- Brazil

- /

- Transportation

- /

- BOVESPA:SIMH3

SIMPAR S.A.'s (BVMF:SIMH3) Shares Leap 25% Yet They're Still Not Telling The Full Story

SIMPAR S.A. (BVMF:SIMH3) shares have had a really impressive month, gaining 25% after a shaky period beforehand. Notwithstanding the latest gain, the annual share price return of 3.4% isn't as impressive.

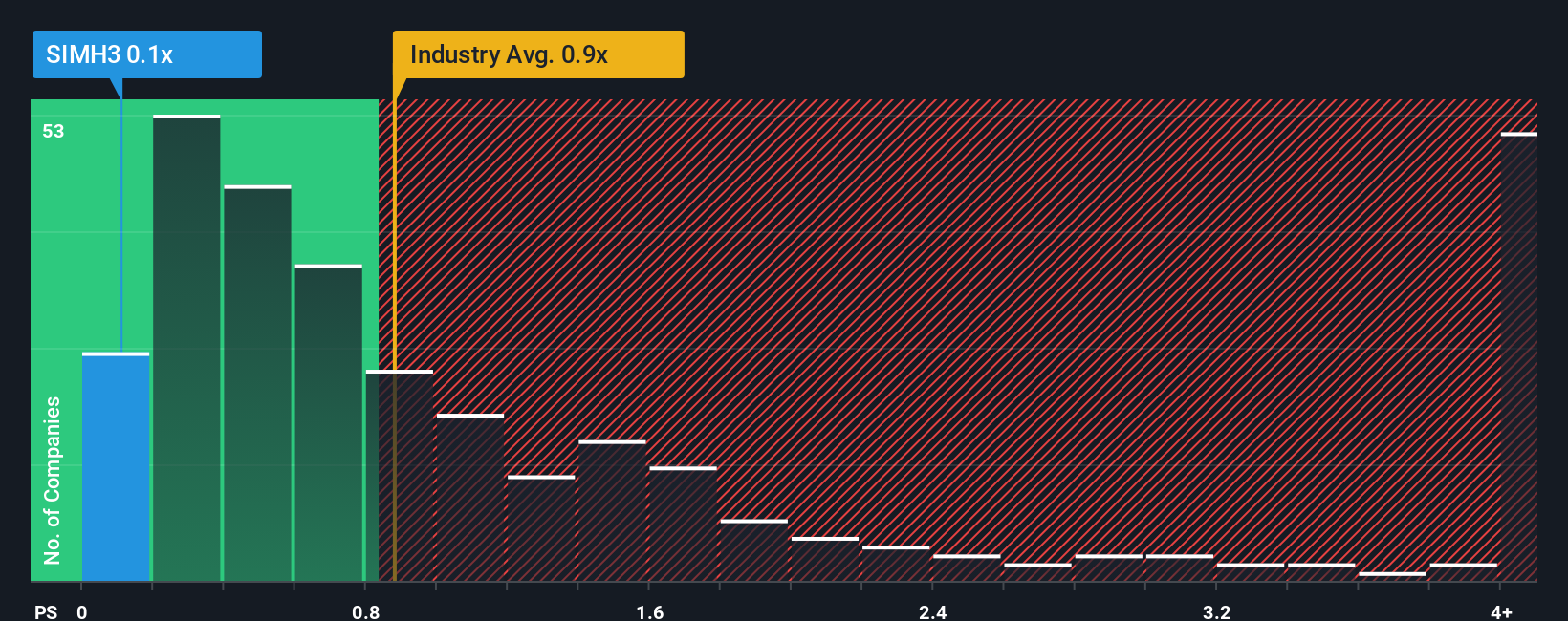

In spite of the firm bounce in price, when close to half the companies operating in Brazil's Transportation industry have price-to-sales ratios (or "P/S") above 1x, you may still consider SIMPAR as an enticing stock to check out with its 0.1x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for SIMPAR

What Does SIMPAR's P/S Mean For Shareholders?

SIMPAR's revenue growth of late has been pretty similar to most other companies. One possibility is that the P/S ratio is low because investors think this modest revenue performance may begin to slide. Those who are bullish on SIMPAR will be hoping that this isn't the case.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on SIMPAR.How Is SIMPAR's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like SIMPAR's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 18% last year. The latest three year period has also seen an excellent 137% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 10% each year during the coming three years according to the six analysts following the company. With the industry predicted to deliver 8.7% growth per year, the company is positioned for a comparable revenue result.

In light of this, it's peculiar that SIMPAR's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Bottom Line On SIMPAR's P/S

SIMPAR's stock price has surged recently, but its but its P/S still remains modest. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It looks to us like the P/S figures for SIMPAR remain low despite growth that is expected to be in line with other companies in the industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. It appears some are indeed anticipating revenue instability, because these conditions should normally provide more support to the share price.

You should always think about risks. Case in point, we've spotted 2 warning signs for SIMPAR you should be aware of, and 1 of them shouldn't be ignored.

If you're unsure about the strength of SIMPAR's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:SIMH3

SIMPAR

Provides light vehicle rental, and fleet management and outsourcing services in Brazil.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives