- Pakistan

- /

- Oil and Gas

- /

- KASE:MARI

Undiscovered Gems with Strong Potential for August 2024

Reviewed by Simply Wall St

As global markets experience heightened volatility and economic indicators show mixed signals, the focus has shifted towards identifying resilient opportunities within the small-cap sector. In this environment, finding stocks with strong fundamentals and growth potential can be particularly rewarding.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Etihad Atheeb Telecommunication | NA | 26.82% | 62.18% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Britam Holdings | 10.05% | 3.47% | 16.62% | ★★★★★☆ |

| Societe de Limonaderies et de Boissons Rafraichissantes d'Afrique | 39.37% | 8.04% | -3.72% | ★★★★★☆ |

| Standard Chartered Bank Kenya | 6.93% | 8.35% | 16.18% | ★★★★☆☆ |

| Central Cooperative Bank AD | 4.88% | 4.12% | 8.95% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Dutch-Bangla Bank (DSE:DUTCHBANGL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Dutch-Bangla Bank PLC offers a range of commercial banking products and services to corporate, retail, and institutional customers in Bangladesh, with a market cap of BDT50.09 billion.

Operations: Dutch-Bangla Bank PLC generates revenue primarily from interest income and fees related to its commercial banking services. The bank's net profit margin is 15.45%.

Dutch-Bangla Bank, with total assets of BDT631.1B and equity of BDT48.8B, boasts a price-to-earnings ratio of 6.5x, significantly lower than the BD market average of 22.1x. The bank’s earnings grew by 30.4% over the past year, outpacing the industry growth rate of 27.4%. It has high bad loans at 5.7%, but maintains low-risk funding with customer deposits making up 86% of liabilities and an allowance for bad loans at 63%.

Square Pharmaceuticals (DSE:SQURPHARMA)

Simply Wall St Value Rating: ★★★★★☆

Overview: Square Pharmaceuticals PLC. and its subsidiaries develop, manufacture, and market drugs for healthcare for various live species in Bangladesh, with a market cap of BDT209.56 billion.

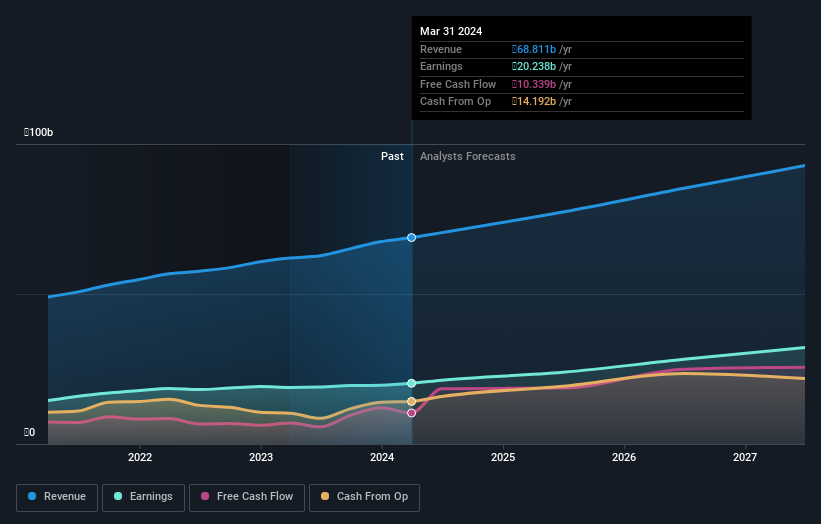

Operations: Square Pharmaceuticals PLC generates revenue primarily from its pharmaceuticals segment, which amounted to BDT68.81 billion. The company's market cap stands at BDT209.56 billion.

Square Pharmaceuticals, trading at a P/E ratio of 10.4x versus the BD market's 22.1x, offers an attractive valuation. With earnings growth of 7.3% over the past year, it outperformed the broader pharmaceuticals industry which saw a -2.8% decline. The company has more cash than total debt and boasts high-quality earnings, ensuring financial stability and interest coverage is not an issue. Future projections indicate annual earnings growth of 12.18%.

Mari Petroleum (KASE:MARI)

Simply Wall St Value Rating: ★★★★★☆

Overview: Mari Petroleum Company Limited explores for, produces, and sells hydrocarbons in Pakistan with a market cap of PKR381.37 billion.

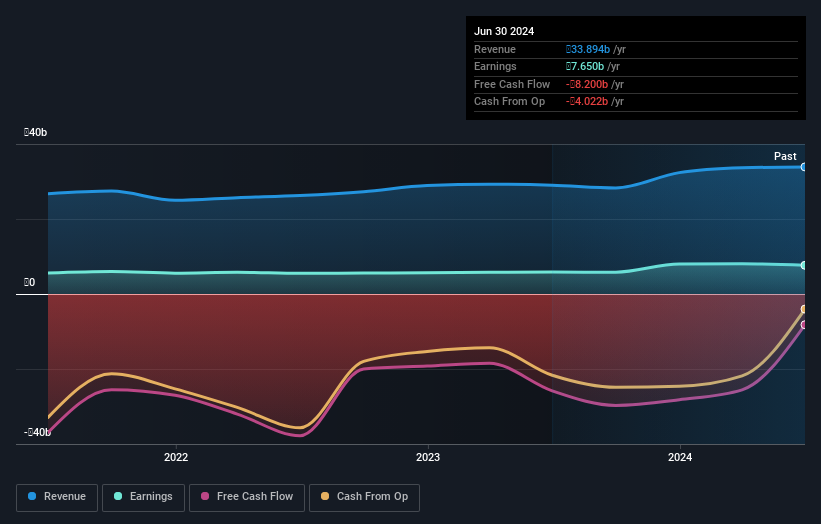

Operations: Mari Petroleum generates revenue primarily from its Oil & Gas - Exploration & Production segment, amounting to PKR166.18 billion.

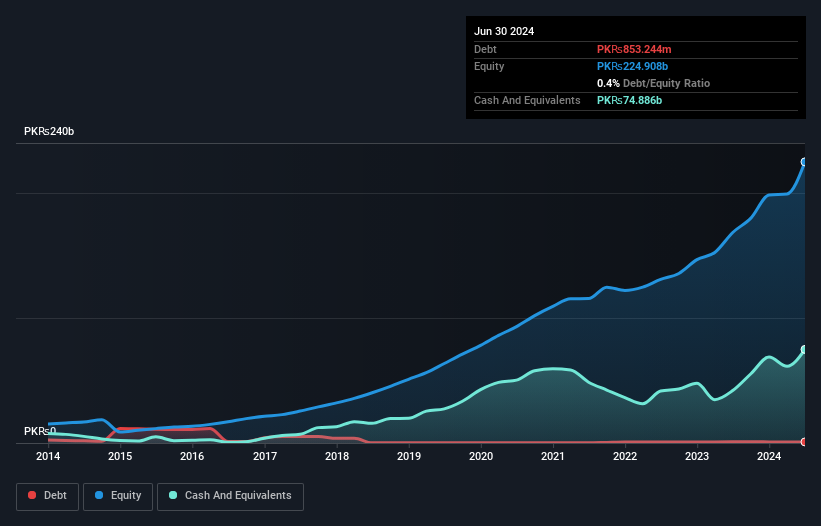

With a price-to-earnings ratio of 5.7x, Mari Petroleum offers better value compared to the PK market's 6.5x. Over the past year, earnings surged by 47%, outpacing the Oil and Gas industry’s -12.7%. The company has more cash than its total debt, indicating strong financial health. Additionally, Mari's debt-to-equity ratio rose from 0.2% to 0.4% over five years while maintaining high-quality earnings and positive free cash flow throughout this period.

- Take a closer look at Mari Petroleum's potential here in our health report.

Gain insights into Mari Petroleum's historical performance by reviewing our past performance report.

Turning Ideas Into Actions

- Unlock our comprehensive list of 4779 Undiscovered Gems With Strong Fundamentals by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KASE:MARI

Mari Petroleum

Explores for, produces, and sells hydrocarbons in Pakistan.

Outstanding track record with excellent balance sheet and pays a dividend.