- Brazil

- /

- Real Estate

- /

- BOVESPA:BRPR3

Earnings Miss: BR Properties S.A. Missed EPS By 19% And Analysts Are Revising Their Forecasts

BR Properties S.A. (BVMF:BRPR3) missed earnings with its latest second-quarter results, disappointing overly-optimistic forecasters. It wasn't a great result overall - while revenue fell marginally short of analyst estimates at R$79m, statutory earnings missed forecasts by 19%, coming in at just R$0.057 per share. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. So we gathered the latest post-earnings forecasts to see what estimates suggest is in store for next year.

Check out our latest analysis for BR Properties

Taking into account the latest results, the most recent consensus for BR Properties from five analysts is for revenues of R$415.0m in 2021 which, if met, would be a substantial 28% increase on its sales over the past 12 months. Statutory earnings per share are forecast to plunge 40% to R$0.27 in the same period. In the lead-up to this report, the analysts had been modelling revenues of R$416.4m and earnings per share (EPS) of R$0.28 in 2021. The analysts seem to have become a little more negative on the business after the latest results, given the small dip in their earnings per share numbers for next year.

The consensus price target held steady at R$11.53, with the analysts seemingly voting that their lower forecast earnings are not expected to lead to a lower stock price in the foreseeable future. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. Currently, the most bullish analyst values BR Properties at R$15.00 per share, while the most bearish prices it at R$10.00. There are definitely some different views on the stock, but the range of estimates is not wide enough as to imply that the situation is unforecastable, in our view.

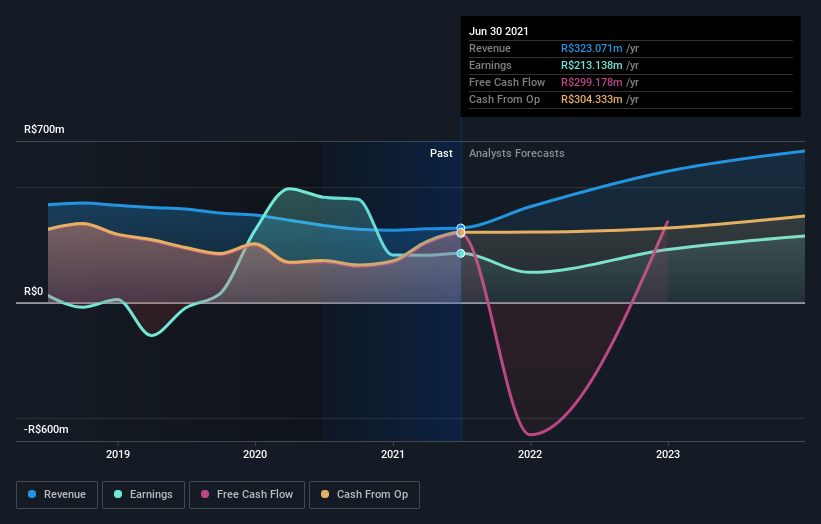

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. One thing stands out from these estimates, which is that BR Properties is forecast to grow faster in the future than it has in the past, with revenues expected to display 65% annualised growth until the end of 2021. If achieved, this would be a much better result than the 10% annual decline over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in the industry are forecast to see their revenue grow 14% per year. So it looks like BR Properties is expected to grow faster than its competitors, at least for a while.

The Bottom Line

The most important thing to take away is that the analysts downgraded their earnings per share estimates, showing that there has been a clear decline in sentiment following these results. Fortunately, they also reconfirmed their revenue numbers, suggesting sales are tracking in line with expectations - and our data suggests that revenues are expected to grow faster than the wider industry. There was no real change to the consensus price target, suggesting that the intrinsic value of the business has not undergone any major changes with the latest estimates.

Following on from that line of thought, we think that the long-term prospects of the business are much more relevant than next year's earnings. At Simply Wall St, we have a full range of analyst estimates for BR Properties going out to 2023, and you can see them free on our platform here..

You should always think about risks though. Case in point, we've spotted 3 warning signs for BR Properties you should be aware of.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if BR Properties might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BOVESPA:BRPR3

BR Properties

BR Properties is one of the leading high-income commercial real estate investment companies in Brazil, focused on the acquisition, leasing, management, development and sale of commercial real estate, including office buildings and industrial and logistics warehouses, located in the main metropolitan regions from Brazil.

Good value with imperfect balance sheet.

Market Insights

Community Narratives