- Brazil

- /

- Renewable Energy

- /

- BOVESPA:EGIE3

Engie Brasil Energia (BVMF:EGIE3) Has A Somewhat Strained Balance Sheet

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Engie Brasil Energia S.A. (BVMF:EGIE3) does have debt on its balance sheet. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Engie Brasil Energia

What Is Engie Brasil Energia's Debt?

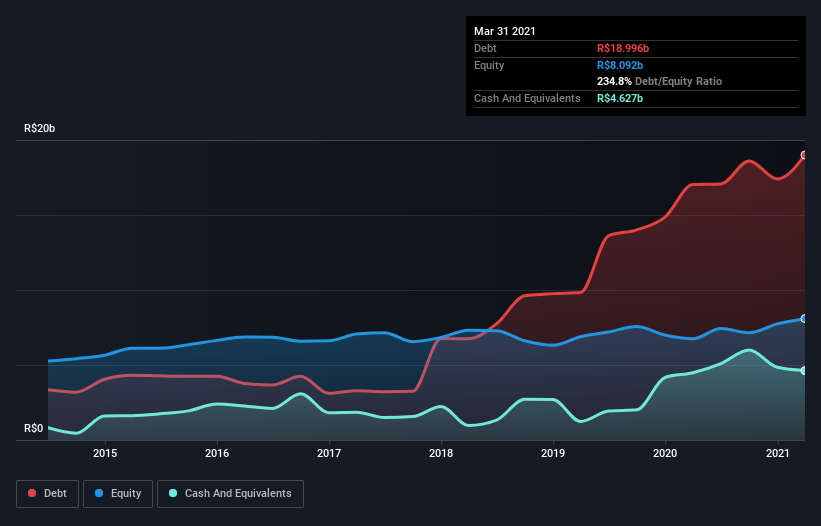

As you can see below, at the end of March 2021, Engie Brasil Energia had R$19.0b of debt, up from R$17.0b a year ago. Click the image for more detail. However, because it has a cash reserve of R$4.63b, its net debt is less, at about R$14.4b.

How Healthy Is Engie Brasil Energia's Balance Sheet?

According to the last reported balance sheet, Engie Brasil Energia had liabilities of R$4.07b due within 12 months, and liabilities of R$23.8b due beyond 12 months. Offsetting these obligations, it had cash of R$4.63b as well as receivables valued at R$1.80b due within 12 months. So its liabilities total R$21.4b more than the combination of its cash and short-term receivables.

This deficit is considerable relative to its market capitalization of R$33.6b, so it does suggest shareholders should keep an eye on Engie Brasil Energia's use of debt. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Even though Engie Brasil Energia's debt is only 2.3, its interest cover is really very low at 2.3. This does have us wondering if the company pays high interest because it is considered risky. Either way there's no doubt the stock is using meaningful leverage. It is well worth noting that Engie Brasil Energia's EBIT shot up like bamboo after rain, gaining 31% in the last twelve months. That'll make it easier to manage its debt. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Engie Brasil Energia's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. Over the last three years, Engie Brasil Energia reported free cash flow worth 18% of its EBIT, which is really quite low. That limp level of cash conversion undermines its ability to manage and pay down debt.

Our View

Engie Brasil Energia's interest cover and conversion of EBIT to free cash flow definitely weigh on it, in our esteem. But the good news is it seems to be able to grow its EBIT with ease. We think that Engie Brasil Energia's debt does make it a bit risky, after considering the aforementioned data points together. That's not necessarily a bad thing, since leverage can boost returns on equity, but it is something to be aware of. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. These risks can be hard to spot. Every company has them, and we've spotted 2 warning signs for Engie Brasil Energia (of which 1 is significant!) you should know about.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Engie Brasil Energia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BOVESPA:EGIE3

Engie Brasil Energia

Generates, sells, and trades in electrical energy in Brazil.

Undervalued slight.