Amid heightened global trade tensions and economic uncertainty, European markets have experienced significant volatility, with the STOXX Europe 600 Index seeing its largest drop in five years due to unexpected U.S. tariffs. Despite these challenges, small-cap stocks in Europe can offer unique opportunities for investors seeking growth potential in a turbulent market environment. Identifying promising small-cap companies involves looking for those with robust fundamentals and innovative strategies that can navigate current economic headwinds effectively.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AB Traction | NA | 3.81% | 3.66% | ★★★★★★ |

| Mirbud | 16.01% | 27.19% | 26.48% | ★★★★★★ |

| Linc | NA | 19.35% | 23.17% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| La Forestière Equatoriale | NA | -58.49% | 45.78% | ★★★★★★ |

| Intellego Technologies | 11.59% | 68.05% | 72.76% | ★★★★★★ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 14.94% | 0.59% | 5.95% | ★★★★★☆ |

| Flügger group | 20.98% | 3.24% | -29.82% | ★★★★★☆ |

| ABG Sundal Collier Holding | 0.61% | -2.06% | -8.96% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Exmar (ENXTBR:EXM)

Simply Wall St Value Rating: ★★★★★☆

Overview: Exmar NV is a global provider of shipping and energy supply chain solutions with a market capitalization of €661.76 million.

Operations: Exmar generates revenue primarily from its Infrastructure segment at $212.20 million, followed by Shipping at $142.80 million and Supporting Services at $90.20 million.

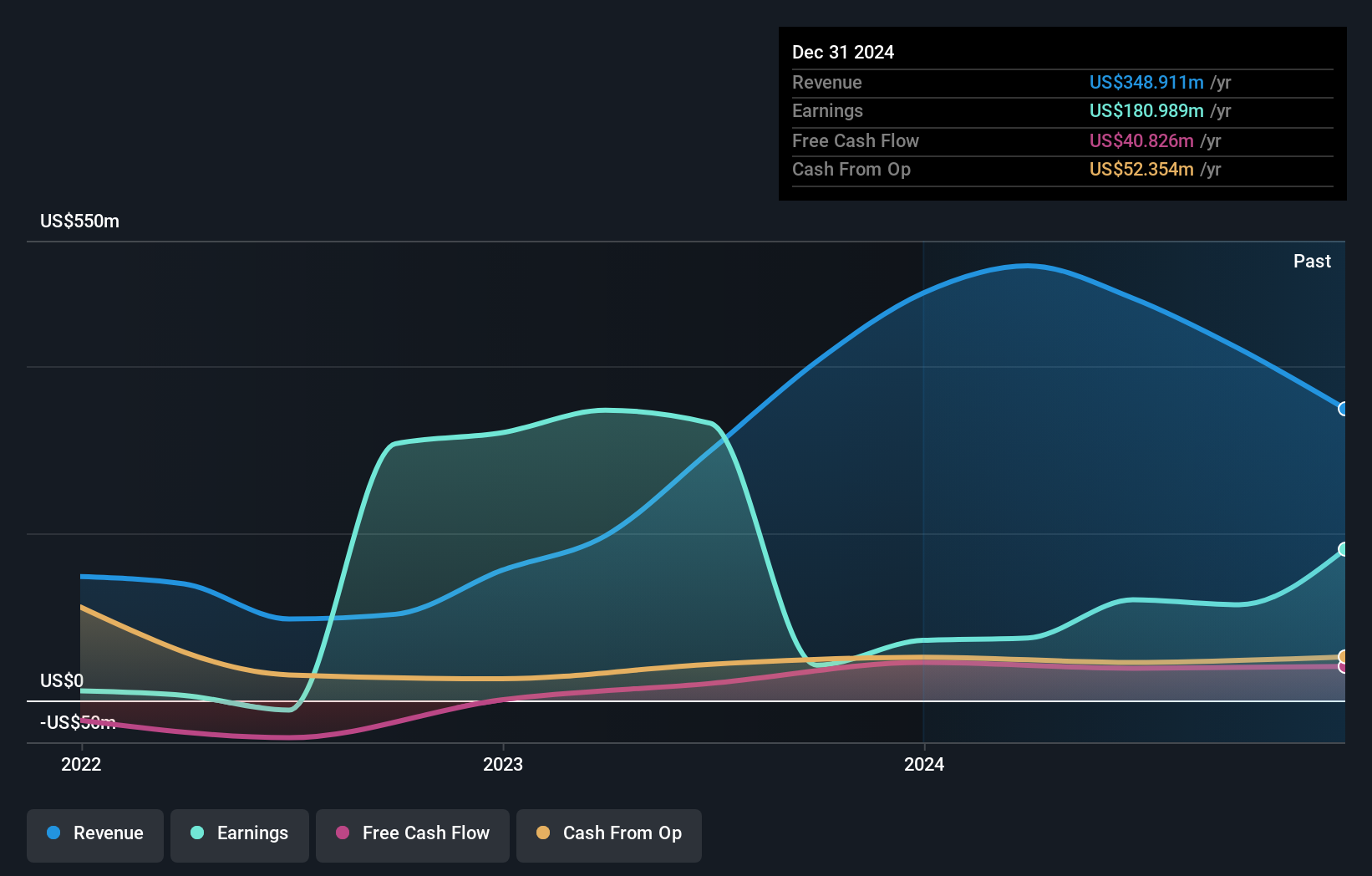

Exmar, a nimble player in the oil and gas sector, has shown strong financial performance despite industry challenges. The company's earnings surged by 151.5% over the past year, significantly outpacing the industry's -26.8%. Exmar's net debt to equity ratio stands at a satisfactory 6.9%, down from 85.5% five years ago, indicating improved financial health. With interest payments well covered by EBIT at 8.3 times and high-quality non-cash earnings, Exmar is on solid footing financially. Recent results highlight an impressive jump in net income to US$180.99 million from US$71.97 million last year, reflecting robust operational success amidst sales fluctuations.

- Click here to discover the nuances of Exmar with our detailed analytical health report.

Understand Exmar's track record by examining our Past report.

EPC Groupe (ENXTPA:EXPL)

Simply Wall St Value Rating: ★★★★★★

Overview: EPC Groupe is involved in the manufacture, storage, and distribution of explosives across Europe, Africa, Asia Pacific, and the Americas with a market capitalization of €420.68 million.

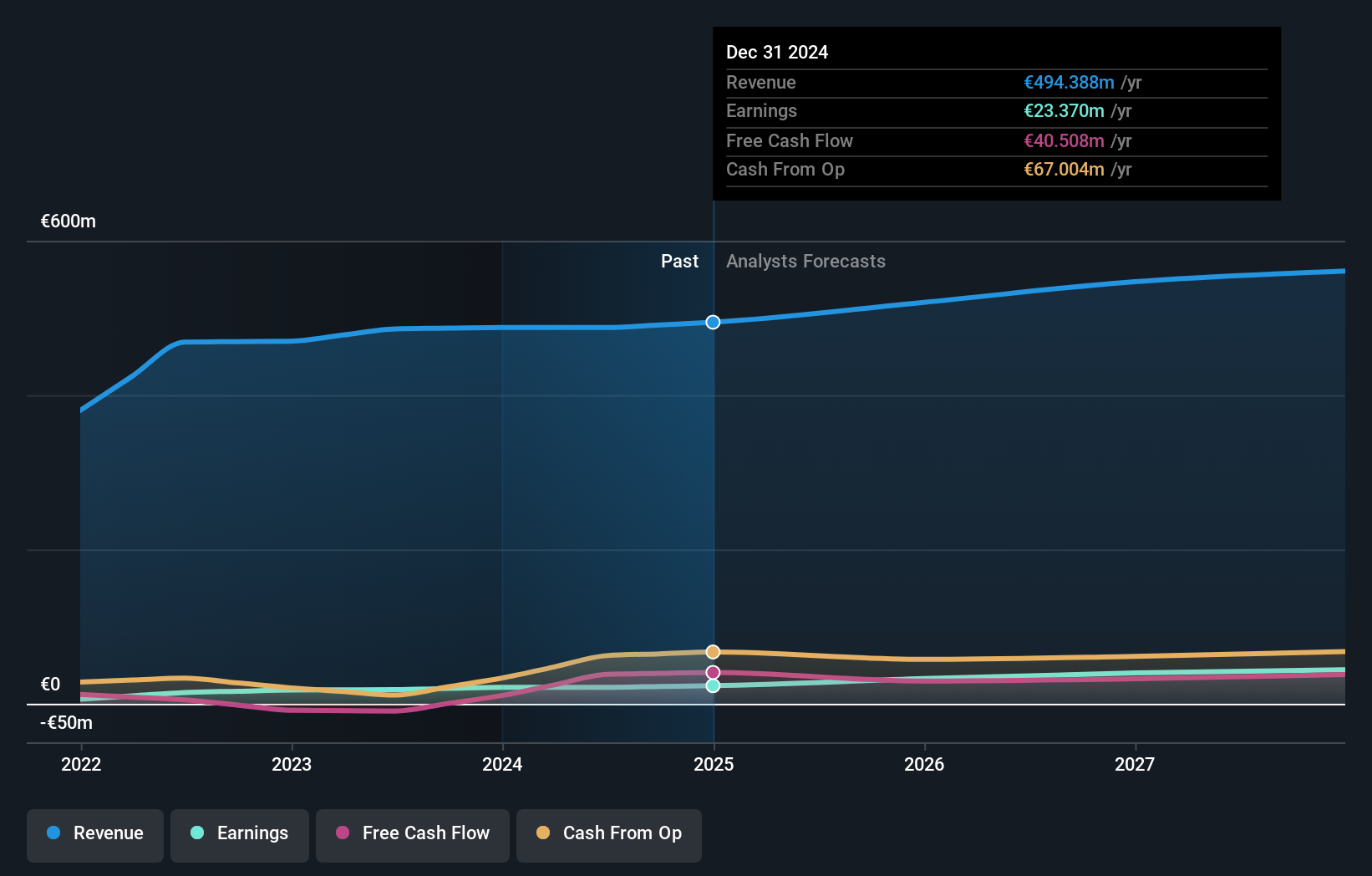

Operations: EPC Groupe generates revenue primarily from its Specialty Chemicals segment, which contributed €494.39 million.

EPC Groupe, a small player in the European market, reported impressive earnings growth of 9.5% last year, surpassing the Chemicals industry average of 8.4%. The company saw its net income rise to €23.37 million from €21.35 million, with basic earnings per share increasing to €11.22 from €10.16. EPC is trading at a significant discount of 35.7% below its estimated fair value and has managed to reduce its debt-to-equity ratio from 73.9% to a satisfactory 45.5% over five years, suggesting prudent financial management and potential for future growth in profitability and value creation.

- Click here and access our complete health analysis report to understand the dynamics of EPC Groupe.

Gain insights into EPC Groupe's past trends and performance with our Past report.

Elma Electronic (SWX:ELMN)

Simply Wall St Value Rating: ★★★★★★

Overview: Elma Electronic AG is a global manufacturer and seller of electronic packaging products for the embedded systems market, with a market capitalization of CHF 249.06 million.

Operations: Elma generates revenue primarily from its Electronic Components and Parts segment, amounting to CHF 177.77 million. The company's market capitalization stands at CHF 249.06 million.

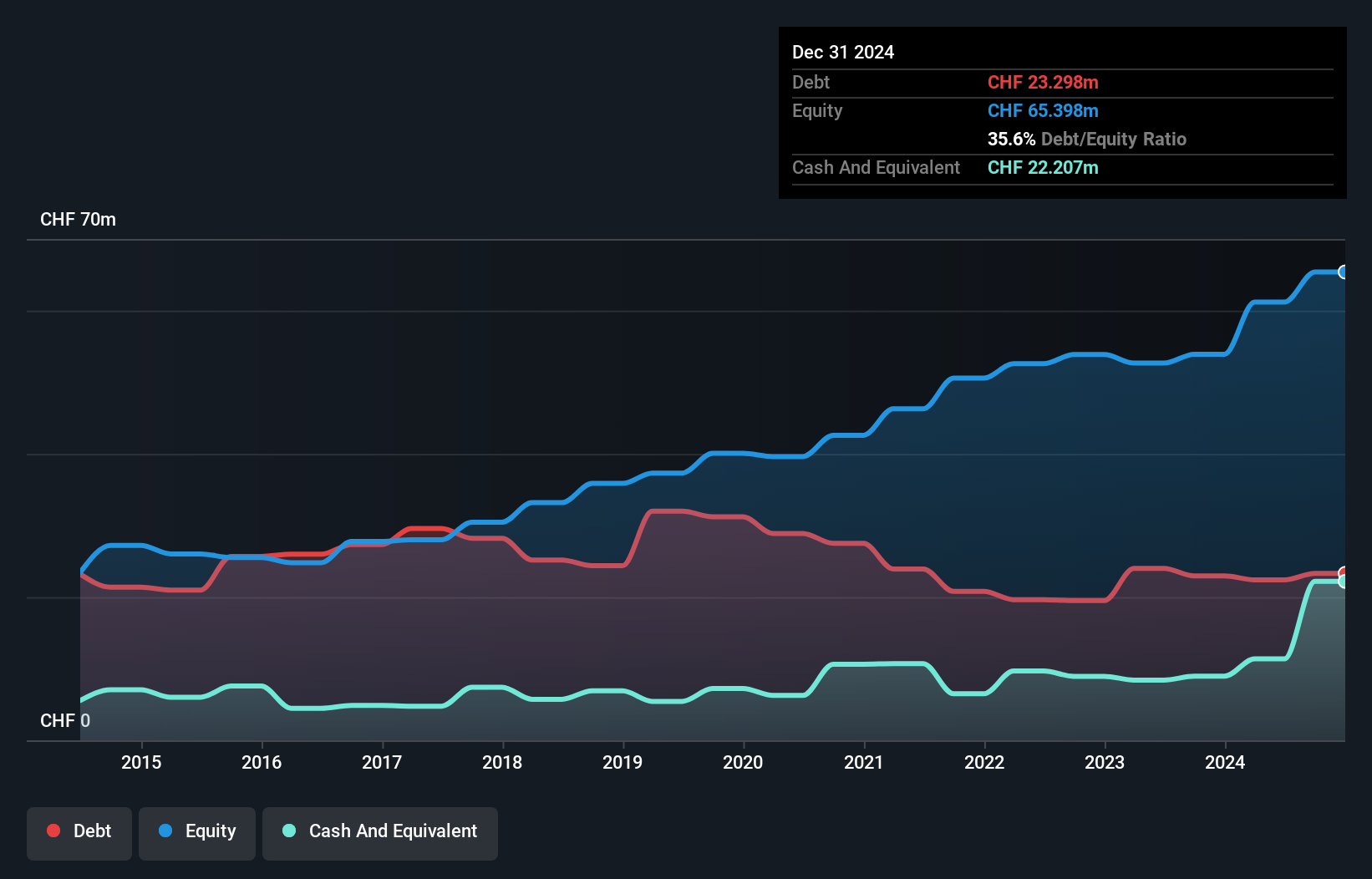

Elma Electronic, a small but promising player in the electronics sector, has shown robust financial health with its debt to equity ratio dropping from 77.9% to 35.6% over five years and a net debt to equity ratio at a satisfactory 1.7%. The company's earnings surged by 69.5% last year, outpacing the industry average and indicating strong operational performance. Elma's EBIT covers interest payments by an impressive factor of 41.5x, underscoring its solid earnings quality and profitability. Trading at around 81% below estimated fair value suggests potential upside for investors seeking undervalued opportunities in niche markets like this one.

- Dive into the specifics of Elma Electronic here with our thorough health report.

Explore historical data to track Elma Electronic's performance over time in our Past section.

Turning Ideas Into Actions

- Unlock our comprehensive list of 339 European Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elma Electronic might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:ELMN

Elma Electronic

Manufactures and sells electronic packaging products for the embedded systems market worldwide.

Flawless balance sheet and fair value.

Market Insights

Community Narratives