Stock Analysis

- Australia

- /

- Specialty Stores

- /

- ASX:CTT

ASX Penny Stocks To Watch In December 2024

Reviewed by Simply Wall St

As the Australian stock market approaches the end of 2025, it faces a modest decline, mirroring Wall Street's recent struggles and signaling a cautious close to the year. Despite this subdued atmosphere, investors continue to seek opportunities beyond traditional large-cap stocks. Penny stocks, often representing smaller or newer companies, remain an intriguing investment area for those looking to uncover potential growth prospects. While sometimes considered outdated, these stocks can still offer significant opportunities when backed by solid financial fundamentals.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.755 | A$138.53M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.555 | A$65.06M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.83 | A$234.64M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.97 | A$320.75M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.51 | A$316.27M | ★★★★★☆ |

| Navigator Global Investments (ASX:NGI) | A$1.70 | A$833.14M | ★★★★★☆ |

| EZZ Life Science Holdings (ASX:EZZ) | A$3.10 | A$143.09M | ★★★★★★ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$216.86M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$1.90 | A$106.58M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.85 | A$478.53M | ★★★★☆☆ |

Click here to see the full list of 1,053 stocks from our ASX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Archer Materials (ASX:AXE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Archer Materials Limited is an Australian technology company focused on developing and commercializing semiconductor devices and sensors for quantum computing and medical diagnostics, with a market cap of A$132.52 million.

