Botanix Pharmaceuticals (ASX:BOT) delivers shareholders solid 122% return over 1 year, surging 17% in the last week alone

Unfortunately, investing is risky - companies can and do go bankrupt. But if you pick the right stock, you can make a lot more than 100%. For example, the Botanix Pharmaceuticals Limited (ASX:BOT) share price has soared 122% in the last 1 year. Most would be very happy with that, especially in just one year! Meanwhile the share price is 17% higher than it was a week ago. It is also impressive that the stock is up 44% over three years, adding to the sense that it is a real winner.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

Check out our latest analysis for Botanix Pharmaceuticals

Given that Botanix Pharmaceuticals didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Botanix Pharmaceuticals grew its revenue by 37% last year. We respect that sort of growth, no doubt. While that revenue growth is pretty good the share price performance outshone it, with a lift of 122% as mentioned above. If the profitability is on the horizon then now could be a very exciting time to be a shareholder. Of course, we are always cautious about succumbing to 'fear of missing out' when a stock has shot up strongly.

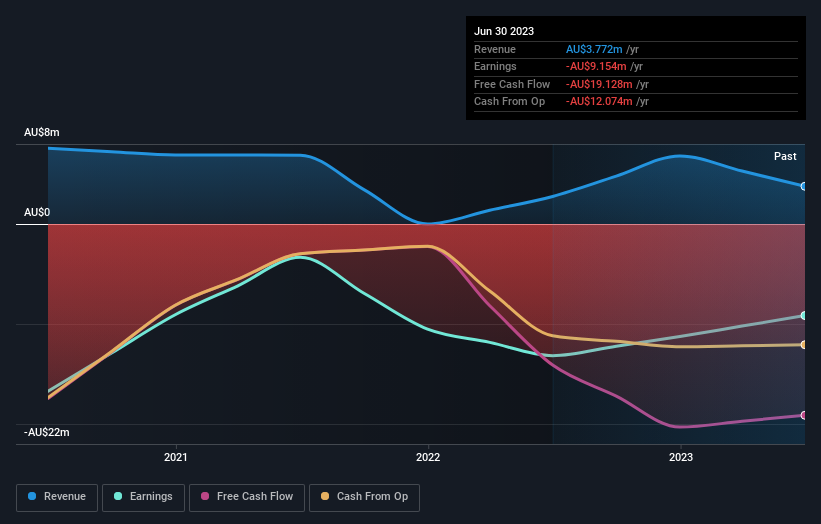

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

It's nice to see that Botanix Pharmaceuticals shareholders have received a total shareholder return of 122% over the last year. That's better than the annualised return of 12% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand Botanix Pharmaceuticals better, we need to consider many other factors. Case in point: We've spotted 4 warning signs for Botanix Pharmaceuticals you should be aware of, and 1 of them is potentially serious.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Botanix Pharmaceuticals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:BOT

Botanix Pharmaceuticals

Engages in the research and development of dermatology and antimicrobial products in Australia and the United States.

Exceptional growth potential with excellent balance sheet.