- Brazil

- /

- Renewable Energy

- /

- BOVESPA:EGIE3

Does Engie Brasil Energia (BVMF:EGIE3) Have A Somewhat Strained Balance Sheet Or Is There More To The Story?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Engie Brasil Energia S.A. ( BVMF:EGIE3 ) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Engie Brasil Energia

What Is Engie Brasil Energia's Debt?

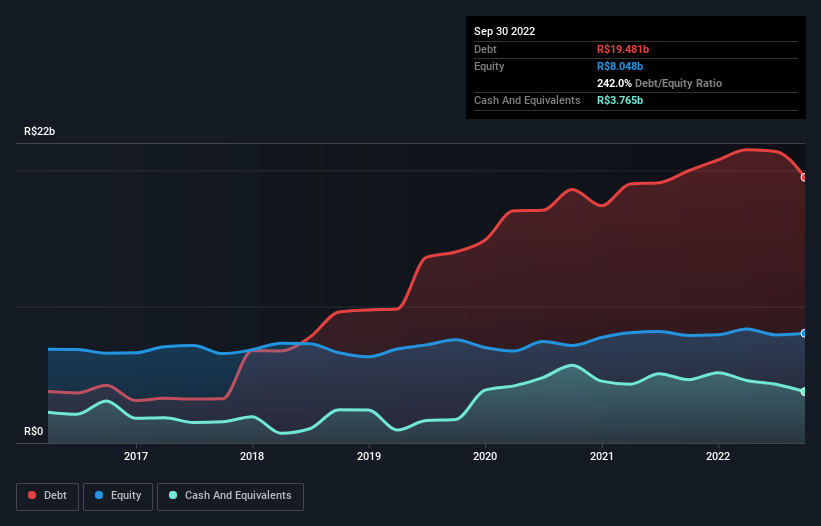

As you can see below, Engie Brasil Energia had R$19.5b of debt, at September 2022, which is about the same as the year before. You can click the chart for greater detail. However, it does have R$3.76b in cash offsetting this, leading to net debt of about R$15.7b.

How Healthy Is Engie Brasil Energia's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Engie Brasil Energia had liabilities of R$7.46b due within 12 months and liabilities of R$24.2b due beyond that. Offsetting these obligations, it had cash of R$3.76b as well as receivables valued at R$1.92b due within 12 months. So it has liabilities totalling R$25.9b more than its cash and near-term receivables, combined.

This deficit is considerable relative to its market capitalization of R$31.1b, so it does suggest shareholders should keep an eye on Engie Brasil Energia's use of debt. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry.

One thing that should be noted however, is that Engie Brasil Energia operates in a very capital intensive industry, and so high levels of debt are not uncommon. The company's goal is to use the debt and leverage the growth of their asset base, which will be coming on operation soon and will start to add cash flow from 2023 onwards.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

While Engie Brasil Energia has a quite reasonable net debt to EBITDA multiple of 2.3, its interest cover seems weak, at 2.0. This does suggest the company is paying fairly high interest rates. Either way there's no doubt the stock is using meaningful leverage. Sadly, Engie Brasil Energia's EBIT actually dropped 2.6% in the last year. If earnings continue on that decline then managing that debt will be difficult like delivering hot soup on a unicycle. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Engie Brasil Energia's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the last three years, Engie Brasil Energia reported free cash flow worth 18% of its EBIT, which is really quite low. That limp level of cash conversion undermines its ability to manage and pay down debt.

Our View

We'd go so far as to say Engie Brasil Energia's interest cover something that investors should closely monitor. Having said that, its ability handle its debt, based on its EBITDA, isn't such a worry. Looking at the bigger picture, it seems clear to us that Engie Brasil Energia's use of debt is creating risks for the company and so they need to ensure they can leverage the assets funded by this debt to generate cash flow once they're operational. If everything goes well that may pay off but the downside of this debt is a greater risk of permanent losses. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 3 warning signs for Engie Brasil Energia (2 are a bit unpleasant!) that you should be aware of before investing here.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Valuation is complex, but we're here to simplify it.

Discover if Engie Brasil Energia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:EGIE3

Engie Brasil Energia

Generates, sells, and trades in electrical energy in Brazil.

Undervalued slight.