Here's Why Shareholders May Want To Be Cautious With Increasing EnWave Corporation's (CVE:ENW) CEO Pay Packet

The share price of EnWave Corporation (CVE:ENW) has been growing in the past few years, however, the per-share earnings growth has been lacking, suggesting something is amiss. Some of these issues will occupy shareholders' minds as the AGM rolls around on 19 March 2021. One way that shareholders can influence managerial decisions is through voting on CEO and executive remuneration packages, which studies show could impact company performance. In our analysis below, we show why shareholders may consider holding off a raise for the CEO's compensation until company performance improves.

See our latest analysis for EnWave

How Does Total Compensation For Brent Charleton Compare With Other Companies In The Industry?

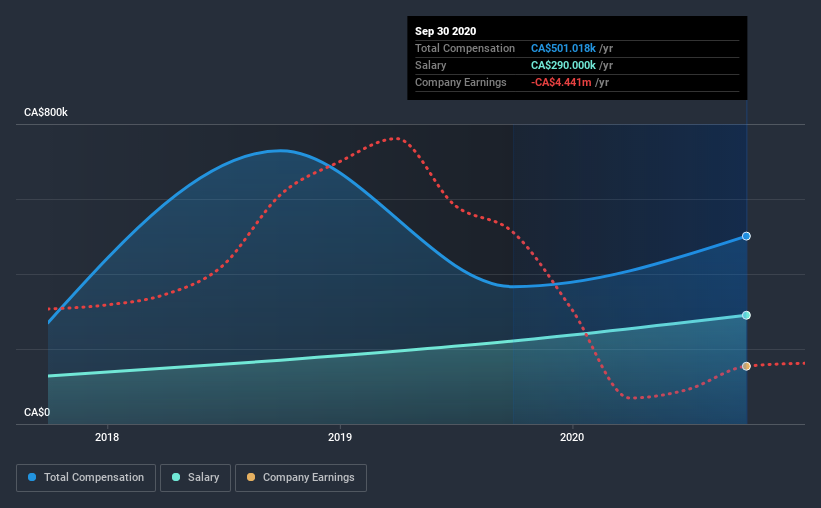

According to our data, EnWave Corporation has a market capitalization of CA$158m, and paid its CEO total annual compensation worth CA$501k over the year to September 2020. That's a notable increase of 37% on last year. Notably, the salary which is CA$290.0k, represents a considerable chunk of the total compensation being paid.

In comparison with other companies in the industry with market capitalizations under CA$250m, the reported median total CEO compensation was CA$312k. Accordingly, our analysis reveals that EnWave Corporation pays Brent Charleton north of the industry median.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | CA$290k | CA$221k | 58% |

| Other | CA$211k | CA$145k | 42% |

| Total Compensation | CA$501k | CA$366k | 100% |

On an industry level, around 60% of total compensation represents salary and 40% is other remuneration. EnWave is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at EnWave Corporation's Growth Numbers

Over the last three years, EnWave Corporation has shrunk its earnings per share by 23% per year. It saw its revenue drop 27% over the last year.

The decline in EPS is a bit concerning. And the impression is worse when you consider revenue is down year-on-year. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has EnWave Corporation Been A Good Investment?

EnWave Corporation has served shareholders reasonably well, with a total return of 20% over three years. But they would probably prefer not to see CEO compensation far in excess of the median.

In Summary...

While it's true that shareholders have owned decent returns, it's hard to overlook the lack of earnings growth and this makes us question whether these returns will continue. Shareholders should make the most of the coming opportunity to question the board on key concerns they may have and revisit their investment thesis with regards to the company.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 1 warning sign for EnWave that investors should think about before committing capital to this stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

When trading EnWave or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if EnWave might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSXV:ENW

EnWave

Designs, constructs, markets, and sells vacuum-microwave dehydration machinery for the food, cannabis, and biomaterial industries in Canada, the United States, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives