Technology One (ASX:TNE) Is Growing Earnings But Are They A Good Guide?

Statistically speaking it is less risky to invest in profitable companies than in unprofitable ones. That said, the current statutory profit is not always a good guide to a company's underlying profitability. This article will consider whether Technology One's (ASX:TNE) statutory profits are a good guide to its underlying earnings.

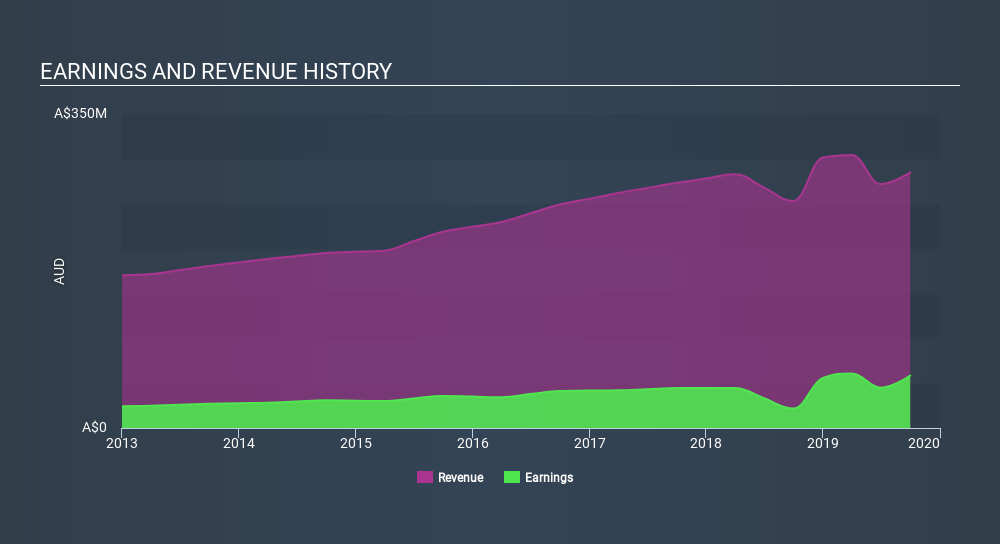

While Technology One was able to generate revenue of AU$285.0m in the last twelve months, we think its profit result of AU$58.5m was more important. Happily, it has grown both its profit and revenue over the last three years, as you can see in the chart below.

Check out our latest analysis for Technology One

Importantly, statutory profits are not always the best tool for understanding a company's true earnings power, so it's well worth examining profits in a little more detail. That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On Technology One's Profit Performance

Therefore, it seems possible to us that Technology One's true underlying earnings power is actually less than its statutory profit. While it's really important to consider how well a company's statutory earnings represent its true earnings power, it's also worth taking a look at what analysts are forecasting for the future. So feel free to check out our free graph representing analyst forecasts.

Our examination of Technology One has focussed on certain factors that can make its earnings look better than they are. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ASX:TNE

Technology One

Engages in the development, marketing, sale, implementation, and support of integrated enterprise business software solutions in Australia and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives