- Brazil

- /

- Commercial Services

- /

- BOVESPA:PRNR3

Priner Serviços Industriais S.A.'s (BVMF:PRNR3) Shares Leap 33% Yet They're Still Not Telling The Full Story

Priner Serviços Industriais S.A. (BVMF:PRNR3) shareholders would be excited to see that the share price has had a great month, posting a 33% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 31%.

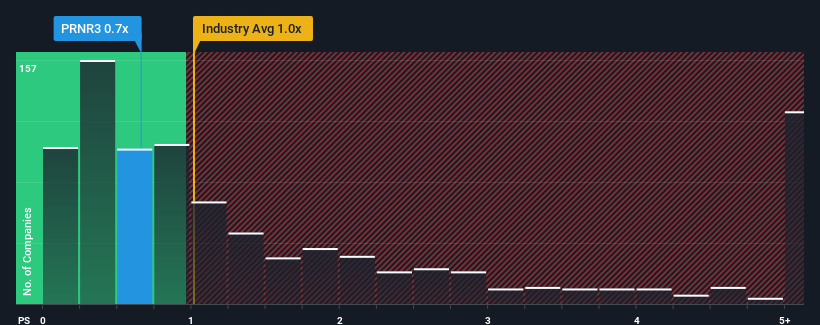

Although its price has surged higher, there still wouldn't be many who think Priner Serviços Industriais' price-to-sales (or "P/S") ratio of 0.7x is worth a mention when the median P/S in Brazil's Commercial Services industry is similar at about 0.8x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Priner Serviços Industriais

How Has Priner Serviços Industriais Performed Recently?

Priner Serviços Industriais could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Priner Serviços Industriais.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Priner Serviços Industriais' is when the company's growth is tracking the industry closely.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 2.3%. Even so, admirably revenue has lifted 211% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 24% as estimated by the two analysts watching the company. With the industry only predicted to deliver 21%, the company is positioned for a stronger revenue result.

With this information, we find it interesting that Priner Serviços Industriais is trading at a fairly similar P/S compared to the industry. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

Priner Serviços Industriais' stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Looking at Priner Serviços Industriais' analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

You need to take note of risks, for example - Priner Serviços Industriais has 5 warning signs (and 1 which doesn't sit too well with us) we think you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:PRNR3

Priner Serviços Industriais

Provides industrial, infrastructure, integrity engineering, and inspection services in the petrochemical, pulp and paper, steel, offshore, naval, mining, and infrastructure sectors in Brazil.

Reasonable growth potential with acceptable track record.

Market Insights

Community Narratives