HMC Capital And 2 ASX Stocks That May Be Trading Below Their Estimated True Value

Reviewed by Simply Wall St

In the past year, the Australian market has seen a modest rise of 7.0%, maintaining a steady pace in just the last week. In this context of promising forecasted annual earnings growth of 13%, stocks that appear to be trading below their intrinsic value could present appealing opportunities for investors seeking potential growth.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Ansell (ASX:ANN) | A$27.17 | A$51.46 | 47.2% |

| Count (ASX:CUP) | A$0.635 | A$1.17 | 45.9% |

| IPH (ASX:IPH) | A$6.00 | A$11.73 | 48.8% |

| VEEM (ASX:VEE) | A$1.84 | A$3.54 | 48.1% |

| ReadyTech Holdings (ASX:RDY) | A$3.23 | A$6.19 | 47.8% |

| hipages Group Holdings (ASX:HPG) | A$1.08 | A$2.06 | 47.6% |

| Atturra (ASX:ATA) | A$0.805 | A$1.50 | 46.5% |

| Red 5 (ASX:RED) | A$0.38 | A$0.74 | 49% |

| Millennium Services Group (ASX:MIL) | A$1.145 | A$2.24 | 48.9% |

| EVT (ASX:EVT) | A$11.37 | A$21.39 | 46.8% |

Here's a peek at a few of the choices from the screener.

HMC Capital (ASX:HMC)

Overview: HMC Capital Limited operates in Australia, where it owns and manages real estate-focused funds, with a market capitalization of approximately A$2.96 billion.

Operations: The company generates revenue primarily through the ownership and management of real estate-focused funds, totaling approximately A$80.29 million.

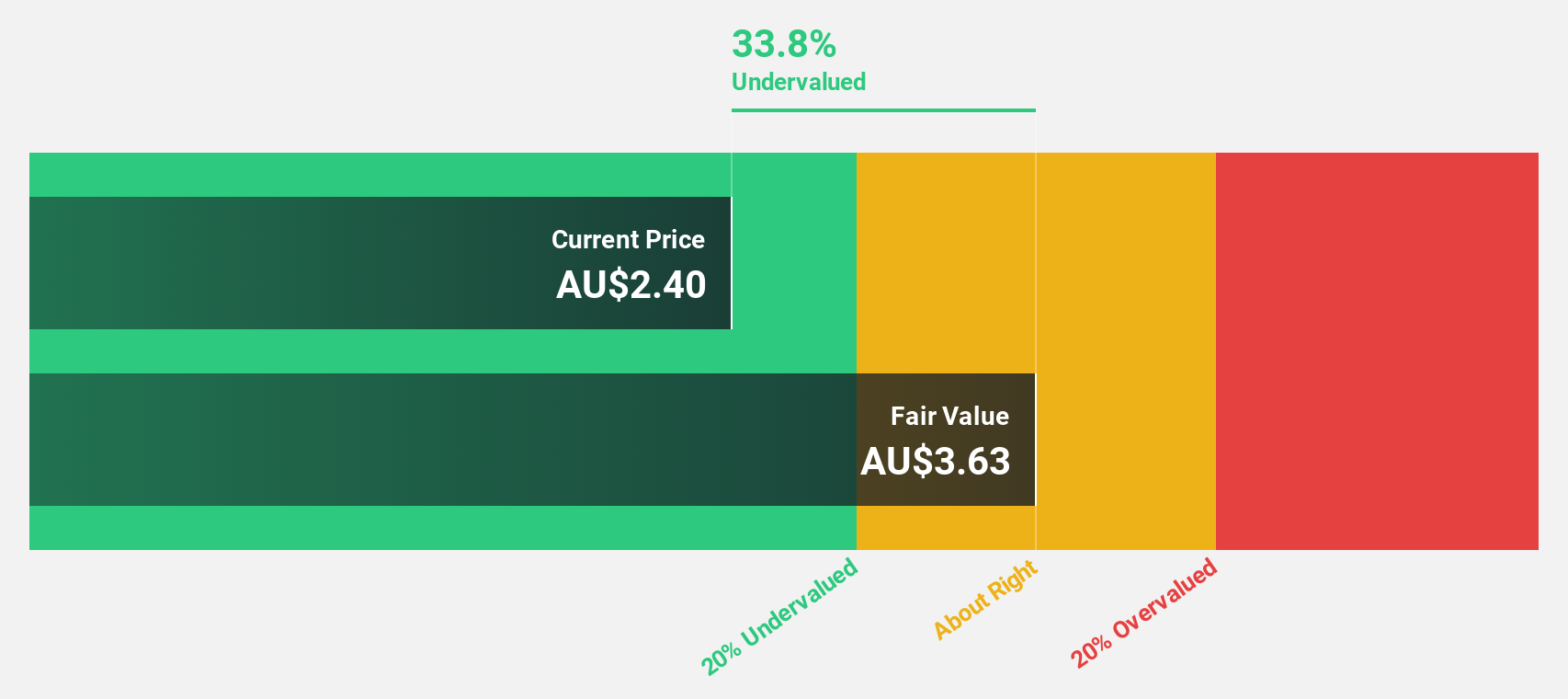

Estimated Discount To Fair Value: 36.3%

HMC Capital, priced at A$7.84, trades significantly below its estimated fair value of A$12.31, indicating a potential undervaluation based on cash flows. Despite recent equity offerings totaling over A$188 million to fund expansion, shareholder dilution has occurred. HMC's revenue and earnings growth forecasts outpace the market at 20.1% and 16.7% per year respectively, yet its projected return on equity remains modest at 10.6%. This mixed financial outlook suggests careful consideration for investors seeking value based on robust future cash flows.

- According our earnings growth report, there's an indication that HMC Capital might be ready to expand.

- Dive into the specifics of HMC Capital here with our thorough financial health report.

Megaport (ASX:MP1)

Overview: Megaport Limited offers elastic interconnection services across Australia, New Zealand, Hong Kong, Singapore, Japan, North America, and Europe with a market capitalization of A$1.74 billion.

Operations: The company generates revenue through its operations in North America (A$99.78 million), Asia-Pacific (A$48.84 million), and Europe (A$28.88 million).

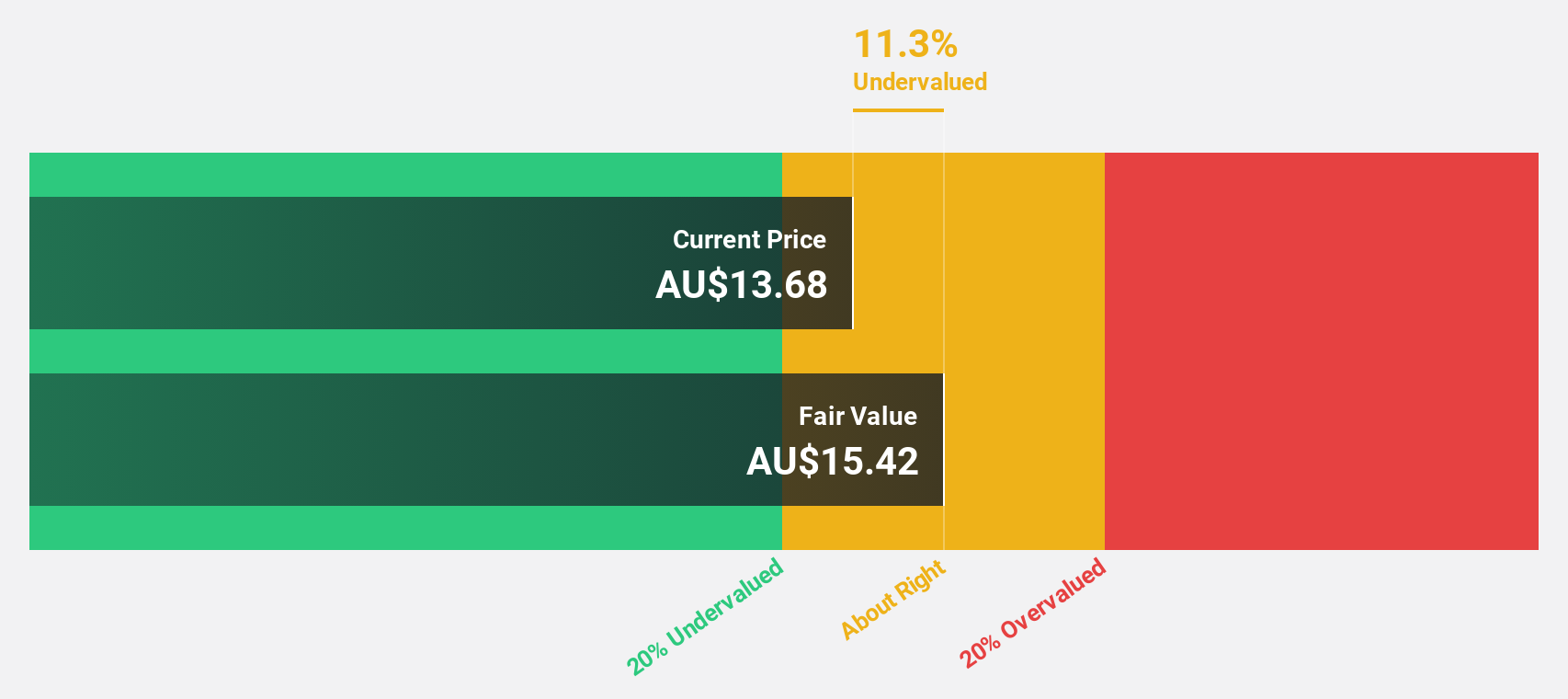

Estimated Discount To Fair Value: 44.4%

Megaport, currently priced at A$10.91, appears undervalued with its market price significantly below the estimated fair value of A$19.62. The company has recently become profitable and is expected to see earnings grow by 35.55% annually over the next three years, outpacing the Australian market's growth rate of 13.2%. Despite slower revenue growth projections at 16.3% per year compared to some peers, Megaport's strategic expansions and partnerships in cloud connectivity solutions underscore its potential for operational efficiency and market penetration.

- The growth report we've compiled suggests that Megaport's future prospects could be on the up.

- Click to explore a detailed breakdown of our findings in Megaport's balance sheet health report.

Regal Partners (ASX:RPL)

Overview: Regal Partners Limited, operating as a privately owned hedge fund sponsor, has a market capitalization of approximately A$1.20 billion.

Operations: The company generates its revenue primarily through the provision of investment management services, totaling A$105.28 million.

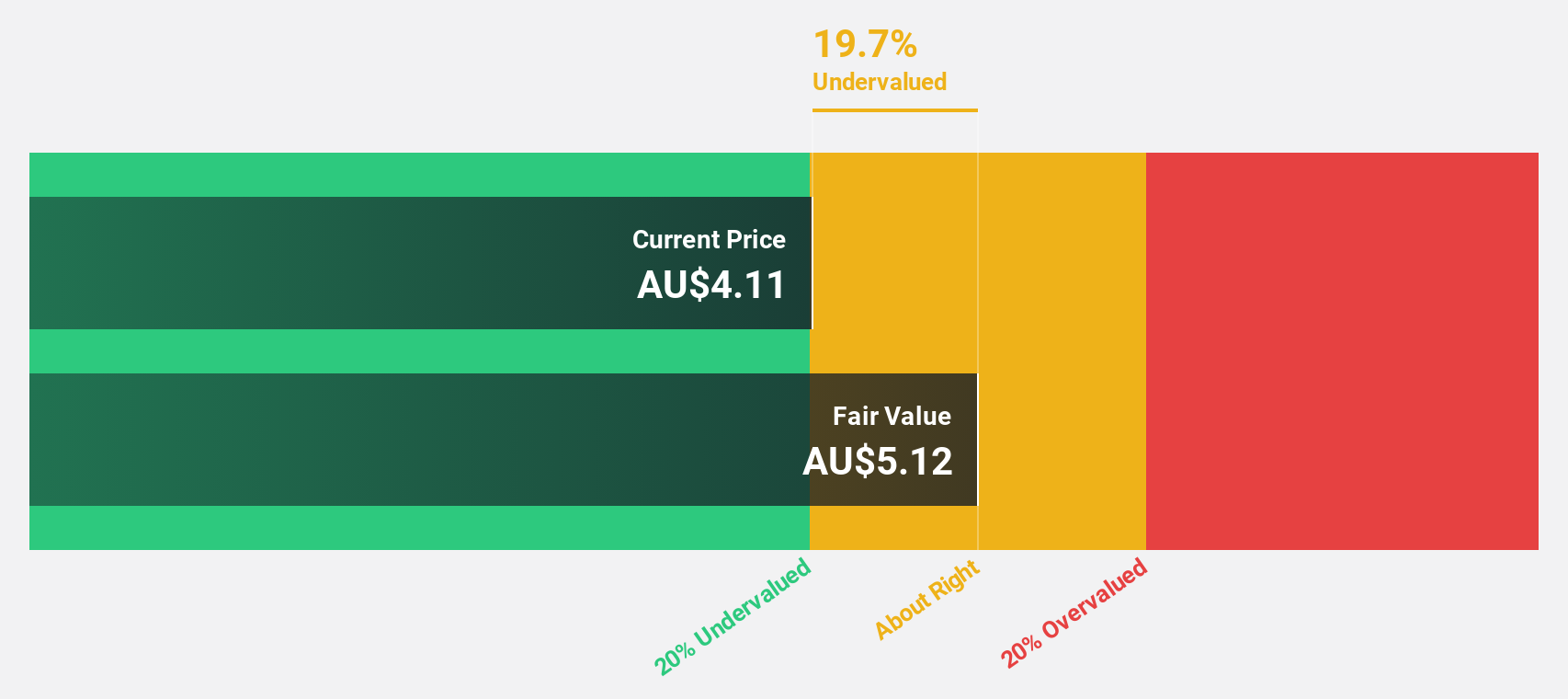

Estimated Discount To Fair Value: 34.1%

Regal Partners, priced at A$3.75, trades significantly below its estimated fair value of A$5.69, suggesting undervaluation based on discounted cash flow analysis. Despite a low return on equity forecast and a profit margin decline from 14.1% to 1.5%, revenue has increased by 19.2% over the past year with expected growth of 25.5% annually outstripping the market's 5.2%. However, dividends are poorly covered by earnings and free cash flows, raising concerns about sustainability amidst aggressive acquisition strategies and auditor changes.

- Upon reviewing our latest growth report, Regal Partners' projected financial performance appears quite optimistic.

- Click here and access our complete balance sheet health report to understand the dynamics of Regal Partners.

Turning Ideas Into Actions

- Access the full spectrum of 45 Undervalued ASX Stocks Based On Cash Flows by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MP1

Megaport

Provides on-demand interconnection and internet exchange services to the enterprises and service providers in Australia, New Zealand, Hong Kong, Singapore, Japan, North America, and Europe.

High growth potential with excellent balance sheet.