- Brazil

- /

- Food and Staples Retail

- /

- BOVESPA:PGMN3

Empreendimentos Pague Menos S.A. (BVMF:PGMN3) Stock Is Going Strong But Fundamentals Look Uncertain: What Lies Ahead ?

Empreendimentos Pague Menos' (BVMF:PGMN3) stock is up by a considerable 17% over the past three months. However, we decided to pay attention to the company's fundamentals which don't appear to give a clear sign about the company's financial health. Specifically, we decided to study Empreendimentos Pague Menos' ROE in this article.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

View our latest analysis for Empreendimentos Pague Menos

How Is ROE Calculated?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Empreendimentos Pague Menos is:

3.5% = R$65m ÷ R$1.8b (Based on the trailing twelve months to September 2020).

The 'return' refers to a company's earnings over the last year. Another way to think of that is that for every R$1 worth of equity, the company was able to earn R$0.04 in profit.

What Has ROE Got To Do With Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Empreendimentos Pague Menos' Earnings Growth And 3.5% ROE

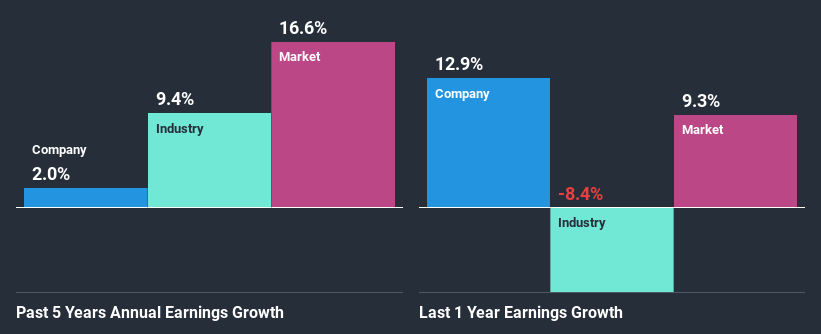

It is quite clear that Empreendimentos Pague Menos' ROE is rather low. Even compared to the average industry ROE of 7.8%, the company's ROE is quite dismal. Accordingly, Empreendimentos Pague Menos' low net income growth of 2.0% over the past five years can possibly be explained by the low ROE amongst other factors.

We then compared Empreendimentos Pague Menos' net income growth with the industry and found that the company's growth figure is lower than the average industry growth rate of 9.4% in the same period, which is a bit concerning.

Earnings growth is an important metric to consider when valuing a stock. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. This then helps them determine if the stock is placed for a bright or bleak future. If you're wondering about Empreendimentos Pague Menos''s valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Empreendimentos Pague Menos Making Efficient Use Of Its Profits?

Conclusion

In total, we're a bit ambivalent about Empreendimentos Pague Menos' performance. Even though it appears to be retaining most of its profits, given the low ROE, investors may not be benefitting from all that reinvestment after all. The low earnings growth suggests our theory correct. Having said that, looking at the current analyst estimates, we found that the company's earnings are expected to gain momentum. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

If you’re looking to trade Empreendimentos Pague Menos, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Empreendimentos Pague Menos might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BOVESPA:PGMN3

Empreendimentos Pague Menos

Engages in the retail sale of medicines, perfumes, personal hygiene and beauty products in Brazil.

Reasonable growth potential with low risk.

Similar Companies

Market Insights

Community Narratives