Alliance Aviation Services (ASX:AQZ): Assessing Valuation After Earnings Downgrade and Leadership Shakeup

Reviewed by Simply Wall St

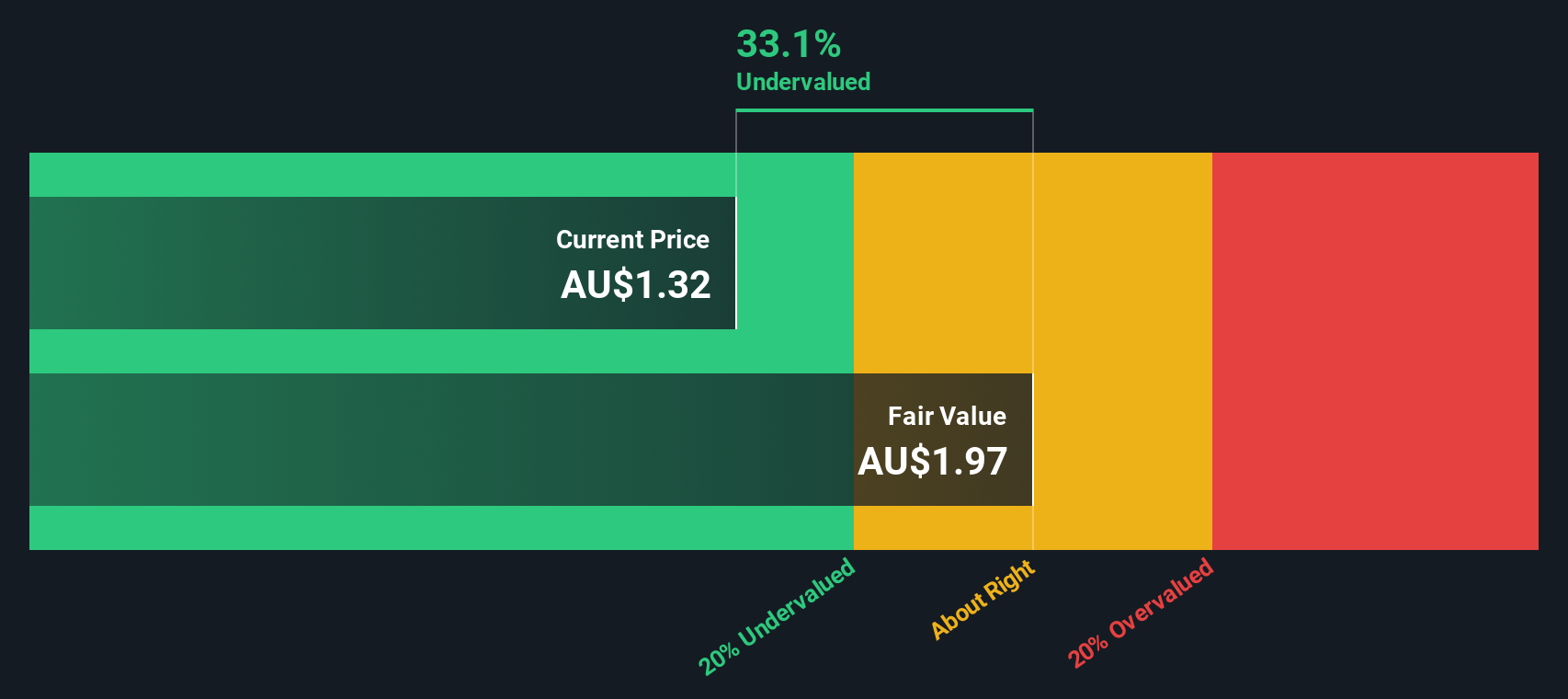

Alliance Aviation Services (ASX:AQZ) has seen its share price drop dramatically after announcing a downgrade to 2026 earnings guidance and revealing a leadership shakeup, including the resignation of its founding CEO and CFO.

See our latest analysis for Alliance Aviation Services.

This latest wave of leadership changes and the sharp downgrade to FY26 earnings have clearly rattled investors. Alliance Aviation Services’ share price tumbled over 47% in the past week and reached its lowest level since early 2020. While the company remains profitable, the momentum behind its stock has faded significantly. The year-to-date share price return is -55% and the 1-year total shareholder return is -49%. These figures indicate that the market’s view of future growth and risk has shifted for now.

If you’re curious to broaden your investing lens and see what else the market has to offer beyond the latest shakeups, now’s a great time to discover fast growing stocks with high insider ownership

With such a steep fall and the stock now trading at a major discount to analyst targets, is the market overreacting to short-term headwinds or is it simply pricing in a tougher future? Could this be a real buying opportunity, or is caution still warranted?

Price-to-Earnings of 3.8x: Is it justified?

Alliance Aviation Services is currently trading at a price-to-earnings (P/E) ratio of 3.8x, which is significantly below both its peers and the wider market. This low ratio highlights deep market pessimism following recent guidance and leadership changes.

The price-to-earnings ratio compares a company’s market price to its per-share earnings, serving as a quick indicator of how markets are valuing a company’s profitability. For an established airline like Alliance, investors often look to the P/E as a signal of confidence in future earnings stability and growth.

At 3.8x, Alliance’s P/E is dramatically lower than the peer average of 9.8x and the global industry average of 8.9x. This suggests that the company is being discounted for its near-term earnings outlook more than its rivals. In addition, the estimated “fair” P/E ratio stands at 6.1x, implying meaningful room for re-rating if the company overcomes its current challenges.

Explore the SWS fair ratio for Alliance Aviation Services

Result: Price-to-Earnings of 3.8x (UNDERVALUED)

However, continued weak revenue growth and falling net income may signal deeper operational issues. This could further pressure the share price in the period ahead.

Find out about the key risks to this Alliance Aviation Services narrative.

Another View: Our SWS DCF Model

While the low price-to-earnings ratio points to undervaluation, our SWS DCF model tells a similar story from a different perspective. It estimates Alliance Aviation Services’ fair value at A$4.10 per share, which is significantly higher than its recent closing price of A$1.34. This raises the question: Could the market be overlooking long-term potential, or are risks still underestimated?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Alliance Aviation Services for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 865 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Alliance Aviation Services Narrative

If you prefer to dig into the numbers yourself or have a different perspective, you can quickly shape your own view in just a few minutes with Do it your way

A great starting point for your Alliance Aviation Services research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t sit on the sidelines while others spot their next winners. Find fresh opportunities tailored to your goals using Simply Wall Street’s powerful screener today.

- Kickstart your income strategy and uncover real opportunities among these 16 dividend stocks with yields > 3% with yields exceeding 3%.

- Target tomorrow’s technology leaders by checking out these 25 AI penny stocks harnessing artificial intelligence for explosive growth.

- Get ahead of the curve on digital transformation by searching these 82 cryptocurrency and blockchain stocks paving the way in blockchain and cryptocurrencies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:AQZ

Alliance Aviation Services

Provides contract, charter, and allied aviation services in Australia and internationally.

Undervalued with mediocre balance sheet.

Market Insights

Community Narratives