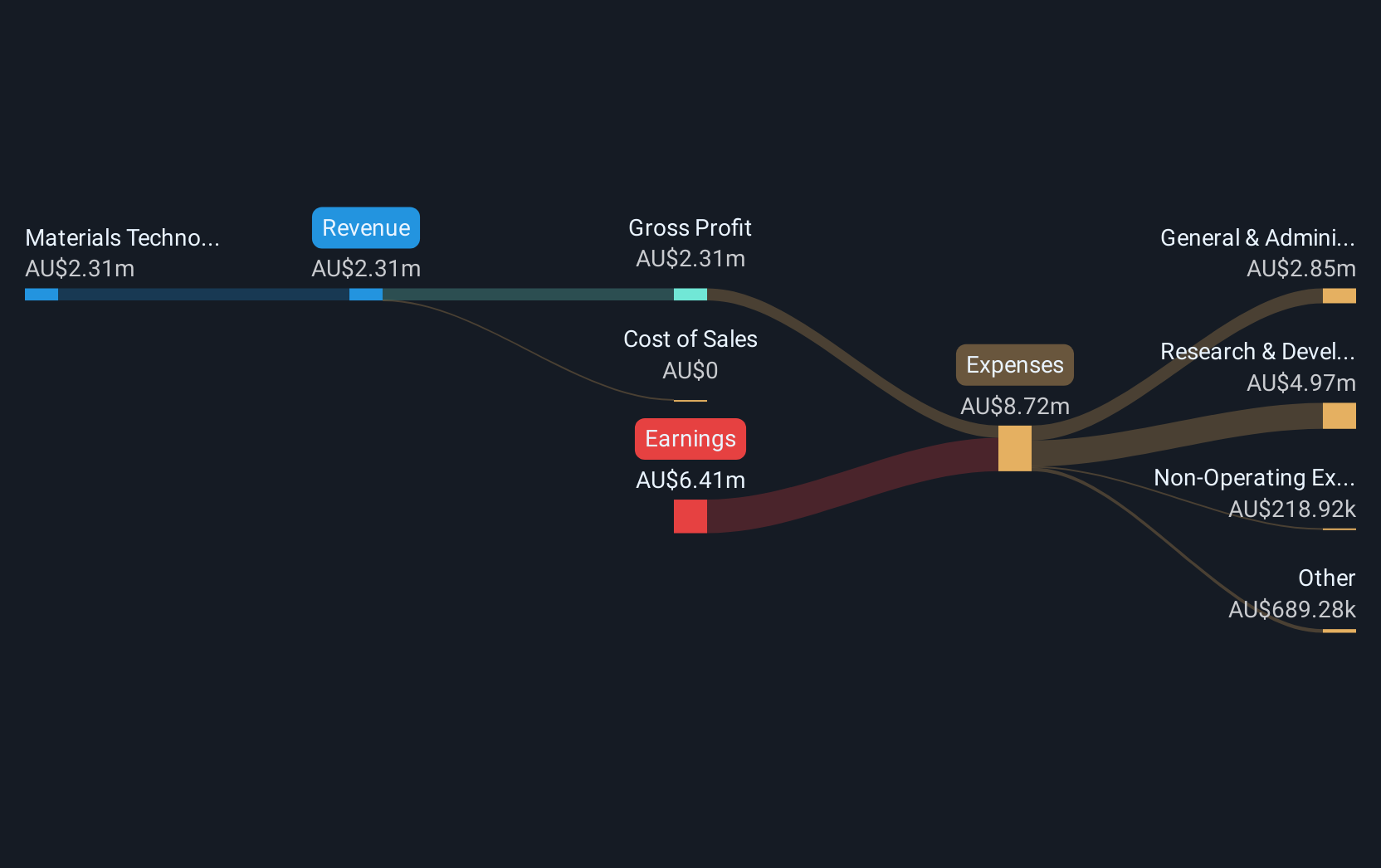

Operations: The company generates revenue of A$2.14 million from its Materials Technology Research and Development segment.

