Should You Be Adding Wesfarmers (ASX:WES) To Your Watchlist Today?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Wesfarmers (ASX:WES). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for Wesfarmers

Wesfarmers' Earnings Per Share Are Growing

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That makes EPS growth an attractive quality for any company. We can see that in the last three years Wesfarmers grew its EPS by 8.2% per year. That's a pretty good rate, if the company can sustain it.

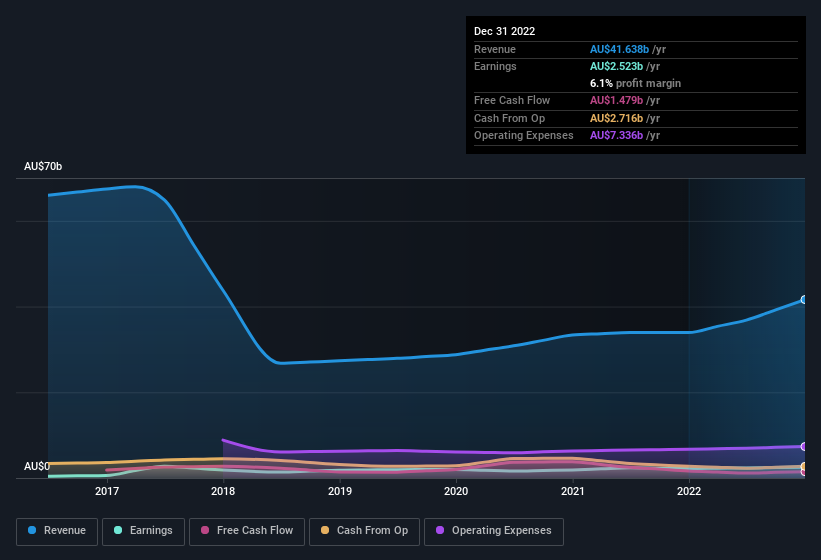

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. EBIT margins for Wesfarmers remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 23% to AU$42b. That's progress.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Wesfarmers?

Are Wesfarmers Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

We haven't seen any insiders selling Wesfarmers shares, in the last year. So it's definitely nice that Independent Non-Executive Director Simon English bought AU$53k worth of shares at an average price of around AU$47.05. Purchases like this can help the investors understand the views of the management team; in which case they see some potential in Wesfarmers.

On top of the insider buying, it's good to see that Wesfarmers insiders have a valuable investment in the business. Indeed, they have a considerable amount of wealth invested in it, currently valued at AU$174m. This comes in at 0.3% of shares in the company, which is a fair amount of a business of this size. So despite their percentage holding being low, company management still have plenty of reasons to deliver the best outcomes for investors.

Should You Add Wesfarmers To Your Watchlist?

One important encouraging feature of Wesfarmers is that it is growing profits. Better yet, insiders are significant shareholders, and have been buying more shares. That makes the company a prime candidate for your watchlist - and arguably a research priority. It is worth noting though that we have found 2 warning signs for Wesfarmers that you need to take into consideration.

Keen growth investors love to see insider buying. Thankfully, Wesfarmers isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Wesfarmers might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:WES

Wesfarmers

Engages in the retail business in Australia, New Zealand, and internationally.

Solid track record average dividend payer.