- Poland

- /

- Real Estate

- /

- WSE:ECH

European Stocks That May Be Trading Below Estimated Value September 2025

Reviewed by Simply Wall St

As European markets navigate a landscape of mixed monetary policy decisions and economic indicators, the pan-European STOXX Europe 600 Index recently ended slightly lower, reflecting investor caution. In this environment, identifying stocks that may be trading below their estimated value can provide opportunities for investors seeking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Truecaller (OM:TRUE B) | SEK43.24 | SEK85.34 | 49.3% |

| Rheinmetall (XTRA:RHM) | €1928.00 | €3793.66 | 49.2% |

| Micro Systemation (OM:MSAB B) | SEK61.40 | SEK121.94 | 49.6% |

| Green Oleo (BIT:GRN) | €0.78 | €1.52 | 48.5% |

| Gofore Oyj (HLSE:GOFORE) | €14.78 | €29.47 | 49.9% |

| Digital Workforce Services Oyj (HLSE:DWF) | €3.41 | €6.78 | 49.7% |

| cyan (XTRA:CYR) | €2.26 | €4.39 | 48.5% |

| ATON Green Storage (BIT:ATON) | €2.05 | €4.09 | 49.9% |

| Atea (OB:ATEA) | NOK144.80 | NOK279.53 | 48.2% |

| Alfio Bardolla Training Group (BIT:ABTG) | €1.955 | €3.78 | 48.2% |

Let's review some notable picks from our screened stocks.

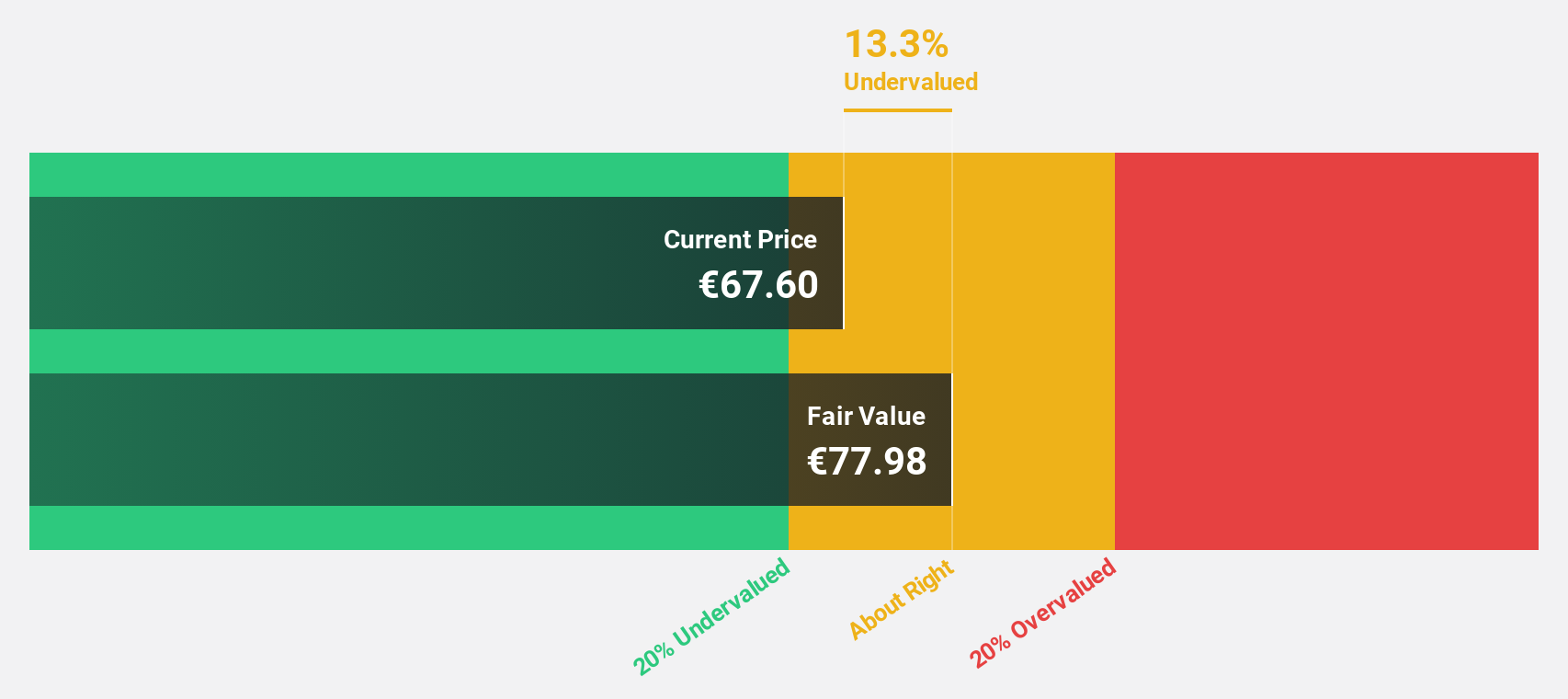

Melexis (ENXTBR:MELE)

Overview: Melexis NV designs, develops, tests, and markets advanced integrated semiconductor devices primarily for the automotive industry across Europe, the Middle East, Africa, the Asia Pacific, and North and Latin America with a market cap of €2.67 billion.

Operations: The company's revenue segment is primarily from the development and sale of integrated circuits, amounting to €855.10 million.

Estimated Discount To Fair Value: 15.1%

Melexis NV's current trading price (€66.2) is below its estimated fair value (€77.93), indicating potential undervaluation based on cash flows. Despite high debt levels, the company forecasts earnings growth of 16% annually, outpacing the Belgian market's 14.9%. However, recent earnings have declined with second-quarter sales at €211.59 million versus €245.73 million last year and net income dropping to €37.81 million from €49.07 million previously reported.

- The growth report we've compiled suggests that Melexis' future prospects could be on the up.

- Click here to discover the nuances of Melexis with our detailed financial health report.

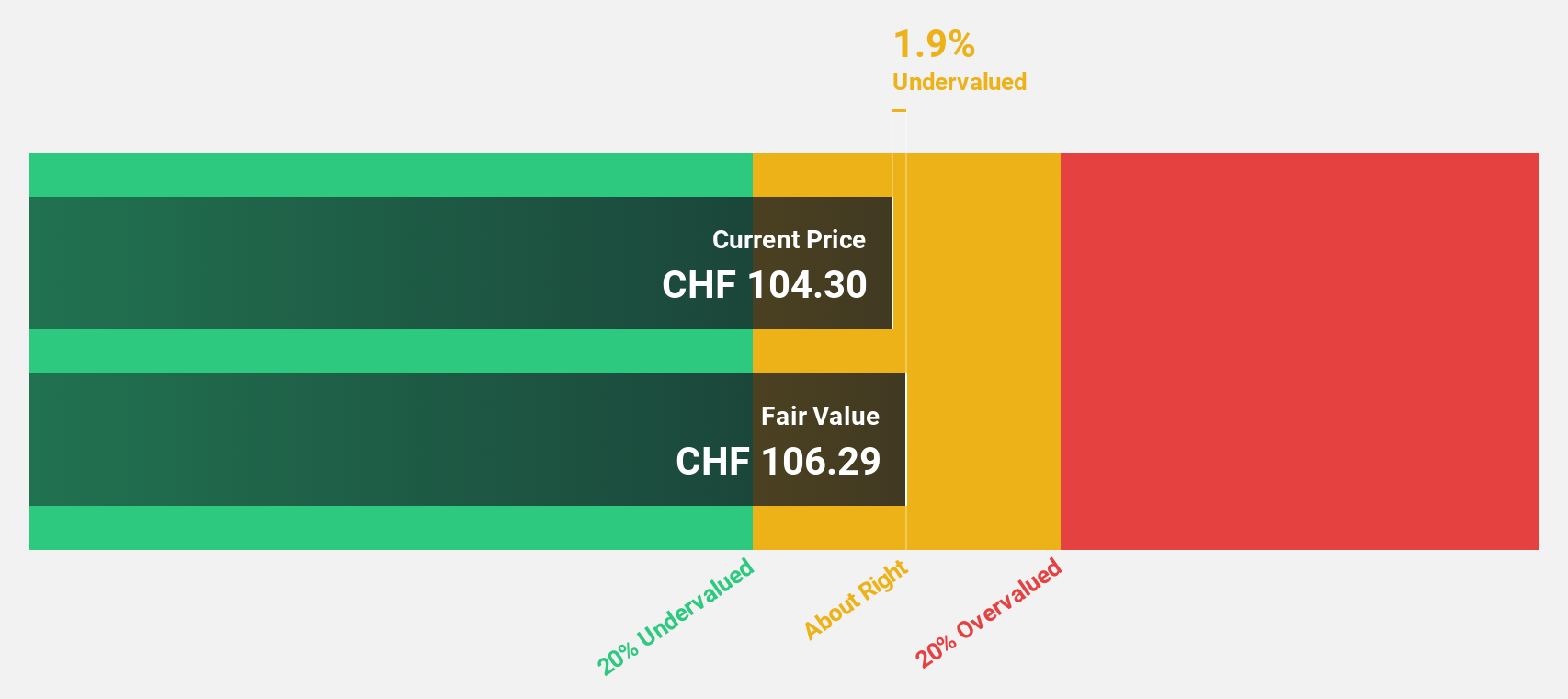

Straumann Holding (SWX:STMN)

Overview: Straumann Holding AG is a global provider of tooth replacement and orthodontic solutions with a market cap of CHF14.51 billion.

Operations: The company's revenue segments are comprised of CHF1.38 billion from operations, CHF655.77 million from sales in Asia Pacific, CHF783.18 million from North America, CHF292.92 million from Latin America, and CHF1.14 billion from Europe, Middle East and Africa sales.

Estimated Discount To Fair Value: 27.5%

Straumann Holding AG, trading at CHF 90.98, is below its estimated fair value of CHF 125.44, reflecting potential undervaluation based on cash flows. Earnings are projected to grow annually by 15.3%, surpassing the Swiss market's growth rate of 11.2%. Recent financials show half-year sales increased to CHF 1.35 billion from CHF 1.27 billion last year, though net income saw modest improvement to CHF 236.44 million from CHF 230.37 million previously reported.

- The analysis detailed in our Straumann Holding growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of Straumann Holding.

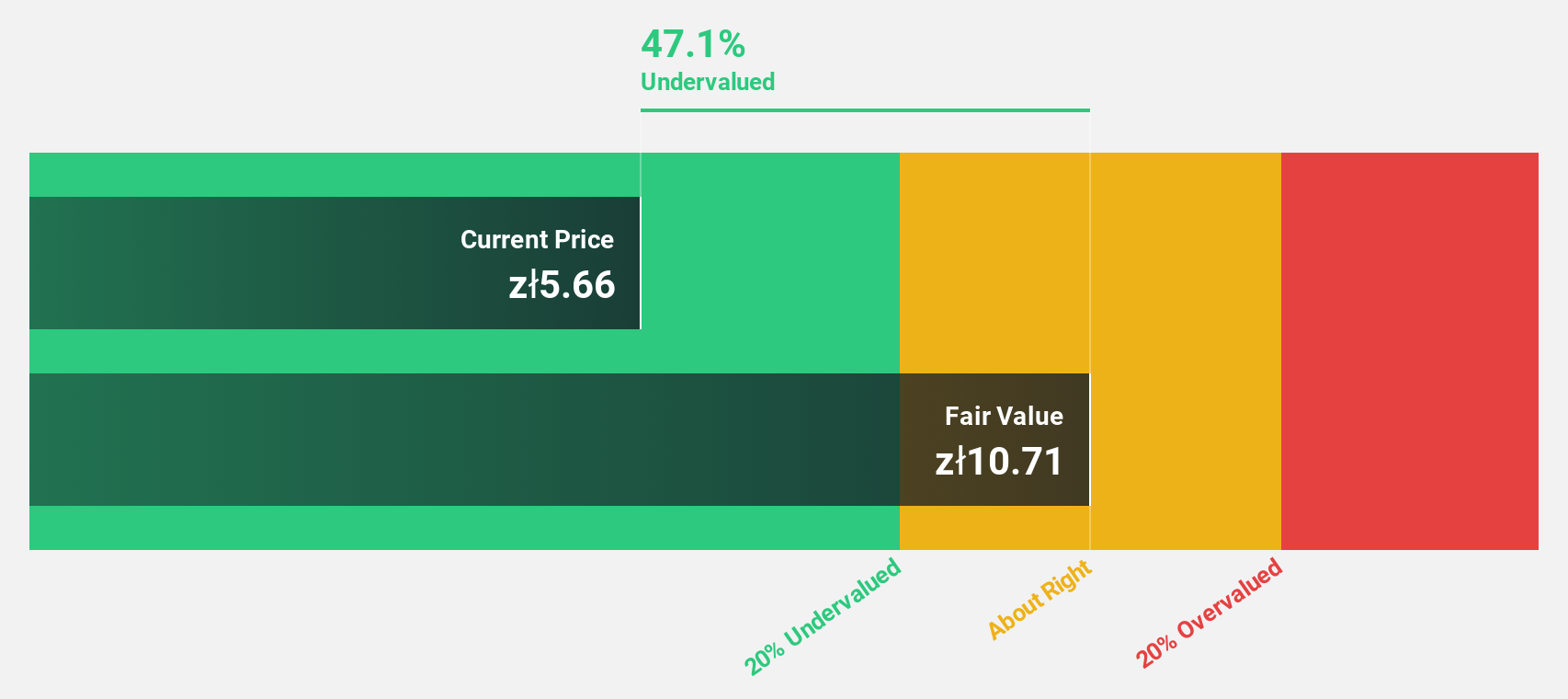

Echo Investment (WSE:ECH)

Overview: Echo Investment S.A. operates in Poland, focusing on the construction, lease, and sale of office, retail, and residential buildings with a market cap of PLN2.48 billion.

Operations: The company's revenue segments include the construction, lease, and sale of office, retail, and residential buildings in Poland.

Estimated Discount To Fair Value: 44%

Echo Investment S.A. is trading at PLN 6, significantly below its fair value estimate of PLN 10.71, indicating a potential undervaluation based on cash flows. Despite current financial challenges with a net loss of PLN 199.06 million for the first half of 2025, revenue growth is forecasted at 19.2% annually, outpacing the Polish market's growth rate. The company is expected to achieve profitability within three years with strong projected earnings growth and high future return on equity.

- Upon reviewing our latest growth report, Echo Investment's projected financial performance appears quite optimistic.

- Get an in-depth perspective on Echo Investment's balance sheet by reading our health report here.

Seize The Opportunity

- Access the full spectrum of 209 Undervalued European Stocks Based On Cash Flows by clicking on this link.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Echo Investment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:ECH

Echo Investment

Engages in the construction, lease, and sale of office, retail, and residential buildings in Poland.

Exceptional growth potential and fair value.

Similar Companies

Market Insights

Community Narratives