Undervalued Small Caps With Insider Action In Global November 2025

Reviewed by Simply Wall St

In the current global market landscape, small-cap stocks are navigating a complex environment marked by heightened volatility in major indices and economic uncertainty due to factors such as the prolonged U.S. government shutdown and fluctuating consumer sentiment. Despite these challenges, opportunities can still be found in small-cap companies that demonstrate resilience through strategic insider actions, which may indicate confidence in their potential to withstand broader market pressures.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Bytes Technology Group | 16.1x | 3.9x | 24.44% | ★★★★★☆ |

| Speedy Hire | NA | 0.3x | 26.07% | ★★★★★☆ |

| Morguard North American Residential Real Estate Investment Trust | 4.9x | 1.7x | 27.98% | ★★★★★☆ |

| Hung Hing Printing Group | NA | 0.4x | 43.30% | ★★★★☆☆ |

| Coveo Solutions | NA | 3.0x | 8.07% | ★★★★☆☆ |

| Senior | 25.0x | 0.8x | 24.72% | ★★★★☆☆ |

| Sagicor Financial | 7.0x | 0.4x | -64.34% | ★★★★☆☆ |

| Bumitama Agri | 11.8x | 1.7x | 43.92% | ★★★☆☆☆ |

| Ever Sunshine Services Group | 6.8x | 0.4x | -450.08% | ★★★☆☆☆ |

| GDI Integrated Facility Services | 16.0x | 0.3x | -12.54% | ★★★☆☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

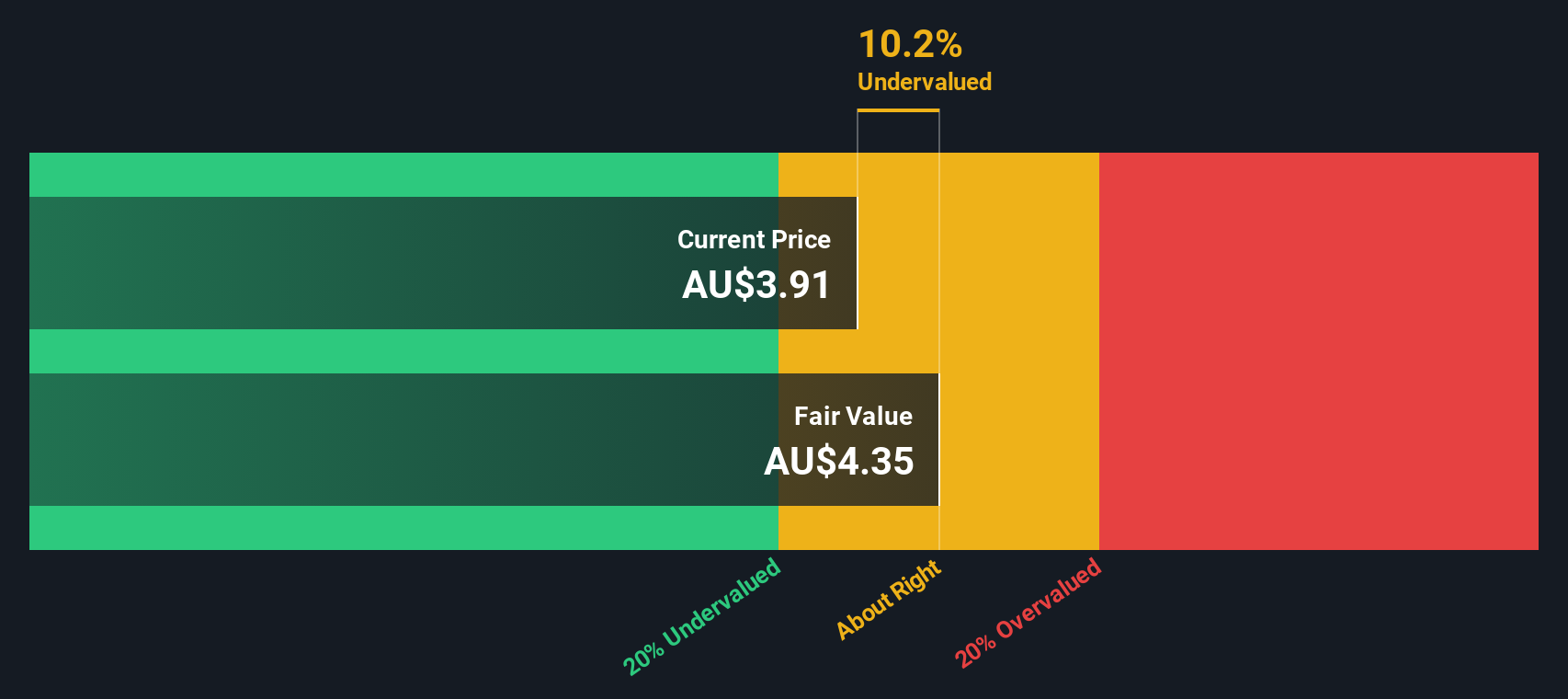

BWP Trust (ASX:BWP)

Simply Wall St Value Rating: ★★★★☆☆

Overview: BWP Trust is a real estate investment entity focused on investments in commercial warehouse properties, with a market capitalization of A$2.59 billion.

Operations: The company's revenue is primarily derived from investments in commercial warehouse properties, with recent figures showing revenue at A$203.30 million. The cost of goods sold (COGS) is A$21.27 million, leading to a gross profit of A$182.03 million and a gross profit margin of 89.54%. Operating expenses are recorded at A$14.02 million, while non-operating expenses stand at -A$97.57 million, impacting the net income margin which was last noted at 1.31%.

PE: 10.5x

BWP Trust, a smaller company in the investment landscape, recently announced a fixed-income offering of A$300 million with 4.55% notes due in 2030. This move highlights their reliance on external borrowing for funding, which carries inherent risks compared to customer deposits. Despite high-quality earnings impacted by one-off items, earnings are projected to decline by an average of 10.8% annually over the next three years. Such dynamics suggest potential challenges ahead amidst its current valuation status.

- Unlock comprehensive insights into our analysis of BWP Trust stock in this valuation report.

Review our historical performance report to gain insights into BWP Trust's's past performance.

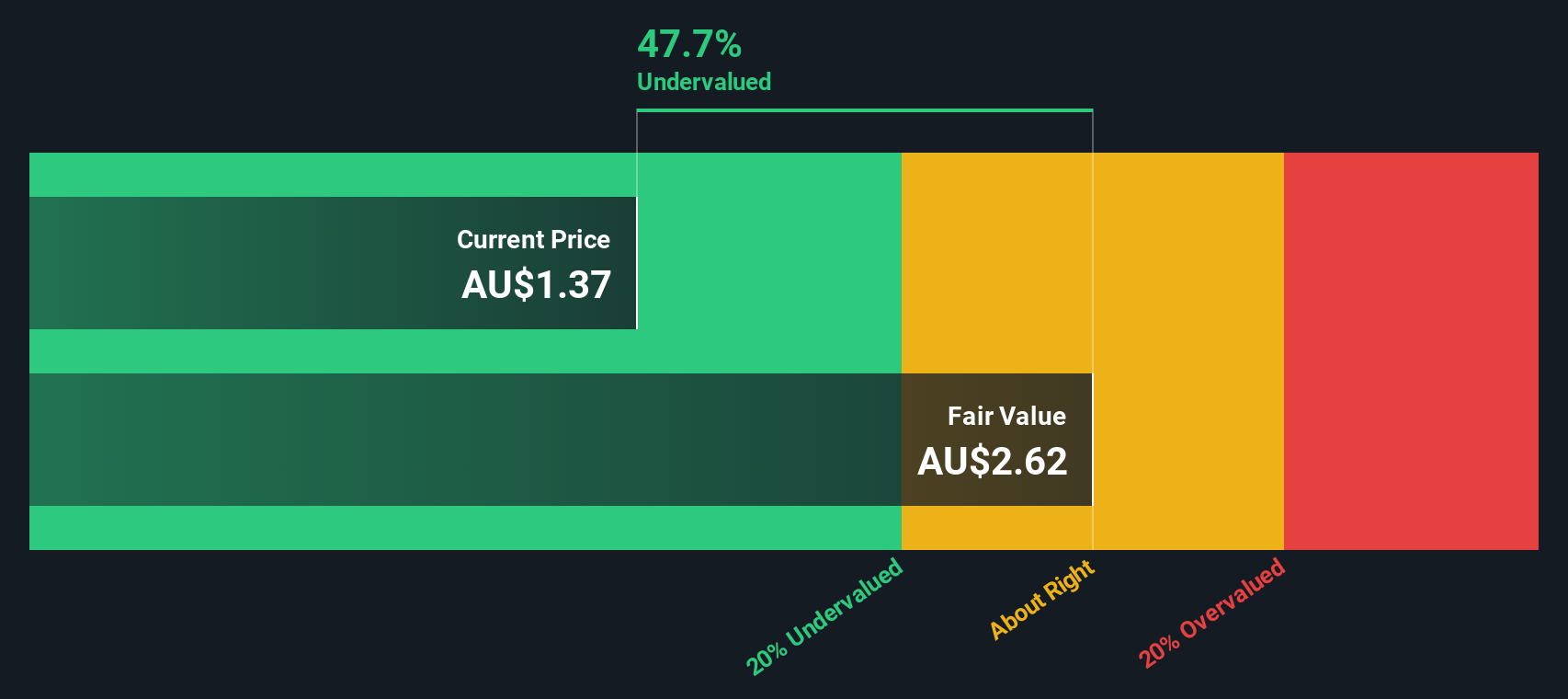

Civmec (ASX:CVL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Civmec is an integrated, multi-disciplinary construction and engineering services provider with operations spanning the energy, resources, infrastructure, marine, and defence sectors; it has a market cap of A$0.83 billion.

Operations: Civmec's revenue primarily comes from the Resources segment, contributing significantly compared to Energy and Infrastructure, Marine & Defence. The company's gross profit margin showed an upward trend reaching 13.14% by June 2023 before slightly declining to 11.47% in June 2025. Operating expenses have been consistent, with General & Administrative Expenses being a major component.

PE: 16.5x

Civmec, a company in the construction and engineering sector, recently reported annual sales of A$810.59 million, down from A$1.03 billion the previous year, with net income at A$42.54 million compared to A$64.41 million previously. Despite this decline, insider confidence is evident as they have been purchasing shares throughout 2025, signaling potential optimism about future growth prospects. The company also declared a fully franked dividend of A$0.035 per share for the six months ended June 30, 2025.

- Delve into the full analysis valuation report here for a deeper understanding of Civmec.

Understand Civmec's track record by examining our Past report.

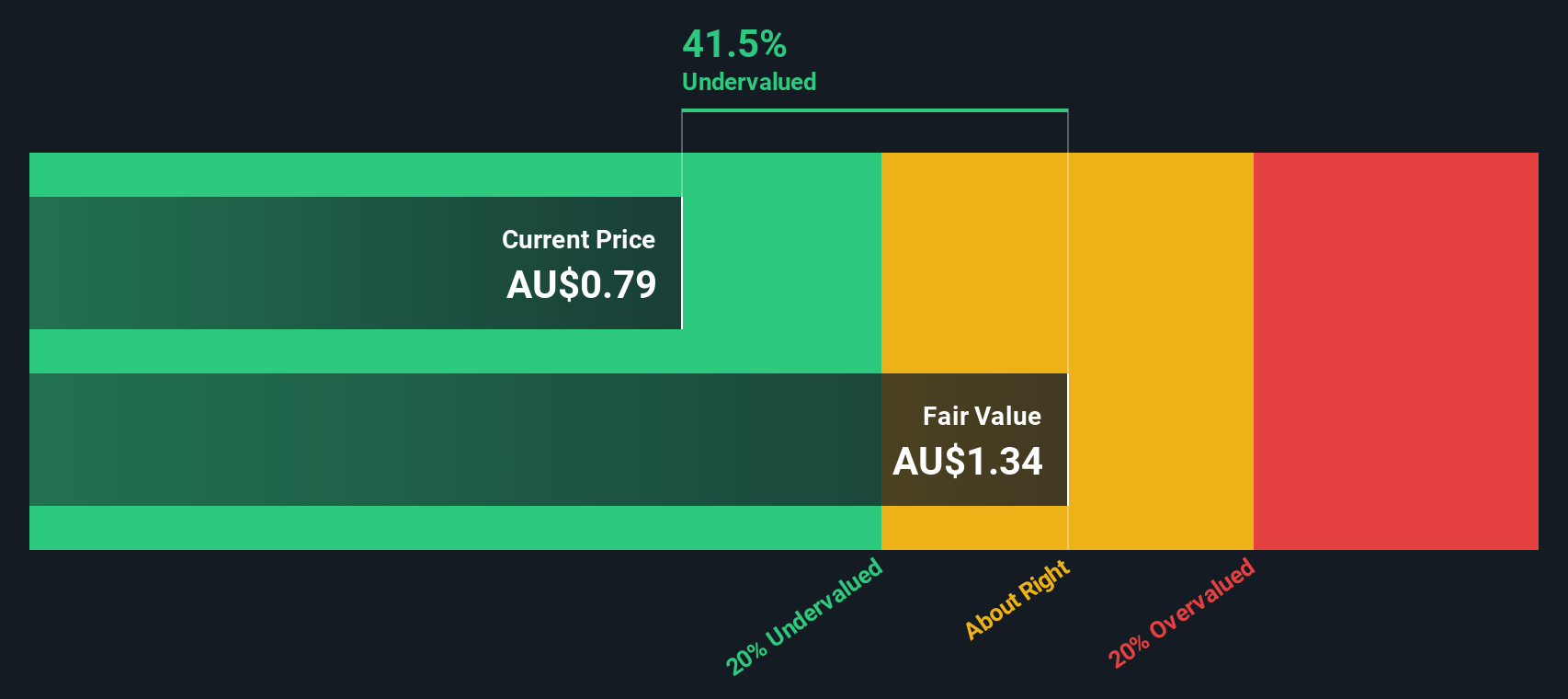

Praemium (ASX:PPS)

Simply Wall St Value Rating: ★★★★★☆

Overview: Praemium is a company that operates in the software and programming sector, focusing on providing investment platforms and portfolio administration services, with a market capitalization of A$0.78 billion.

Operations: Praemium's primary revenue stream is derived from its Software & Programming segment, generating A$103.04 million. The company has seen a gross profit margin of up to 44.27%. Operating expenses are significant, with general and administrative costs being a notable component.

PE: 30.3x

Praemium's recent financial performance highlights a promising trajectory, with sales rising to A$103.04 million and net income reaching A$13.56 million for the year ending June 30, 2025. This growth in earnings per share from A$0.018 to A$0.028 suggests potential value appreciation. Insider confidence is evident as Barry Lewin acquired 150,000 shares recently, indicating faith in the company's prospects despite its reliance on higher-risk external borrowing for funding. The addition of experienced CFO Emma Stepcic further strengthens Praemium's leadership team amid these developments.

Summing It All Up

- Gain an insight into the universe of 118 Undervalued Global Small Caps With Insider Buying by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PPS

Praemium

Provides advisors and wealth management solutions in Australia and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives