- Canada

- /

- Professional Services

- /

- TSX:TRI

Could Thomson Reuters’ (TSX:TRI) AI Audit Partnership Reveal a New Edge in Professional Services?

Reviewed by Sasha Jovanovic

- Fieldguide recently announced a partnership with Thomson Reuters to embed Guided Assurance audit methodology powered by agentic AI directly into Fieldguide's platform, streamlining risk assessments, client workflows, and compliance for professional services firms.

- This integration uniquely combines Thomson Reuters' authoritative guidance with automated, adaptive AI execution, promising increased audit quality and efficiency without added administrative overhead or system changes.

- We'll explore how Thomson Reuters' latest collaboration to embed its audit methodology with Fieldguide's AI tools shapes the company's long-term investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Thomson Reuters Investment Narrative Recap

For shareholders, the core investment thesis in Thomson Reuters revolves around the company's ability to drive higher-value recurring revenues by embedding proprietary content within advanced, AI-enabled workflow tools. The recent Fieldguide partnership aligns well with this vision, but its direct impact on short-term revenue acceleration appears limited, as the largest catalyst remains broader customer adoption of agentic AI, while the most immediate risk continues to be pressure from newer competitors and evolving technology standards.

The just-completed US$1,000 million share buyback is especially relevant, as it underscores ongoing capital return alongside innovation investments, a potential support for shareholder returns even as the focus intensifies on AI-related product deployments and client uptake. The interplay of these factors continues to define the near-term outlook for both growth and valuation.

However, investors should also be aware that, despite these advances, the rapid evolution of open-source AI and competing legal technology platforms could...

Read the full narrative on Thomson Reuters (it's free!)

Thomson Reuters' narrative projects $9.2 billion in revenue and $2.1 billion in earnings by 2028. This requires 7.8% yearly revenue growth and a $0.5 billion increase in earnings from $1.6 billion today.

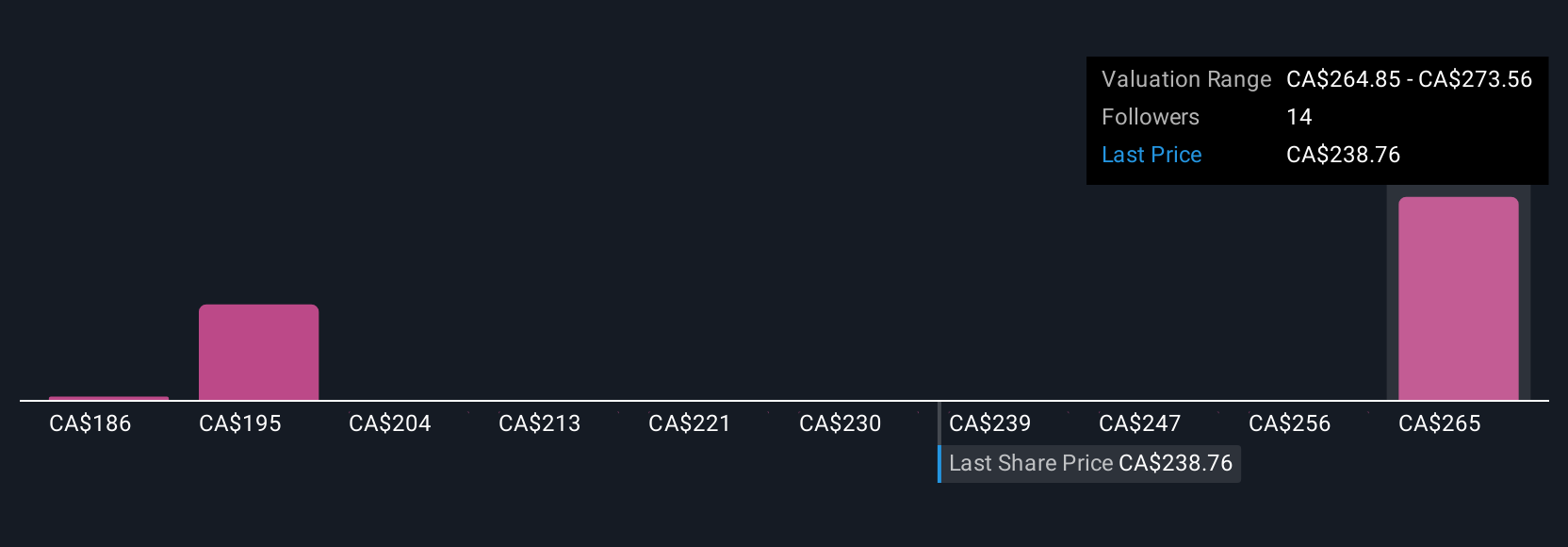

Uncover how Thomson Reuters' forecasts yield a CA$270.03 fair value, a 40% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community fair value estimates for Thomson Reuters range from CA$186.45 to CA$270.03 across four analyses. While many see growth potential from agentic AI integration, competition from new legal technology entrants could limit upside, so reviewing multiple viewpoints may be helpful.

Explore 4 other fair value estimates on Thomson Reuters - why the stock might be worth just CA$186.45!

Build Your Own Thomson Reuters Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Thomson Reuters research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Thomson Reuters research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Thomson Reuters' overall financial health at a glance.

No Opportunity In Thomson Reuters?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Thomson Reuters might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TRI

Thomson Reuters

Operates as a content and technology company in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives