- Canada

- /

- Trade Distributors

- /

- TSXV:ZDC

Recent 10% pullback isn't enough to hurt long-term Zedcor (CVE:ZDC) shareholders, they're still up 752% over 5 years

Zedcor Inc. (CVE:ZDC) shareholders might be concerned after seeing the share price drop 13% in the last month. But that doesn't undermine the fantastic longer term performance (measured over five years). Indeed, the share price is up a whopping 752% in that time. Arguably, the recent fall is to be expected after such a strong rise. Of course what matters most is whether the business can improve itself sustainably, thus justifying a higher price. Anyone who held for that rewarding ride would probably be keen to talk about it.

Although Zedcor has shed CA$12m from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

Check out our latest analysis for Zedcor

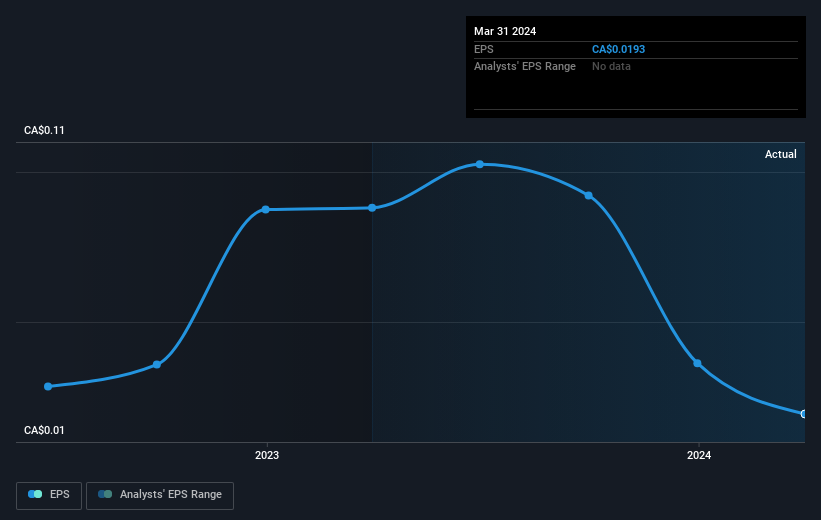

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the last half decade, Zedcor became profitable. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It is of course excellent to see how Zedcor has grown profits over the years, but the future is more important for shareholders. This free interactive report on Zedcor's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's nice to see that Zedcor shareholders have received a total shareholder return of 98% over the last year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 53% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 6 warning signs for Zedcor (2 make us uncomfortable) that you should be aware of.

Of course Zedcor may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Canadian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Zedcor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:ZDC

Zedcor

Provides technology-based security and surveillance services in Canada.

Adequate balance sheet low.