Market Cap: A$132.52M

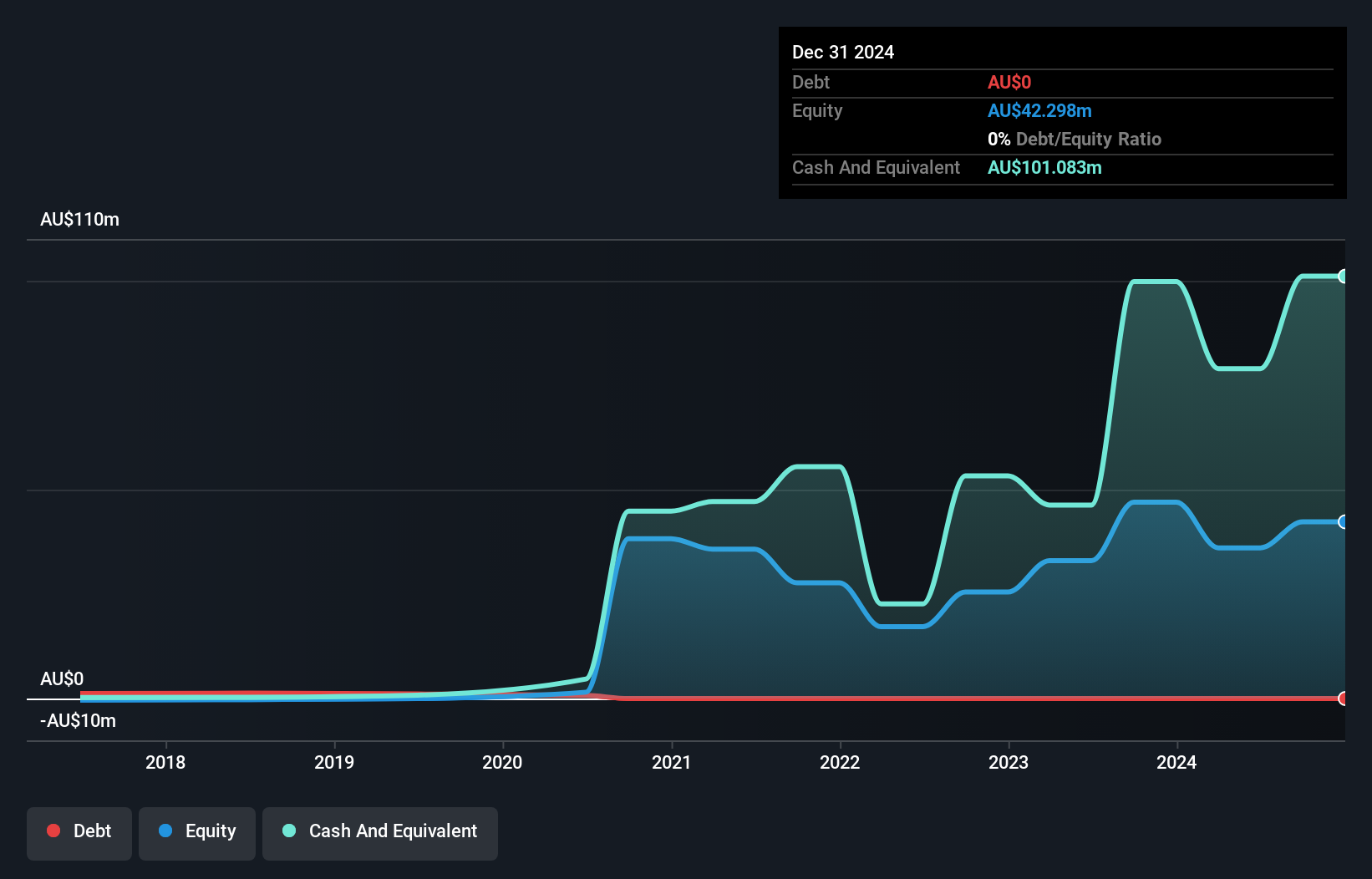

Archer Materials, with a market cap of A$132.52 million, is focused on semiconductor and sensor technology for quantum computing and medical diagnostics. Despite generating A$2.14 million in revenue, the company is still pre-revenue by some standards due to its unprofitability and lack of significant earnings growth compared to industry benchmarks. Archer has a strong cash position with short-term assets significantly exceeding liabilities and no debt, providing a cash runway exceeding three years if current cash flow trends persist. However, its share price remains highly volatile, reflecting broader uncertainties in the penny stock segment.

- Click here to discover the nuances of Archer Materials with our detailed analytical financial health report.

- Gain insights into Archer Materials' historical outcomes by reviewing our past performance report.

Cettire (ASX:CTT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cettire Limited operates as an online luxury goods retailer serving markets in Australia, the United States, and internationally, with a market cap of A$550.89 million.

Operations: The company generates revenue from online retail sales amounting to A$742.26 million.

Market Cap: A$550.89M

Cettire Limited, with a market cap of A$550.89 million, operates debt-free and has a strong financial position with short-term assets (A$108.9M) exceeding liabilities. Despite recent negative earnings growth (-34.4%), it trades at 52% below estimated fair value, suggesting potential undervaluation in the penny stock segment. The company has high-quality past earnings and a high Return on Equity (29%). However, its profit margins have declined to 1.4% from last year's 3.8%, reflecting challenges in maintaining profitability amidst volatile market conditions despite reduced weekly volatility to 12%.

- Take a closer look at Cettire's potential here in our financial health report.

- Explore Cettire's analyst forecasts in our growth report.

Strike Energy (ASX:STX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Strike Energy Limited is an independent gas producer that explores and develops oil and gas resources in Australia, with a market cap of A$573.07 million.

Operations: The company's revenue segment is derived from Exploration and Corporate activities, amounting to A$45.60 million.

Market Cap: A$573.07M

Strike Energy Limited, with a market cap of A$573.07 million, is an independent gas producer focusing on exploration and development in Australia. The company has recently achieved profitability, growing earnings by 34.2% annually over the past five years. Its financial stability is underscored by short-term assets exceeding both short- and long-term liabilities. Recent developments include securing a significant debt financing package from Macquarie Bank to support its South Erregulla project, indicating strategic expansion efforts in the Perth Basin. However, its Return on Equity remains low at 1.9%, highlighting potential areas for improvement despite trading below estimated fair value.

- Click here and access our complete financial health analysis report to understand the dynamics of Strike Energy.

- Gain insights into Strike Energy's outlook and expected performance with our report on the company's earnings estimates.

Seize The Opportunity

- Discover the full array of 1,053 ASX Penny Stocks right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CTT

Cettire

Engages in the online luxury goods retailing business in Australia, the United States, and internationally.