- Australia

- /

- Retail REITs

- /

- ASX:WPR

Waypoint REIT (ASX:WPR) announces stable dividend amid projected 33.34% earnings growth potential

Reviewed by Simply Wall St

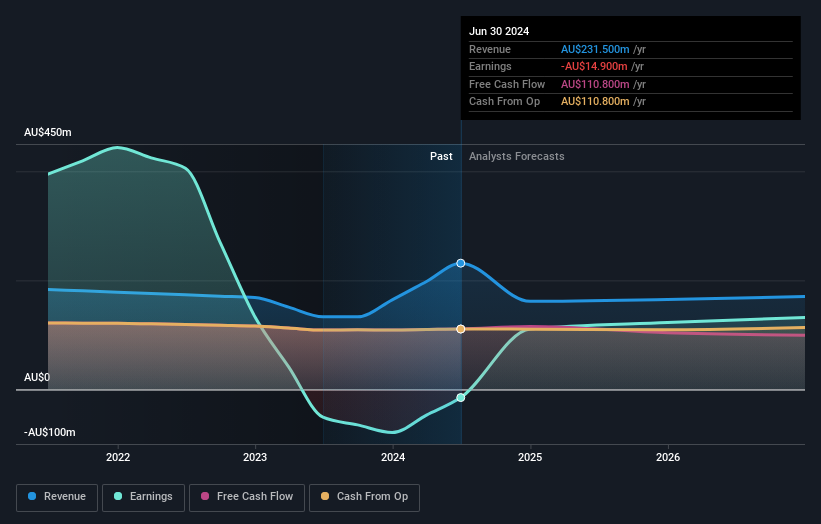

Waypoint REIT (ASX:WPR) has recently announced a cash dividend of AUD 0.0412 per security, reinforcing its stable dividend yield of 6.65%, which positions it among the top performers in the Australian market. The company reported strong financial results for the half year ending June 30, 2024, with net income surging to AUD 93.3 million, up from AUD 29.1 million the previous year, indicating significant growth potential. Readers can expect a discussion on Waypoint REIT's strategic focus on innovation, operational improvements, and market expansion as it navigates financial challenges and competitive pressures.

Take a closer look at Waypoint REIT's potential here.

Key Assets Propelling Waypoint REIT Forward

Waypoint REIT is on a promising trajectory, with expectations to turn profitable within the next three years. The company forecasts an impressive earnings growth of 33.34% annually, reflecting strong financial health. Its dividend payments are stable, yielding 6.65%, placing it among the top 25% in the Australian market. This reliability is further supported by the recent announcement of a cash dividend of AUD 0.0412 per security, reinforcing investor confidence. The company's commitment to innovation, as highlighted by CEO Hadyn Stephens, underscores its focus on long-term growth and market adaptability. The current share price, trading below its estimated fair value, suggests potential undervaluation, highlighting a strong market position.

Critical Issues Affecting the Performance of Waypoint REIT and Areas for Growth

Waypoint REIT faces challenges, including a 27.8% annual increase in losses over the past five years. The negative return on equity of -0.8% and a high net debt to equity ratio of 46.8% indicate financial hurdles. Competitive pressures are notable, as Stephens acknowledges the fierce market dynamics, necessitating strategic differentiation. Operational inefficiencies are being addressed, as noted by Stephens, indicating management's proactive stance on internal improvements to enhance profitability.

Potential Strategies for Leveraging Growth and Competitive Advantage

Exploring new markets and customer segments presents significant growth opportunities for Waypoint REIT. Stephens highlights the potential in expanding the company's footprint in emerging markets, a move that could enhance revenue streams. Digital transformation is also at the forefront, promising improved operational efficiency and customer engagement. Monitoring regulatory developments could open new avenues for growth, showcasing the company's adaptability to external factors.

External Factors Threatening Waypoint REIT

Economic headwinds pose a potential risk, with Stephens expressing caution about the business environment's impact. Supply chain disruptions are a concern, prompting the company to strengthen its resilience. Navigating regulatory hurdles remains complex, requiring robust strategies to ensure operational continuity. These challenges necessitate careful risk management to safeguard Waypoint REIT's market position.

Conclusion

Waypoint REIT is poised for significant growth, with a projected annual earnings increase of 33.34% and a stable dividend yield of 6.65%, which strengthens investor confidence. However, the company must address rising losses and financial leverage challenges to fully capitalize on its market potential. The current share price, trading below its estimated fair value, suggests that there is room for appreciation, especially as the company implements strategic initiatives like digital transformation and market expansion. These efforts, coupled with proactive risk management against economic and regulatory challenges, could enhance Waypoint REIT's competitive edge and financial performance in the coming years.

Summing It All Up

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Valuation is complex, but we're here to simplify it.

Discover if Waypoint REIT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About ASX:WPR

Waypoint REIT

Waypoint REIT is Australia’s largest listed REIT owning solely service station and convenience retail properties with a high-quality portfolio of properties across all Australian States and mainland Territories.

Good value average dividend payer.