- Brazil

- /

- Consumer Durables

- /

- BOVESPA:GFSA3

Shareholders In Gafisa (BVMF:GFSA3) Should Look Beyond Earnings For The Full Story

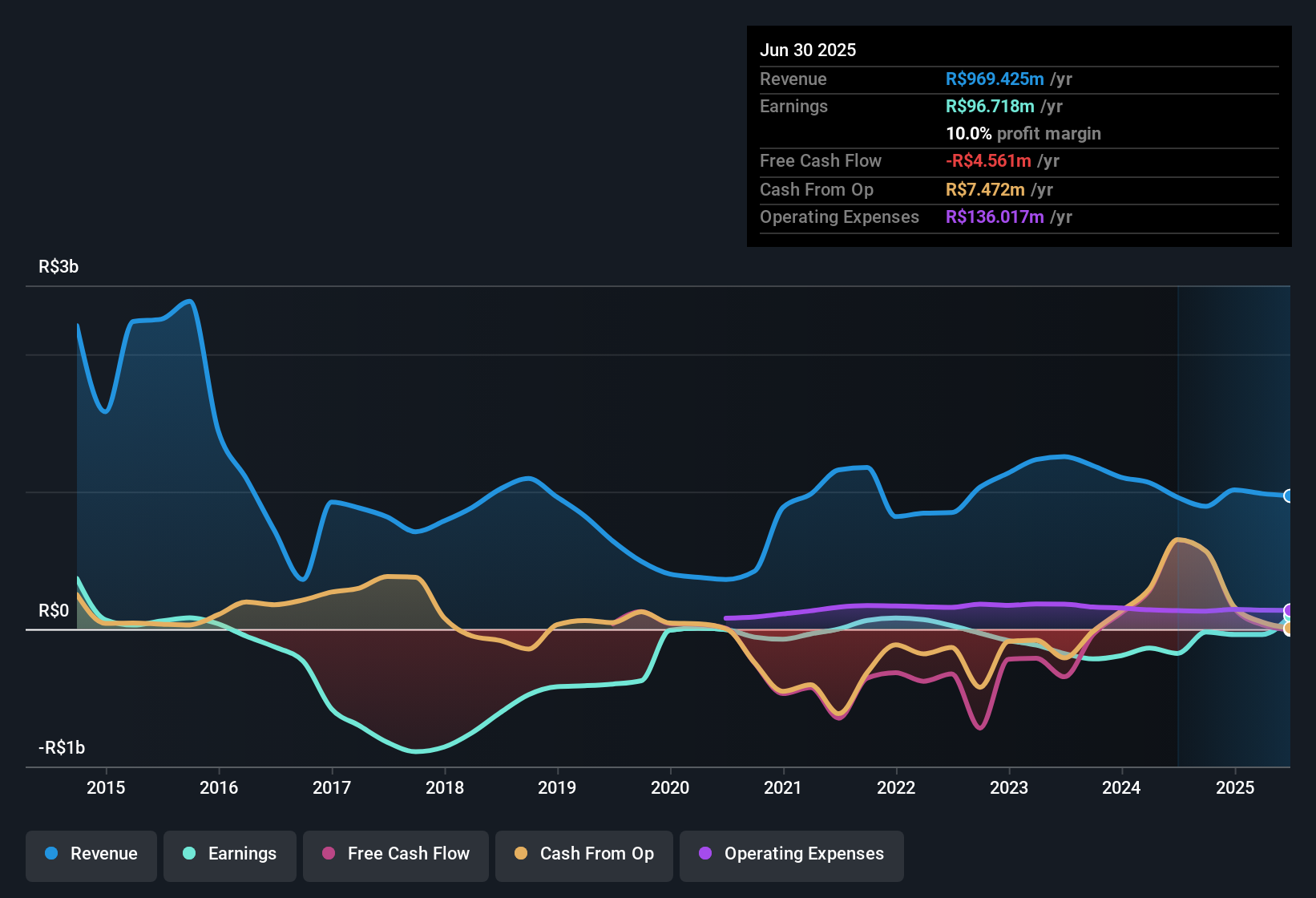

Investors were disappointed with Gafisa S.A.'s (BVMF:GFSA3) recent earnings release. Our analysis found several concerning factors in the earnings report beyond the strong statutory profit number.

To understand the value of a company's earnings growth, it is imperative to consider any dilution of shareholders' interests. As it happens, Gafisa issued 93% more new shares over the last year. As a result, its net income is now split between a greater number of shares. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. Check out Gafisa's historical EPS growth by clicking on this link.

A Look At The Impact Of Gafisa's Dilution On Its Earnings Per Share (EPS)

As it happens, we don't know how much the company made or lost three years ago, because we don't have the data. And even focusing only on the last twelve months, we don't have a meaningful growth rate because it made a loss a year ago, too. What we do know is that while it's great to see a profit over the last twelve months, that profit would have been better, on a per share basis, if the company hadn't needed to issue shares. So you can see that the dilution has had a fairly significant impact on shareholders.

In the long term, if Gafisa's earnings per share can increase, then the share price should too. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Gafisa.

The Impact Of Unusual Items On Profit

Finally, we should also consider the fact that unusual items boosted Gafisa's net profit by R$61m over the last year. While we like to see profit increases, we tend to be a little more cautious when unusual items have made a big contribution. When we crunched the numbers on thousands of publicly listed companies, we found that a boost from unusual items in a given year is often not repeated the next year. And, after all, that's exactly what the accounting terminology implies. Gafisa had a rather significant contribution from unusual items relative to its profit to June 2025. As a result, we can surmise that the unusual items are making its statutory profit significantly stronger than it would otherwise be.

Our Take On Gafisa's Profit Performance

In its last report Gafisa benefitted from unusual items which boosted its profit, which could make the profit seem better than it really is on a sustainable basis. And furthermore, it went and issued plenty of new shares, ensuring that each shareholder (who did not tip more money in) now owns a smaller proportion of the company. For all the reasons mentioned above, we think that, at a glance, Gafisa's statutory profits could be considered to be low quality, because they are likely to give investors an overly positive impression of the company. If you'd like to know more about Gafisa as a business, it's important to be aware of any risks it's facing. Case in point: We've spotted 5 warning signs for Gafisa you should be mindful of and 3 of these can't be ignored.

Our examination of Gafisa has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:GFSA3

Gafisa

Operates as a development and construction company under the Gafisa brand name in Brazil.

Moderate risk and slightly overvalued.

Market Insights

Community Narratives