- Canada

- /

- Construction

- /

- TSX:ATRL

Could AtkinsRéalis Group’s (TSX:ATRL) Global Exposure Reshape Its Competitive Edge in Nuclear and Infrastructure?

Reviewed by Sasha Jovanovic

- AtkinsRéalis Group participated in the World Nuclear Exhibition 2025 in Paris and the Super Terminal Expo 2025 in Hong Kong, featuring presentations by senior leaders across three days earlier this week.

- This high-profile presence underscores the company’s international reach and focus on both nuclear and infrastructure sectors, highlighting its ongoing engagement in key global markets.

- Now, we’ll discuss how AtkinsRéalis Group’s expanded global visibility in nuclear and infrastructure could influence its investment case going forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

AtkinsRéalis Group Investment Narrative Recap

Shareholders in AtkinsRéalis Group need conviction in the global necessity for resilient infrastructure and low-carbon energy, with a belief that the company can secure major new contracts and successfully integrate acquisitions. While its strong presence at high-profile international exhibitions could strengthen global relationships and widen its opportunity set, there is no immediate evidence that these appearances will materially change the short-term catalysts or offset the primary risk of project delays and potential revenue contraction in its key U.S. and EMEA regions.

Among its recent developments, AtkinsRéalis' joint venture win for the Hong Kong-Shenzhen Western Rail Link consultancy aligns directly with the company’s push for infrastructure expansion in Asia, highlighted again by its active participation at the Super Terminal Expo. This could strengthen the company's backlog and help sustain revenue momentum if contract execution remains robust, providing a tangible context for optimism about regional growth even as underlying demand trends remain under scrutiny.

Yet, in contrast, one crucial risk investors should keep in mind relates to how project reprioritizations or contract terminations in its core regions could...

Read the full narrative on AtkinsRéalis Group (it's free!)

AtkinsRéalis Group is projected to reach CA$12.8 billion in revenue and CA$896.4 million in earnings by 2028. This outlook is based on a 7.4% annual revenue growth rate but reflects a sharp earnings decrease of CA$1.6 billion from the current CA$2.5 billion.

Uncover how AtkinsRéalis Group's forecasts yield a CA$113.96 fair value, a 21% upside to its current price.

Exploring Other Perspectives

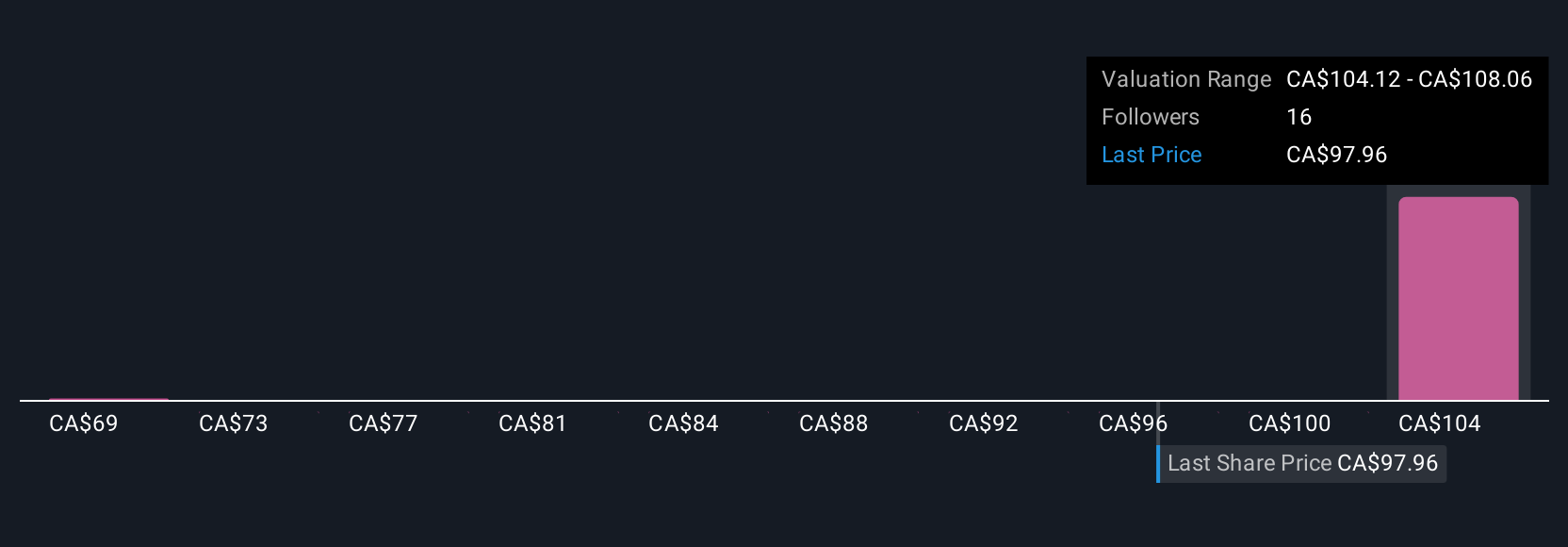

Three Simply Wall St Community members estimate AtkinsRéalis’ fair value in a wide band from CA$68.73 to CA$113.96. While their views diverge, recent efforts to secure large-scale infrastructure contracts abroad could meaningfully influence the company’s future outlook depending on project performance.

Explore 3 other fair value estimates on AtkinsRéalis Group - why the stock might be worth 27% less than the current price!

Build Your Own AtkinsRéalis Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AtkinsRéalis Group research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

- Our free AtkinsRéalis Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AtkinsRéalis Group's overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ATRL

AtkinsRéalis Group

Provides professional services and project management, and capital investment services in United Kingdom, Canada, the United States, Saudi Arabia, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives