As the Canadian market navigates through a period of manageable yet unresolved inflation, with potential rate cuts on the horizon, investors are keenly observing how these macroeconomic factors might influence their portfolios. Amidst these conditions, penny stocks—often representing smaller or newer companies—remain an intriguing area for exploration due to their lower price points and potential for growth. Despite being considered a somewhat outdated term, penny stocks can still offer surprising value when backed by strong balance sheets and solid fundamentals.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.63 | CA$63.72M | ✅ 3 ⚠️ 4 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.235 | CA$1.96M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.31 | CA$48.82M | ✅ 2 ⚠️ 1 View Analysis > |

| Fintech Select (TSXV:FTEC) | CA$0.04 | CA$3.2M | ✅ 2 ⚠️ 3 View Analysis > |

| Findev (TSXV:FDI) | CA$0.45 | CA$12.89M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.95 | CA$612.07M | ✅ 3 ⚠️ 2 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$2.25 | CA$352.05M | ✅ 2 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$4.01 | CA$198.45M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.95 | CA$184.63M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$1.65 | CA$8.85M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 426 stocks from our TSX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Base Carbon (NEOE:BCBN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Base Carbon Inc., along with its subsidiaries, offers capital, development expertise, and management operating resources with a market cap of CA$71.30 million.

Operations: The company's revenue is primarily derived from the development and deployment of its projects, amounting to $17.25 million.

Market Cap: CA$71.3M

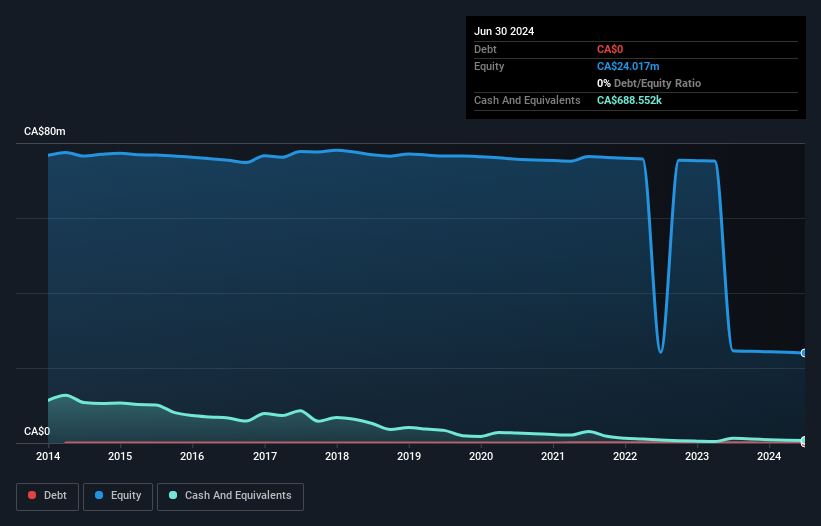

Base Carbon Inc., with a market cap of CA$71.30 million, recently reported second-quarter net income of US$0.24 million, marking a turnaround from last year's loss. Despite being unprofitable over the past five years with declining earnings, the company remains debt-free and has stable weekly volatility at 9%. Its management and board are considered experienced, though significant insider selling occurred recently. The company completed a share buyback program repurchasing 6.32% of its shares for US$2.44 million, signaling potential confidence in its valuation despite trading significantly below estimated fair value.

- Jump into the full analysis health report here for a deeper understanding of Base Carbon.

- Evaluate Base Carbon's historical performance by accessing our past performance report.

NervGen Pharma (TSXV:NGEN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: NervGen Pharma Corp. is a biotechnology company focused on discovering, developing, and commercializing pharmaceutical treatments for nervous system repair in neurotrauma and neurologic disease settings, with a market cap of CA$204.44 million.

Operations: NervGen Pharma Corp. has not reported any revenue segments.

Market Cap: CA$204.44M

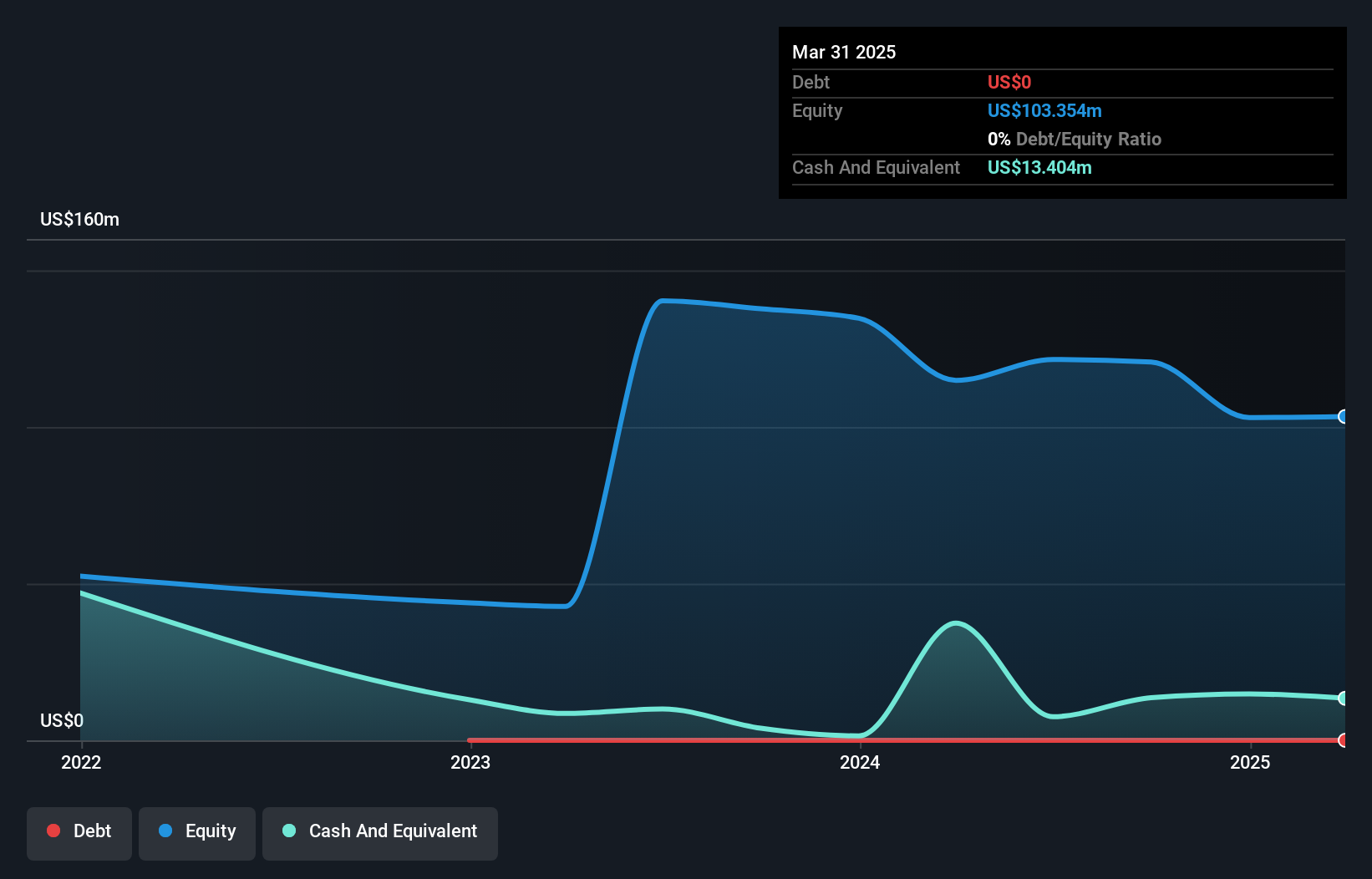

NervGen Pharma Corp., a pre-revenue biotechnology firm with a market cap of CA$204.44 million, is focused on developing NVG-291 for nervous system repair. Despite being unprofitable with increasing losses over the past five years, it remains debt-free and has short-term assets exceeding its liabilities. Recent leadership changes include Dr. Adam Rogers as Interim CEO, emphasizing commitment to advancing NVG-291 after positive Phase 1b/2a trial results for spinal cord injury treatment. The company faces challenges with less than a year of cash runway but holds FDA Fast Track designation, highlighting its potential in neurorepair therapeutics.

- Unlock comprehensive insights into our analysis of NervGen Pharma stock in this financial health report.

- Gain insights into NervGen Pharma's outlook and expected performance with our report on the company's earnings estimates.

ZincX Resources (TSXV:ZNX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: ZincX Resources Corp. is involved in the acquisition, exploration, and evaluation of mineral resource properties in Canada, with a market cap of CA$16.91 million.

Operations: ZincX Resources Corp. has not reported any revenue segments.

Market Cap: CA$16.91M

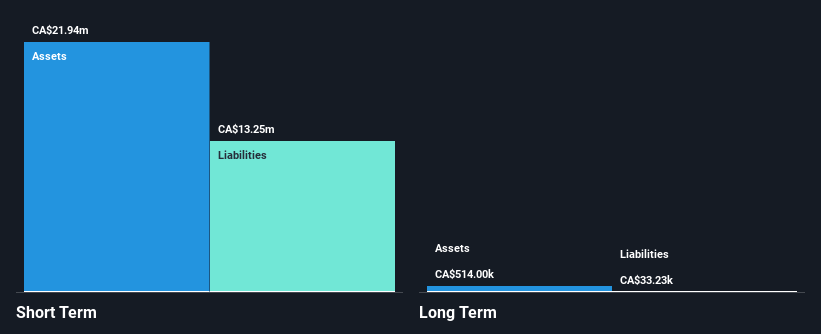

ZincX Resources Corp., with a market cap of CA$16.91 million, is pre-revenue and focused on mineral exploration in Canada. The company has experienced board members, averaging 17.8 years of tenure, though it faces challenges with short-term liabilities exceeding its assets by CA$545.8K. Despite being unprofitable, ZincX has more cash than debt and hasn't diluted shareholders recently. The recent appointment of Mr. Chen Bangguo to the board brings over 33 years of mining expertise from Tongling Nonferrous Metals Group Holdings Co., Ltd., potentially strengthening strategic direction amidst ongoing financial losses and high share price volatility.

- Dive into the specifics of ZincX Resources here with our thorough balance sheet health report.

- Assess ZincX Resources' previous results with our detailed historical performance reports.

Make It Happen

- Navigate through the entire inventory of 426 TSX Penny Stocks here.

- Ready To Venture Into Other Investment Styles? AI is about to change healthcare. These 28 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NervGen Pharma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:NGEN

NervGen Pharma

A biotechnology company, engages in the discovery, development, and commercialization of pharmaceutical treatments to promote nervous system repair in settings of neurotrauma and neurologic disease.

Slight risk with worrying balance sheet.

Market Insights

Community Narratives