- Canada

- /

- Trade Distributors

- /

- TSX:TIH

What Toromont Industries (TSX:TIH)'s Margin Gains Amid Slower Sales Reveal for Shareholders

Reviewed by Sasha Jovanovic

- Toromont Industries Ltd. recently reported its third quarter 2025 financial results, posting net income of CA$140.62 million and diluted earnings per share of CA$1.72, while sales declined slightly to CA$1.31 billion compared to the prior year.

- Despite the decrease in sales, quarterly net income and earnings per share increased, highlighting efficiency improvements and margin resilience in the company’s operations.

- We'll now explore how Toromont's increased profitability, despite softer sales, could influence its investment narrative going forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Toromont Industries Investment Narrative Recap

To be a shareholder of Toromont Industries, you need to believe in the company's ability to deliver profit growth and margin improvement through cycles of variable customer demand, a theme underscored by its Q3 results, which showed rising net income and EPS despite sales dipping. This recent news suggests the company’s operational efficiency supports the most important short-term catalyst, sustained margin resilience, while ongoing exposure to shifts in commodity and construction activity remains the biggest business risk; neither was materially changed by these results.

Among the recent announcements, the Board’s affirmation of a regular quarterly dividend at CA$0.52 per share stands out as a sign of management’s confidence in the company’s underlying cash flow, even as topline growth faces some near-term uncertainty. This dividend continuity can support investor sentiment, particularly while Toromont’s backlog visibility and capacity expansion in AVL remain mid-term performance drivers.

However, investors should still be aware that, despite profit improvements, persistent inflation and choppy market demand can quickly pressure margins and slow recurring revenue growth if...

Read the full narrative on Toromont Industries (it's free!)

Toromont Industries' forecast projects CA$5.9 billion in revenue and CA$626.8 million in earnings by 2028. This is based on a 4.8% annual revenue growth rate and an earnings increase of CA$140.8 million from the current earnings of CA$486.0 million.

Uncover how Toromont Industries' forecasts yield a CA$161.33 fair value, in line with its current price.

Exploring Other Perspectives

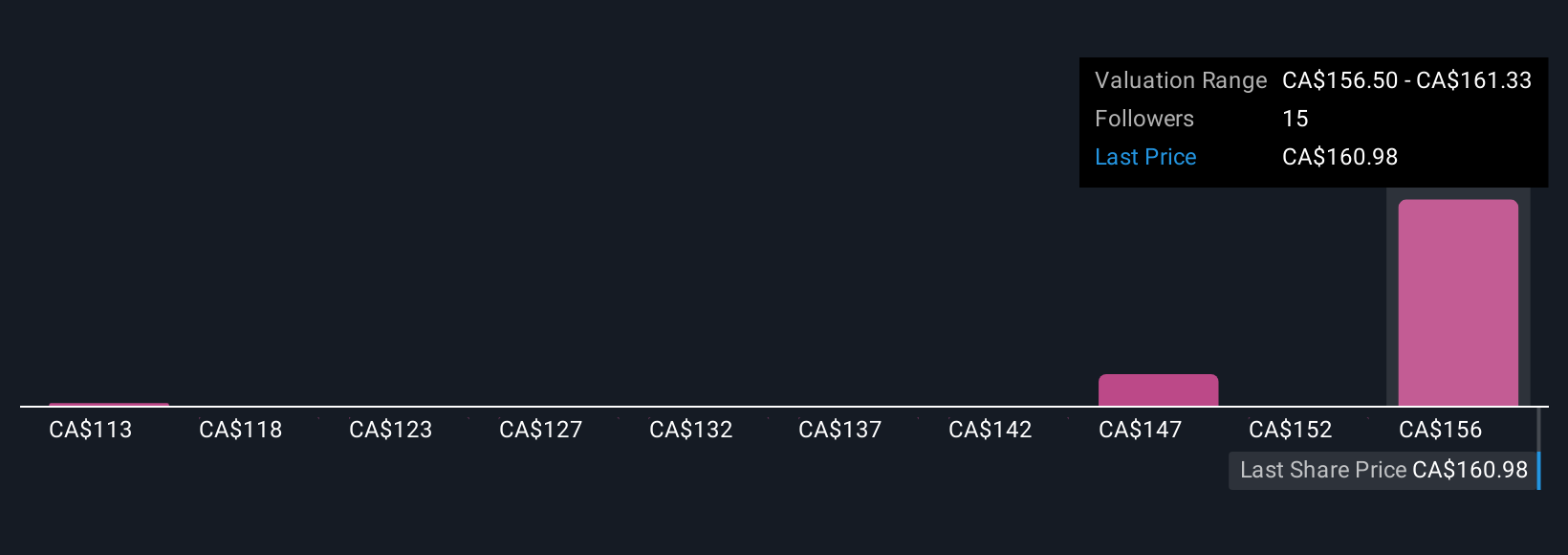

Three perspectives from the Simply Wall St Community estimate Toromont’s fair value between CA$113 and CA$161.33, highlighting wide divergence in investor opinion. While margin resilience has improved this quarter, expectations for sustained earnings growth may hinge on how volatile end-market demand unfolds in the coming periods.

Explore 3 other fair value estimates on Toromont Industries - why the stock might be worth 30% less than the current price!

Build Your Own Toromont Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Toromont Industries research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Toromont Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Toromont Industries' overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toromont Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TIH

Toromont Industries

Provides specialized capital equipment in Canada, the United States, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives