3 Growth Companies With High Insider Ownership Growing Earnings Up To 89%

Reviewed by Simply Wall St

In a week marked by significant economic data releases and heightened market volatility, global markets experienced notable declines, with major indices such as the S&P 500 and Nasdaq Composite pulling back sharply. Amidst this backdrop, investors are increasingly focusing on growth companies with high insider ownership as potential opportunities for robust earnings growth. In challenging market conditions like these, stocks with strong insider ownership can be particularly appealing because they often signal that those closest to the company have confidence in its future prospects. This article will explore three such growth companies that are not only demonstrating impressive earnings performance but also boast significant insider stakes.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Gaming Innovation Group (OB:GIG) | 26.7% | 37.4% |

| Medley (TSE:4480) | 34% | 28.7% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 13.6% | 26.8% |

| KebNi (OM:KEBNI B) | 37.8% | 90.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.4% | 60.9% |

| Seojin SystemLtd (KOSDAQ:A178320) | 29.6% | 58.7% |

| Calliditas Therapeutics (OM:CALTX) | 11.6% | 52.9% |

| Vow (OB:VOW) | 31.7% | 97.7% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 74.3% |

| HANA Micron (KOSDAQ:A067310) | 20% | 97.4% |

Below we spotlight a couple of our favorites from our exclusive screener.

GPS Participações e Empreendimentos (BOVESPA:GGPS3)

Simply Wall St Growth Rating: ★★★★☆☆

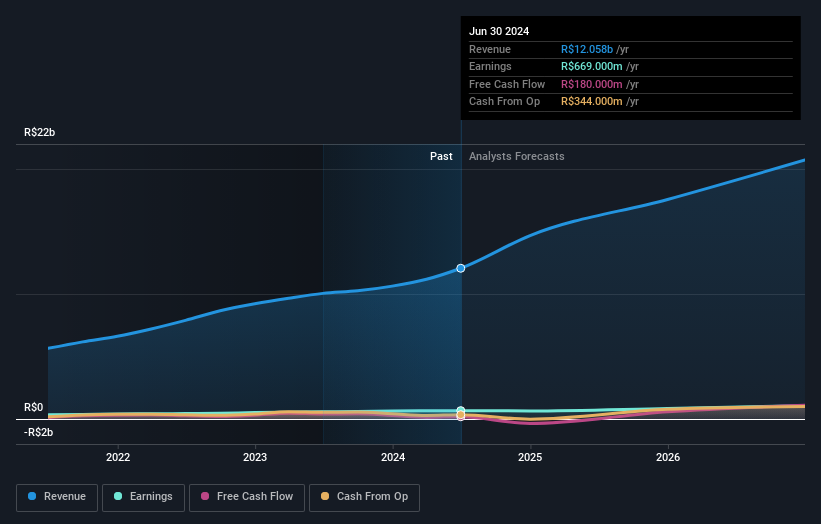

Overview: GPS Participações e Empreendimentos S.A. (BOVESPA:GGPS3) operates in Brazil, offering services in facilities, security, logistics, utility engineering, industrial service, catering, and infrastructure with a market cap of R$12.16 billion.

Operations: The company generates revenue by providing services in facilities, security, logistics, utility engineering, industrial service, catering, and infrastructure across Brazil.

Insider Ownership: 24%

Earnings Growth Forecast: 18.2% p.a.

GPS Participações e Empreendimentos reported a net income of BRL 137.67 million for Q1 2024, up from BRL 120.86 million a year ago, with basic and diluted earnings per share at BRL 0.2. The company's revenue is forecast to grow at 19.6% annually, outpacing the Brazilian market's growth rate of 7.5%. Earnings are expected to increase by 18.25% per year, higher than the market average of 13.7%, with a projected Return on Equity of 25.3%.

- Navigate through the intricacies of GPS Participações e Empreendimentos with our comprehensive analyst estimates report here.

- In light of our recent valuation report, it seems possible that GPS Participações e Empreendimentos is trading behind its estimated value.

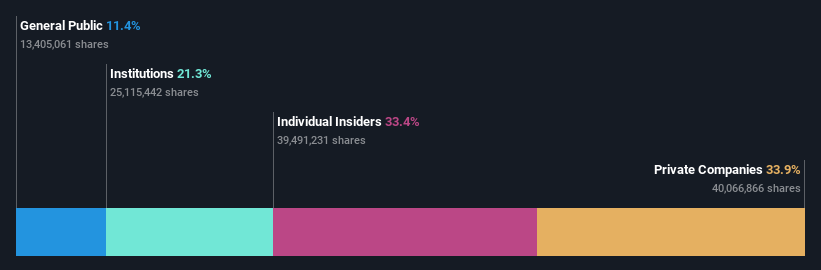

Shanghai Action Education TechnologyLTD (SHSE:605098)

Simply Wall St Growth Rating: ★★★★★★

Overview: Shanghai Action Education Technology LTD (ticker: SHSE:605098) operates in the education technology sector with a market cap of CN¥3.84 billion.

Operations: Shanghai Action Education Technology LTD (ticker: SHSE:605098) operates in the education technology sector with a market cap of CN¥3.84 billion. The company's revenue segments include various educational products and services, generating millions of CN¥ annually.

Insider Ownership: 33.4%

Earnings Growth Forecast: 24% p.a.

Shanghai Action Education Technology LTD is expected to see its revenue grow at 22.3% annually, outpacing the CN market's 13.6%. Earnings are forecast to increase by 23.99% per year, significantly higher than the market average of 22.2%, with a high Return on Equity projected at 38.2% in three years. Despite an impressive past earnings growth of 86.8%, its current dividend yield of 5.59% is not well covered by earnings, raising sustainability concerns.

- Dive into the specifics of Shanghai Action Education TechnologyLTD here with our thorough growth forecast report.

- Insights from our recent valuation report point to the potential undervaluation of Shanghai Action Education TechnologyLTD shares in the market.

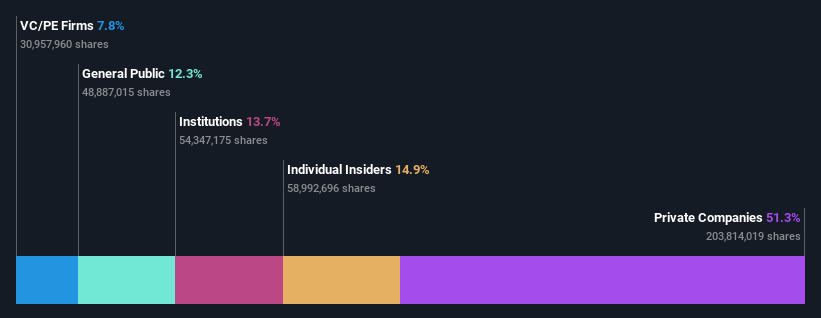

Nanjing Vazyme BiotechLtd (SHSE:688105)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Nanjing Vazyme Biotech Co., Ltd. provides technology solutions for life science, biomedicine, and in vitro diagnostics with a market cap of CN¥8.15 billion.

Operations: The company's revenue segments include technology solutions for life science (CN¥1.25 billion), biomedicine (CN¥980 million), and in vitro diagnostics (CN¥2.10 billion).

Insider Ownership: 14.9%

Earnings Growth Forecast: 89.1% p.a.

Nanjing Vazyme Biotech Ltd. is forecast to achieve 89.08% annual earnings growth and 27.6% revenue growth, surpassing the CN market's average of 13.6%. Expected to become profitable within three years, it trades at a good value compared to peers and industry standards. Despite being removed from the Shanghai Stock Exchange Health Care Sector Index in June 2024, recent presentations at major biotech conferences highlight ongoing R&D efforts in mRNA-based therapeutics and oligonucleotide therapies.

- Get an in-depth perspective on Nanjing Vazyme BiotechLtd's performance by reading our analyst estimates report here.

- Our expertly prepared valuation report Nanjing Vazyme BiotechLtd implies its share price may be lower than expected.

Next Steps

- Delve into our full catalog of 1463 Fast Growing Companies With High Insider Ownership here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Nanjing Vazyme BiotechLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688105

Nanjing Vazyme BiotechLtd

Nanjing Vazyme Biotech Co., Ltd. offers technology solutions for life science, biomedicine, and in vitro diagnostics.

High growth potential with adequate balance sheet.