- Belgium

- /

- Specialized REITs

- /

- ENXTBR:SHUR

Shurgard Self Storage (ENXTBR:SHUR): Evaluating Current Valuation After Extended Share Price Weakness

Reviewed by Simply Wall St

Most Popular Narrative: 18.8% Undervalued

According to the most widely followed narrative, Shurgard Self Storage shares are trading below what analysts consider to be fair value. This presents a notable discount based on future earnings outlook and sector dynamics.

Ongoing investments in technology and operational efficiencies, such as digital booking platforms, cluster management, store automation, and unit remixing, are yielding tangible gains in NOI margin (up 90bps in H1 2025). This points to the ability to further improve net margins and operational earnings.

Curious why so many market-watchers think this stock deserves a much higher valuation? There is a pivotal set of financial assumptions powering this bullish price target, and the future performance expectations behind it might surprise you. Want to know what is fueling the case for a sharp market re-rate? The full narrative reveals the strategic moves and bold numbers at the heart of this value call.

Result: Fair Value of €40.07 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, rising competition and slower revenue growth in Shurgard's core markets could challenge the optimistic outlook and limit future returns for shareholders.

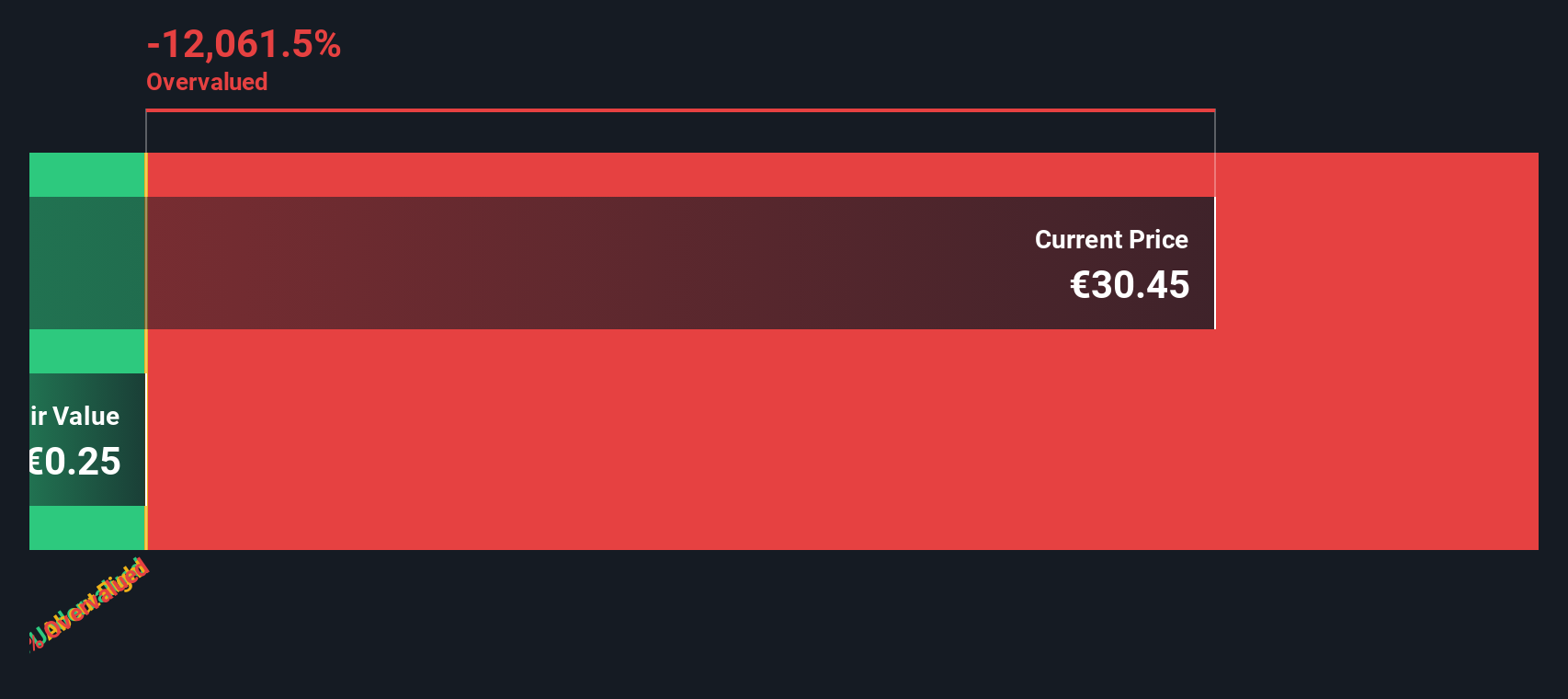

Find out about the key risks to this Shurgard Self Storage narrative.Another View: Our DCF Model Steps In

While many focus on price multiples for quick comparisons, our SWS DCF model looks deeper. Interestingly, it also points toward undervaluation, but takes a more granular approach to future cash flows. Could this valuation offer a different shade of insight?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Shurgard Self Storage Narrative

If you believe there is more to Shurgard Self Storage’s story, or want to explore the numbers on your own terms, you can easily build your own perspective in just a few minutes. Do it your way

A great starting point for your Shurgard Self Storage research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Step up your investing game and uncover powerful stock ideas other investors might miss. Our handpicked screeners bring you strategic opportunities, tailored for your goals. See where your next big winner could be hiding.

- Target companies that may be undervalued today based on their future cash potential by tapping into our undervalued stocks based on cash flows resource.

- Capture high-yield opportunities and spot businesses offering reliable income streams using our gateway to dividend stocks with yields > 3%.

- Follow the money into breakthrough sectors as AI transforms industries, with fresh picks from our AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About ENXTBR:SHUR

Shurgard Self Storage

Engages in the acquisition, development, and operation of self-storage facilities for business and personal use.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives