With WiseTech Global Limited (ASX:WTC) It Looks Like You'll Get What You Pay For

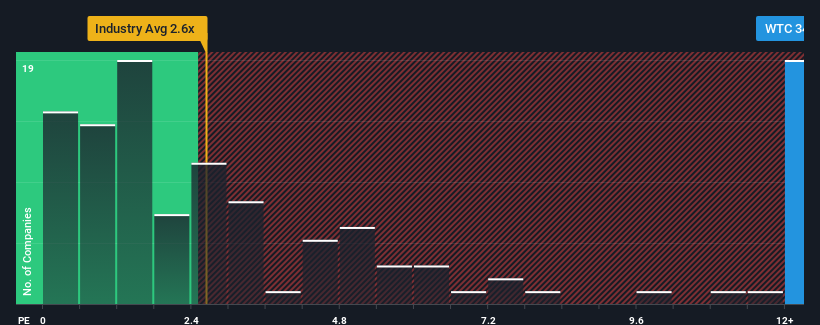

When you see that almost half of the companies in the Software industry in Australia have price-to-sales ratios (or "P/S") below 2.6x, WiseTech Global Limited (ASX:WTC) looks to be giving off strong sell signals with its 34.1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for WiseTech Global

What Does WiseTech Global's Recent Performance Look Like?

Recent times have been advantageous for WiseTech Global as its revenues have been rising faster than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on WiseTech Global will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like WiseTech Global's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 29%. Pleasingly, revenue has also lifted 103% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 26% each year as estimated by the analysts watching the company. That's shaping up to be materially higher than the 20% per annum growth forecast for the broader industry.

In light of this, it's understandable that WiseTech Global's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From WiseTech Global's P/S?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of WiseTech Global's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for WiseTech Global with six simple checks.

If these risks are making you reconsider your opinion on WiseTech Global, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if WiseTech Global might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:WTC

WiseTech Global

Engages in the development and provision of software solutions to the logistics execution industry in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives