- Brazil

- /

- Capital Markets

- /

- BOVESPA:BIED3

Bahema Educação S.A. (BVMF:BIED3) Might Not Be As Mispriced As It Looks

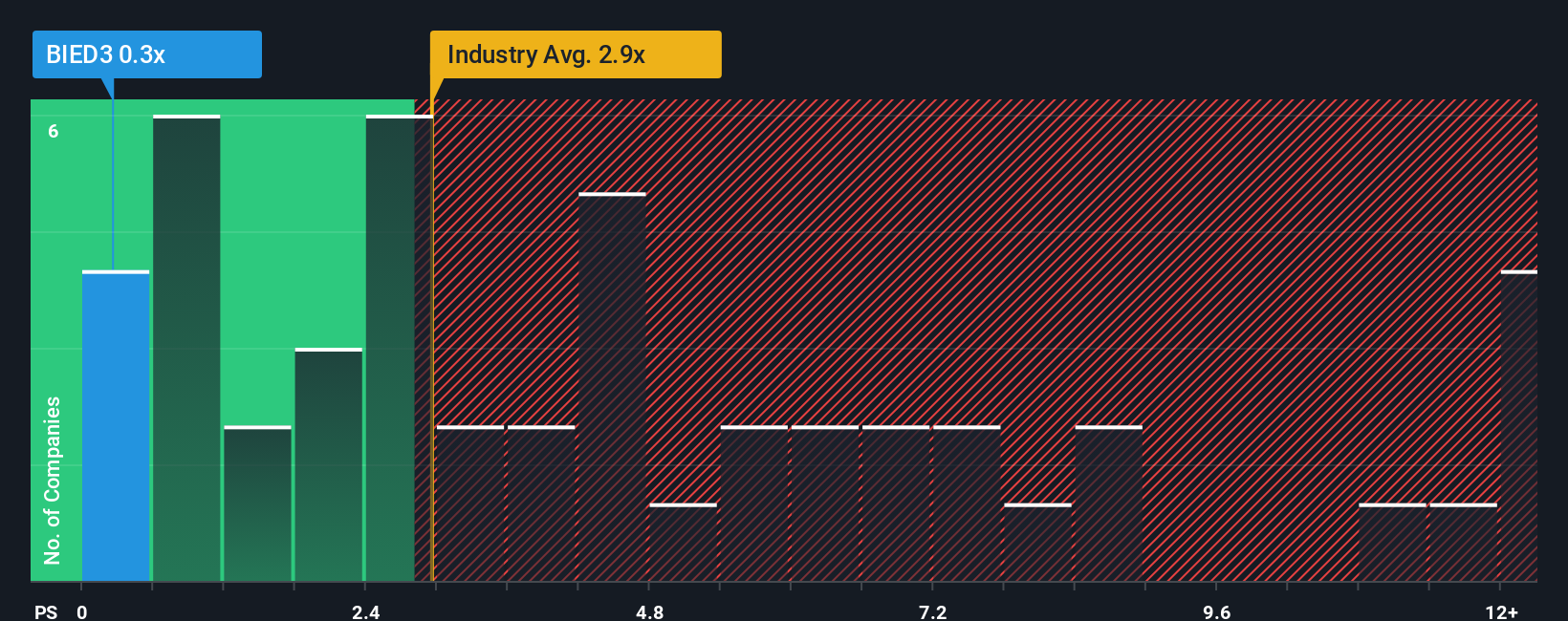

When close to half the companies in the Capital Markets industry in Brazil have price-to-sales ratios (or "P/S") above 5.5x, you may consider Bahema Educação S.A. (BVMF:BIED3) as a highly attractive investment with its 0.3x P/S ratio. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Bahema Educação

What Does Bahema Educação's P/S Mean For Shareholders?

For example, consider that Bahema Educação's financial performance has been poor lately as its revenue has been in decline. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Bahema Educação's earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Bahema Educação?

Bahema Educação's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Retrospectively, the last year delivered a frustrating 3.4% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 12% overall rise in revenue. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to shrink 2.7% in the next 12 months, the company's positive momentum based on recent medium-term revenue results is a bright spot for the moment.

With this information, we find it very odd that Bahema Educação is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can maintain its recent positive growth rate in the face of a shrinking broader industry.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Bahema Educação revealed that despite growing revenue over the medium-term in a shrinking industry, the P/S doesn't reflect this as it's lower than the industry average. We think potential risks might be placing significant pressure on the P/S ratio and share price. Amidst challenging industry conditions, perhaps a key concern is whether the company can sustain its superior revenue growth trajectory. While the chance of the share price dropping sharply is fairly remote, investors do seem to be anticipating future revenue instability.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Bahema Educação (at least 1 which is potentially serious), and understanding these should be part of your investment process.

If these risks are making you reconsider your opinion on Bahema Educação, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Bahema Educação might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:BIED3

Slightly overvalued with imperfect balance sheet.

Market Insights

Community Narratives