Dubber Corporation Limited (ASX:DUB) Looks Inexpensive But Perhaps Not Attractive Enough

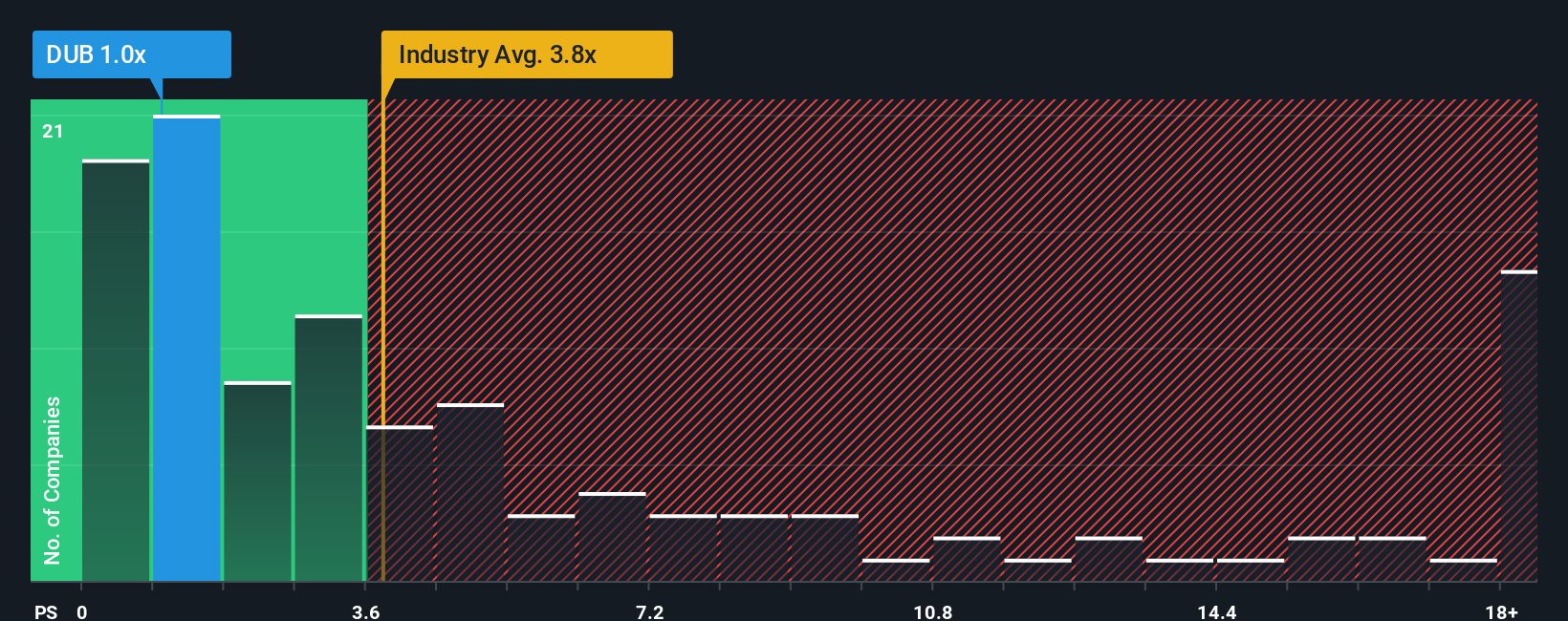

With a price-to-sales (or "P/S") ratio of 1x Dubber Corporation Limited (ASX:DUB) may be sending very bullish signals at the moment, given that almost half of all the Software companies in Australia have P/S ratios greater than 3.8x and even P/S higher than 9x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

See our latest analysis for Dubber

What Does Dubber's Recent Performance Look Like?

Revenue has risen firmly for Dubber recently, which is pleasing to see. It might be that many expect the respectable revenue performance to degrade substantially, which has repressed the P/S. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Dubber's earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

Dubber's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 9.1% last year. Pleasingly, revenue has also lifted 157% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 55% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this in consideration, it's easy to understand why Dubber's P/S falls short of the mark set by its industry peers. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the wider industry.

The Final Word

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Dubber confirms that the company's revenue trends over the past three-year years are a key factor in its low price-to-sales ratio, as we suspected, given they fall short of current industry expectations. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

There are also other vital risk factors to consider and we've discovered 4 warning signs for Dubber (3 make us uncomfortable!) that you should be aware of before investing here.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:DUB

Dubber

Provides unified call recording and conversation artificial intelligence services to the telecommunications industry in Australia, Europe, the United States, and internationally.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives