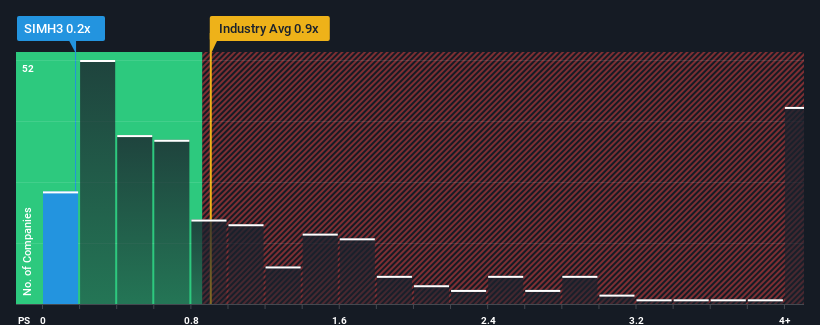

SIMPAR S.A.'s (BVMF:SIMH3) price-to-sales (or "P/S") ratio of 0.2x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Transportation industry in Brazil have P/S ratios greater than 1.3x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for SIMPAR

What Does SIMPAR's Recent Performance Look Like?

There hasn't been much to differentiate SIMPAR's and the industry's revenue growth lately. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. Those who are bullish on SIMPAR will be hoping that this isn't the case.

Want the full picture on analyst estimates for the company? Then our free report on SIMPAR will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For SIMPAR?

There's an inherent assumption that a company should underperform the industry for P/S ratios like SIMPAR's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 32% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 225% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 16% per year as estimated by the five analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 18% per annum, which is not materially different.

With this in consideration, we find it intriguing that SIMPAR's P/S is lagging behind its industry peers. It may be that most investors are not convinced the company can achieve future growth expectations.

What Does SIMPAR's P/S Mean For Investors?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've seen that SIMPAR currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

We don't want to rain on the parade too much, but we did also find 4 warning signs for SIMPAR (2 are significant!) that you need to be mindful of.

If these risks are making you reconsider your opinion on SIMPAR, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:SIMH3

SIMPAR

Provides light vehicle rental, and fleet management and outsourcing services in Brazil.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives