Alliance Aviation (ASX:AQZ) Is Down 42.7% After Leadership Shakeup and Earnings Downgrade - Has the Outlook Shifted?

Reviewed by Sasha Jovanovic

- Alliance Aviation Services Limited recently announced a sharp downgrade to its FY26 earnings outlook, citing higher aircraft purchase and maintenance costs, ongoing supply chain inflation, and an unresolved contract dispute, alongside the immediate resignation of founding Managing Director Scott McMillan and CFO Andrew Evans.

- The leadership transition, combined with rising cost pressures and internal reviews of business units and capital allocation, marks a pivotal period for the company's operational and financial direction.

- We'll explore how the leadership changes and renewed focus on cost reduction could shape Alliance Aviation's future investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Alliance Aviation Services' Investment Narrative?

Owning Alliance Aviation Services right now means believing the company can weather a sharp shift in its short-term outlook and rebuild confidence following a period of heavy turbulence. The surprise downgrade to FY26 profit before tax guidance and the abrupt departure of key executives mark a material reset in both the company's near-term profit drivers and longer-term story. Previously, the main catalysts included disciplined cost management, contract wins, and ongoing fleet expansion, all underpinned by steady, if unspectacular, revenue growth and a deep discount to estimated fair value. However, the latest news throws cost controls, debt reduction targets, and the stability of major contracts into question, now set against a share price hitting its lowest point in five years. Investors will want to watch closely how new leadership responds amid ongoing internal reviews, cost inflation, and a material profit downgrade, as these will likely set the tone for recovery or further challenges ahead. Yet, with executive turnover compounding short-term cost headwinds, governance stability is now a risk investors should be mindful of.

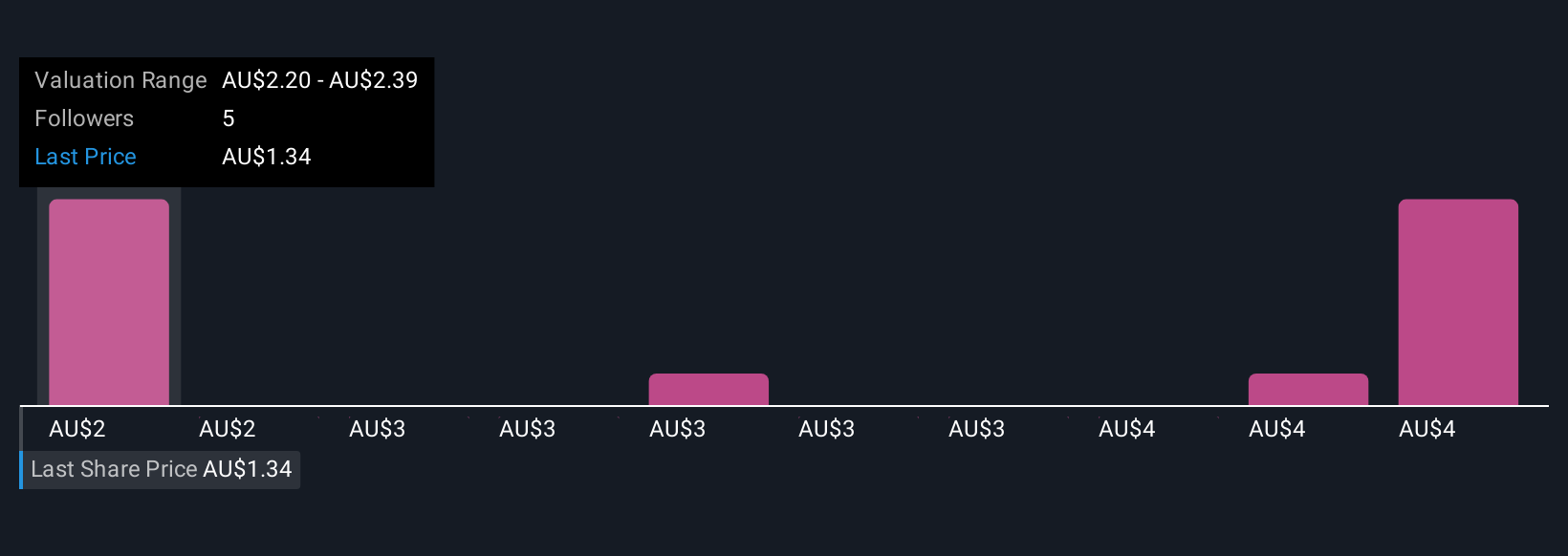

Despite retreating, Alliance Aviation Services' shares might still be trading 39% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 4 other fair value estimates on Alliance Aviation Services - why the stock might be worth over 2x more than the current price!

Build Your Own Alliance Aviation Services Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alliance Aviation Services research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Alliance Aviation Services research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alliance Aviation Services' overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:AQZ

Alliance Aviation Services

Provides contract, charter, and allied aviation services in Australia and internationally.

Undervalued with mediocre balance sheet.

Market Insights

Community Narratives