- Canada

- /

- Trade Distributors

- /

- TSX:TIH

Toromont Industries (TSX:TIH) Margin Dip Counters Bullish Growth Narrative Despite Forecast-Beating Revenue Outlook

Reviewed by Simply Wall St

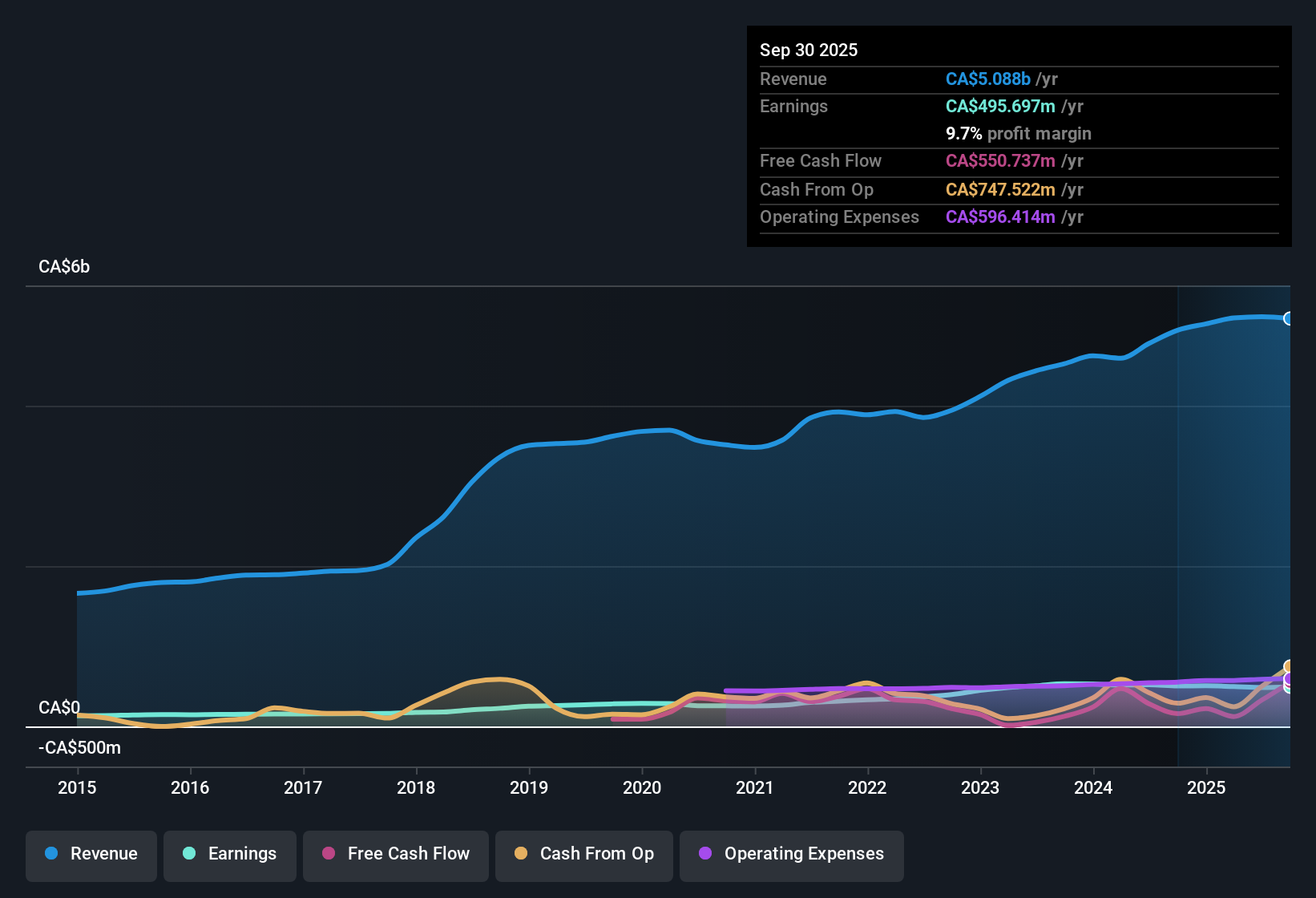

Toromont Industries (TSX:TIH) is forecasting revenue growth of 5.9% per year, outpacing the broader Canadian market’s 5% rate. Despite this, the company’s net profit margin has dipped to 9.5% from last year’s 10.9%, and it posted negative earnings growth over the past year. Shares recently traded at CA$168.51, below the calculated fair value of CA$183.86. With a Price-to-Earnings ratio of 28.2x, Toromont stands out as expensive compared to both its industry and peer averages. Investors will be weighing robust historical earnings growth and strong revenue prospects against narrowing margins and high relative valuation multiples.

See our full analysis for Toromont Industries.The next section measures these numbers against the dominant narratives tracked by Simply Wall St, exploring where expectations and reality mesh and where they may diverge.

See what the community is saying about Toromont Industries

Stable Revenue Growth, Margin Recovery in Sight

- Analysts forecast Toromont’s annual revenue will climb by 4.8% for the next three years, with profit margins expected to rise from 9.5% today to 10.7% by 2026.

- According to the analysts' consensus view, expansion into data center infrastructure and electrification projects is set to drive sizable new streams of revenue and future margin upside.

- Consensus notes that ongoing investments in service, rental, and higher-margin after-sales support are aimed at lifting recurring revenues and net margins beyond today’s levels.

- Broader market resilience is expected, as a strong backlog and steady order intake support a more stable earnings profile and help counterbalance any short-term margin softness.

Analysts argue that as Toromont’s earnings and margins rebound, there is an opportunity for quality growth. See the full Consensus Narrative for details. 📊 Read the full Toromont Industries Consensus Narrative.

Premium Valuation Boosted by Earnings Track Record

- Toromont’s current Price-to-Earnings ratio stands at 28.2x, which is notably higher than the Trade Distributors industry average of 19.4x and peer average of 18.1x. This reflects a valuation premium tied to its history of 15.2% annual earnings growth over five years.

- Analysts' consensus view is that past high-quality earnings and robust growth prospects partly justify the premium multiple. However, future returns may depend on achieving the projected margin improvement.

- Shareholders may be willing to pay a premium given Toromont’s margin recovery potential and leadership in sectors like electrification and data centers.

- At the same time, consensus highlights that if profit margins fail to rebound as expected, there is a risk returns could lag industry peers despite the current valuation premium.

Margin Risk from Cost Pressures and Supplier Concentration

- Operating margin declined from 12.0% to 10.9% year-to-date, pressured by cost inflation, wage increases, and higher integration expenses linked to acquisitions.

- According to the consensus narrative, persistent supplier reliance, particularly on Caterpillar, combined with labor shortages and aggressive expansion, raises the risk that margin recovery could be delayed.

- Critics highlight that over-investment in AVL capacity and possible shifts in OEM relationships could leave Toromont exposed if demand or technology trends move faster than anticipated.

- Nonetheless, consensus believes that strong backlog and recurring revenue streams help offset near-term volatility, making the risk worth monitoring rather than a reason to abandon the stock today.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Toromont Industries on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a fresh angle on these figures? Share your unique perspective and craft a personal narrative in just a few minutes. Do it your way

A great starting point for your Toromont Industries research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Toromont’s premium valuation, recently declining margins, and exposure to cost and supplier risks mean future returns are not guaranteed.

If you’re looking for opportunities with more attractive pricing, use our these 833 undervalued stocks based on cash flows to uncover companies trading below their intrinsic value right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toromont Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TIH

Toromont Industries

Provides specialized capital equipment in Canada, the United States, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives