Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Ambev S.A. (BVMF:ABEV3) does carry debt. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Ambev

What Is Ambev's Debt?

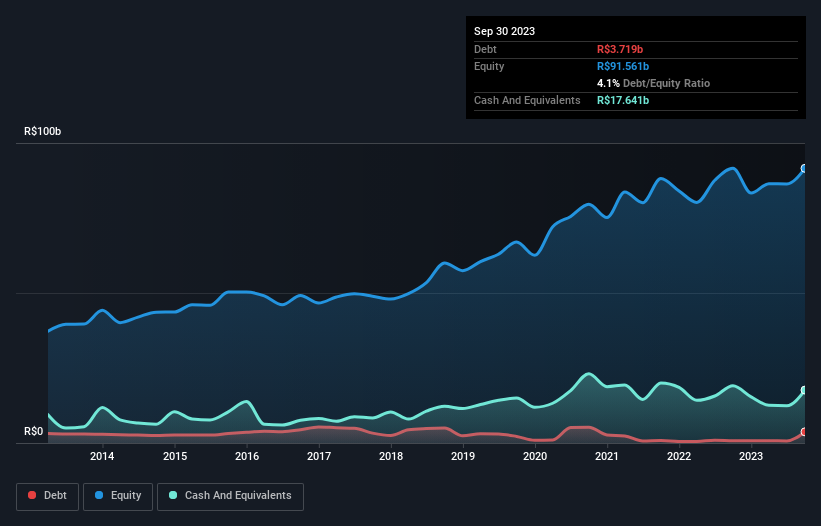

The image below, which you can click on for greater detail, shows that at September 2023 Ambev had debt of R$3.72b, up from R$768.6m in one year. However, its balance sheet shows it holds R$17.6b in cash, so it actually has R$13.9b net cash.

How Strong Is Ambev's Balance Sheet?

According to the last reported balance sheet, Ambev had liabilities of R$33.8b due within 12 months, and liabilities of R$12.5b due beyond 12 months. On the other hand, it had cash of R$17.6b and R$7.66b worth of receivables due within a year. So it has liabilities totalling R$21.0b more than its cash and near-term receivables, combined.

Given Ambev has a humongous market capitalization of R$214.1b, it's hard to believe these liabilities pose much threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time. While it does have liabilities worth noting, Ambev also has more cash than debt, so we're pretty confident it can manage its debt safely.

Fortunately, Ambev grew its EBIT by 7.5% in the last year, making that debt load look even more manageable. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Ambev can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. While Ambev has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. During the last three years, Ambev produced sturdy free cash flow equating to 78% of its EBIT, about what we'd expect. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Summing Up

We could understand if investors are concerned about Ambev's liabilities, but we can be reassured by the fact it has has net cash of R$13.9b. And it impressed us with free cash flow of R$17b, being 78% of its EBIT. So we don't think Ambev's use of debt is risky. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 1 warning sign for Ambev that you should be aware of.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:ABEV3

Ambev

Through its subsidiaries, engages in the production, distribution, and sale of beer, draft beer, carbonated soft drinks, malt and food, other alcoholic beverages, and non-alcoholic and non-carbonated products in Brazil, Central America and Caribbean, Latin America South, and Canada.

Flawless balance sheet, good value and pays a dividend.