue to underpin the company’s valuation appeal. The share price remains well below analyst targets, suggesting room for optimism, yet, no sudden buybacks and unchanged governance mean that organic profit and margin trends remain central factors to watch. The biggest risks, such as cost pressure or weak consumer demand, are unchanged by the new announcement, so market sentiment may hinge mainly on the story told during the upcoming results call.

But, despite this stability, cost pressures remain a risk that investors shouldn't overlook. Despite retreating, North West's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 4 other fair value estimates on North West - why the stock might be worth over 3x more than the current price!

Build Your Own North West Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your North West research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free North West research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate North West's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 29 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if North West might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:NWC

North West

Through its subsidiaries, engages in the retail of food and everyday products and services in northern Canada, rural Alaska, the South Pacific, and the Caribbean.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives