Does TPG Telecom’s Special Dividend Reflect Renewed Capital Discipline for ASX:TPG Investors?

Reviewed by Sasha Jovanovic

- TPG Telecom Limited recently announced a special dividend of A$0.09 per share, with an ex-date of November 14, 2025, a record date of November 17, 2025, and payment set for November 24, 2025.

- This move may reflect confidence in the company’s financial strength and could be interpreted as a sign of returning value to shareholders beyond ordinary dividends.

- We'll examine how TPG Telecom’s special dividend announcement could influence its longer-term investment narrative and capital returns profile.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

TPG Telecom Investment Narrative Recap

To be a shareholder in TPG Telecom, you generally need to believe in the company’s ability to regain sustainable growth despite stiff competition and thin margins in Australia’s telecom sector. While the recent special dividend signals a return of capital to investors, it does not meaningfully alter the main short-term catalyst, TPG’s ability to reverse subscriber declines in fixed broadband, or the major ongoing risk from value-focused competition pressuring profits. The announcement of an extraordinary shareholders meeting scheduled for November 11, 2025, is particularly relevant, as it centers on a proposed return of capital, potentially providing further near-term clarity about the company’s capital management and dividend profile. This development aligns with the current focus on rewarding shareholders, but growth and margin trends still hold the key for TPG’s longer-term outlook. However, it is important for investors to be alert to ongoing competitive threats in the fixed broadband segment that may affect revenue if market share losses continue…

Read the full narrative on TPG Telecom (it's free!)

TPG Telecom's narrative projects A$5.3 billion in revenue and A$247.4 million in earnings by 2028. This requires a 1.6% annual revenue decline and a A$329.4 million increase in earnings from the current A$-82.0 million.

Uncover how TPG Telecom's forecasts yield a A$5.50 fair value, a 3% downside to its current price.

Exploring Other Perspectives

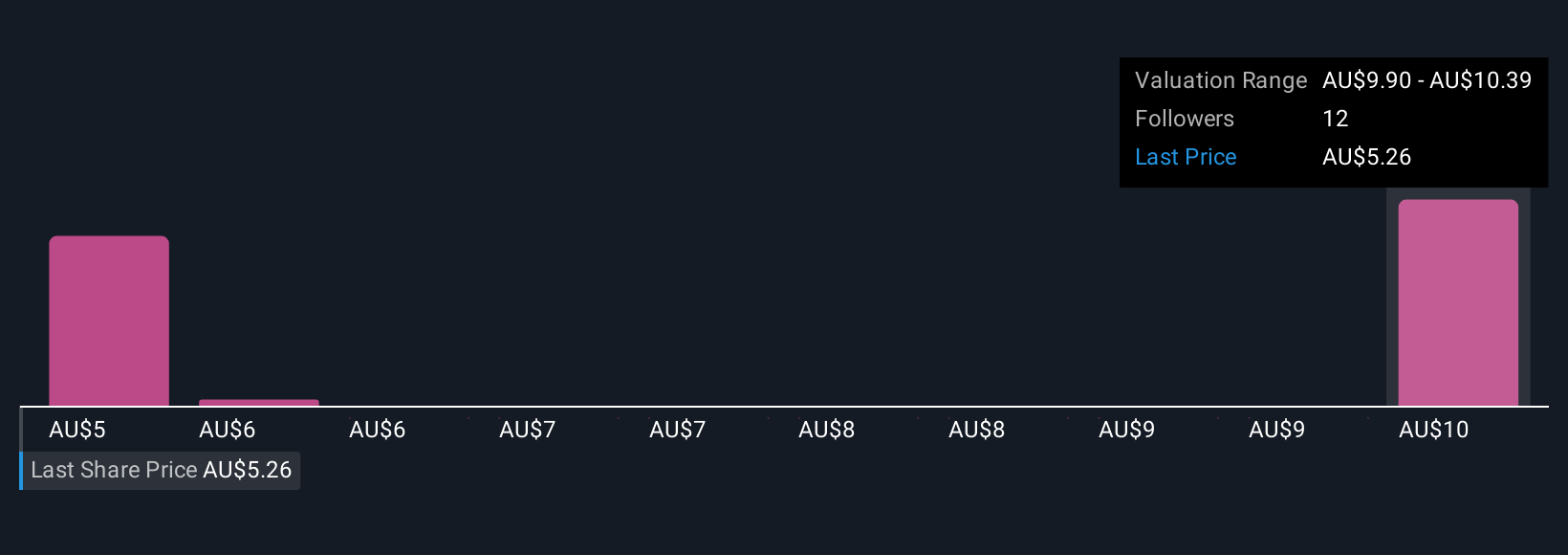

Simply Wall St Community members have provided three fair value estimates for TPG Telecom, ranging widely from A$5.50 to A$9.24 per share. These varied opinions highlight how competition and margin pressure remain top-of-mind for many, inviting you to compare different viewpoints on TPG’s prospects.

Explore 3 other fair value estimates on TPG Telecom - why the stock might be worth just A$5.50!

Build Your Own TPG Telecom Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TPG Telecom research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free TPG Telecom research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TPG Telecom's overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TPG Telecom might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:TPG

TPG Telecom

Provides telecommunications services to consumer, business, enterprise, and government and wholesale customers in Australia.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives