Solvay (ENXTBR:SOLB): Valuation Focus After 2025 Guidance Reaffirmation, Resilient Profit, and Dividend Decision

Reviewed by Simply Wall St

Solvay (ENXTBR:SOLB) has drawn attention after confirming its 2025 guidance even as tariff issues affect its Brazilian business. The company also approved a stable interim dividend and reported stronger net profit, sparking investor interest.

See our latest analysis for Solvay.

Momentum around Solvay has been choppy this year, with the company’s confirmation of 2025 guidance and recent profit beat offering reassurance after a challenging stretch. While the share price is down nearly 14% year-to-date, the longer-term story is more resilient. This is shown by a 54% total shareholder return over the past three years and 92% over five. Investors seem to be weighing fresh earnings, portfolio shifts tied to the energy transition, and ongoing tariff risks as they gauge the outlook.

Curious what else is trending in materials and industrials right now? It could pay to broaden your search and discover fast growing stocks with high insider ownership

With shares still trading below analysts’ price targets and at a significant discount to some intrinsic value estimates, is Solvay now an undervalued opportunity or is the market already factoring in future growth potential?

Most Popular Narrative: 7.2% Undervalued

Solvay’s most widely followed valuation narrative puts its fair value above the latest close, suggesting room for appreciation. However, the path to that valuation is shaped by complex operational shifts and evolving industry dynamics.

Expansion in rare earths and battery materials, along with operational digitalization, positions Solvay for stronger asset utilization, margin gains, and long-term growth leadership. Sustainability initiatives and supply chain localization strategies align with regulatory trends and premium pricing opportunities, further supporting future-proofing and profitability.

Want to know which big-picture shifts could drive Solvay’s next move? The narrative’s calculation is built on projected improvements in both earnings power and margin profile, leading to a future valuation typically reserved for companies with stronger pricing power. Discover which financial levers and strategic bets underlie this outlook in the complete narrative.

Result: Fair Value of €28.7 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent pricing pressure and global trade tensions could undermine Solvay's growth prospects and introduce greater earnings volatility in the coming years.

Find out about the key risks to this Solvay narrative.

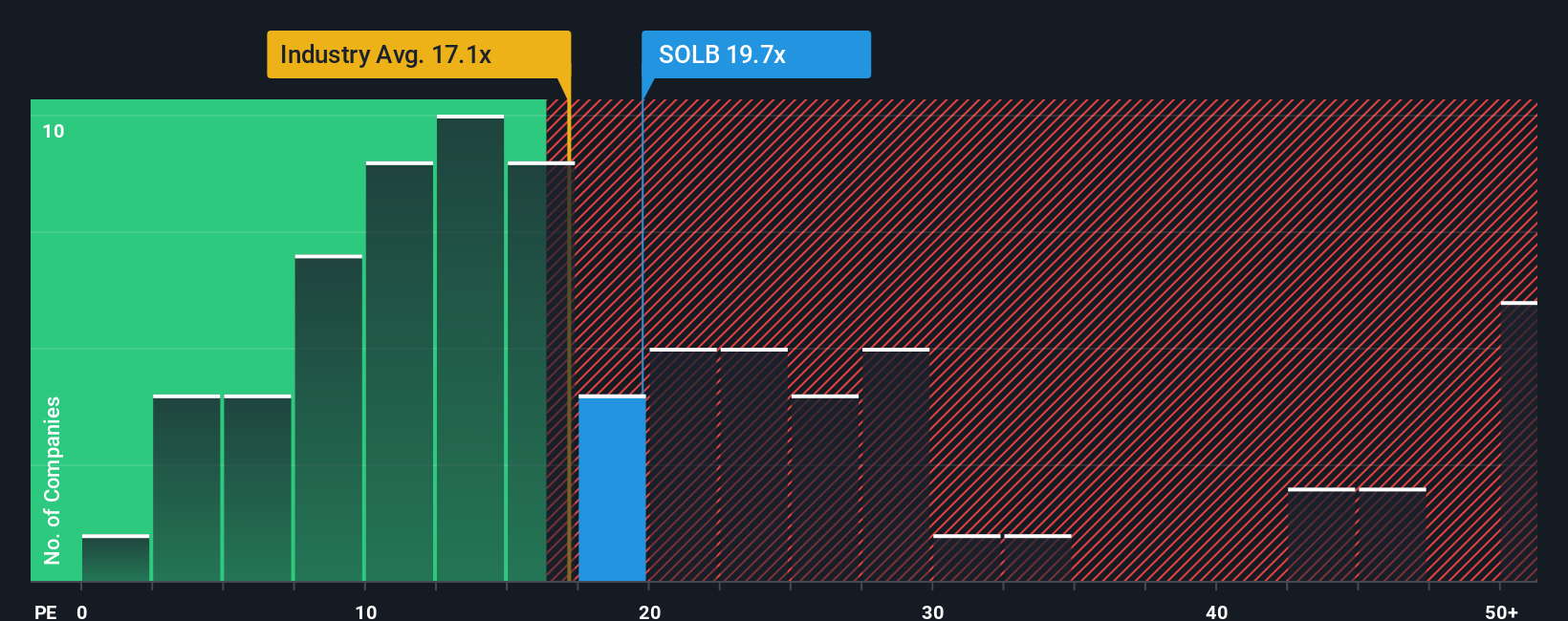

Another View: What Do Market Ratios Suggest?

Looking through the lens of the price-to-earnings ratio, Solvay appears expensive compared to both its European Chemical peers and the sector average. Shares currently trade at 18.1 times earnings, while the European industry sits at 17.5 times and direct peers average 16.5, both below Solvay’s level. The fair ratio could be closer to 18.2 times. This suggests a narrow margin for error if expectations slip. Does this premium truly reflect Solvay’s upside, or might market sentiment swing quickly on further earnings shifts?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Solvay Narrative

If you see things differently or want to dig deeper into the numbers yourself, you can easily shape your own perspective in just a few minutes, and Do it your way.

A great starting point for your Solvay research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Want to boost your investing strategy and spot tomorrow’s leaders before everyone else? These opportunities could be the edge you need to stay ahead.

- Spot stocks with momentum and strong cash flow by starting with these 870 undervalued stocks based on cash flows and position yourself for value-driven growth.

- Catch potential in the hottest sector and capitalize on trends by scoping out these 24 AI penny stocks shaping groundbreaking advancements in artificial intelligence.

- Lock in reliable income streams when you assess these 16 dividend stocks with yields > 3% offering robust dividends and yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:SOLB

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives