Discover Airtasker And 2 Other Promising Penny Stocks On The ASX

Reviewed by Simply Wall St

As Australian shares see a modest uptick in ASX 200 futures, investors are keenly watching the Reserve Bank of Australia's upcoming rate decision and geopolitical developments that could influence market dynamics. In such a landscape, identifying stocks with potential becomes crucial. While the term "penny stocks" might seem outdated, these smaller or newer companies can offer significant growth opportunities when backed by strong financials. This article explores three penny stocks on the ASX that stand out for their potential to deliver value amidst current market conditions.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.365 | A$104.6M | ✅ 3 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.29 | A$108.03M | ✅ 4 ⚠️ 3 View Analysis > |

| GTN (ASX:GTN) | A$0.62 | A$118.24M | ✅ 3 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.86 | A$440.96M | ✅ 4 ⚠️ 2 View Analysis > |

| Duratec (ASX:DUR) | A$1.435 | A$362.18M | ✅ 3 ⚠️ 1 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.785 | A$471.97M | ✅ 4 ⚠️ 1 View Analysis > |

| Sugar Terminals (NSX:SUG) | A$0.99 | A$363.6M | ✅ 2 ⚠️ 2 View Analysis > |

| Navigator Global Investments (ASX:NGI) | A$1.77 | A$867.44M | ✅ 5 ⚠️ 3 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$4.15 | A$196.92M | ✅ 3 ⚠️ 1 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.80 | A$144.98M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 469 stocks from our ASX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Airtasker (ASX:ART)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Airtasker Limited operates a technology-enabled online marketplace for local services in Australia, with a market capitalization of A$136.24 million.

Operations: The company generates revenue from two segments: New Marketplaces, contributing A$2.09 million, and Established Marketplaces, which account for A$46.89 million.

Market Cap: A$136.24M

Airtasker Limited, with a market capitalization of A$136.24 million, operates debt-free and maintains a strong liquidity position with short-term assets (A$66.4M) exceeding both its short-term (A$9.7M) and long-term liabilities (A$55.4M). Despite being unprofitable with increasing losses over the past five years, it has not diluted shareholders recently and trades at 76% below its estimated fair value. The company's revenue is forecast to grow by 16.52% annually, supported by an experienced management team and board of directors, while maintaining a cash runway for more than three years due to positive free cash flow growth.

- Get an in-depth perspective on Airtasker's performance by reading our balance sheet health report here.

- Examine Airtasker's earnings growth report to understand how analysts expect it to perform.

Bell Financial Group (ASX:BFG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Bell Financial Group Limited provides full-service and online broking, corporate finance, and financial advisory services to private, institutional, and corporate clients across several regions including Australia, the US, the UK, Hong Kong, and Kuala Lumpur with a market cap of A$386.50 million.

Operations: The company's revenue is primarily derived from Broking (A$173.47 million), followed by Products & Services (A$51.01 million) and Technology & Platforms (A$29.89 million).

Market Cap: A$386.5M

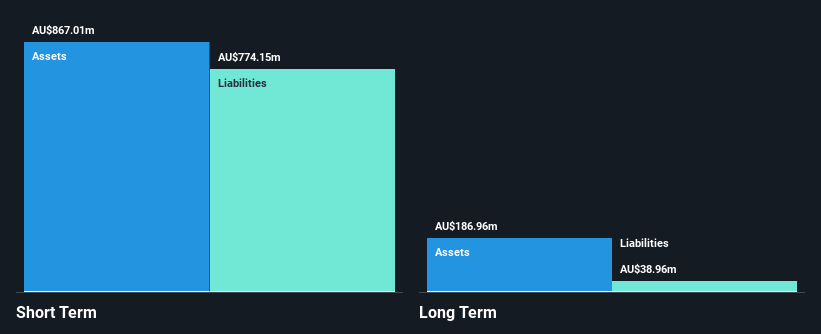

Bell Financial Group, with a market cap of A$386.50 million, demonstrates financial stability through its short-term assets (A$867.0M) exceeding liabilities and a reduced debt-to-equity ratio over five years. Despite negative operating cash flow impacting debt coverage and low return on equity (12.8%), the company shows solid earnings growth of 26.4% over the past year, outperforming industry averages. Trading at 14.9% below estimated fair value, it offers good relative value compared to peers but faces challenges with dividend sustainability due to inadequate free cash flow coverage and high non-cash earnings impacting profit quality.

- Click here and access our complete financial health analysis report to understand the dynamics of Bell Financial Group.

- Learn about Bell Financial Group's future growth trajectory here.

Cyclopharm (ASX:CYC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Cyclopharm Limited manufactures and sells medical equipment and radiopharmaceuticals across the Asia Pacific, Europe, Canada, the United States, and internationally with a market cap of A$123.92 million.

Operations: The company's revenue is primarily derived from its Medical Imaging Systems segment, which generated A$27.57 million.

Market Cap: A$123.92M

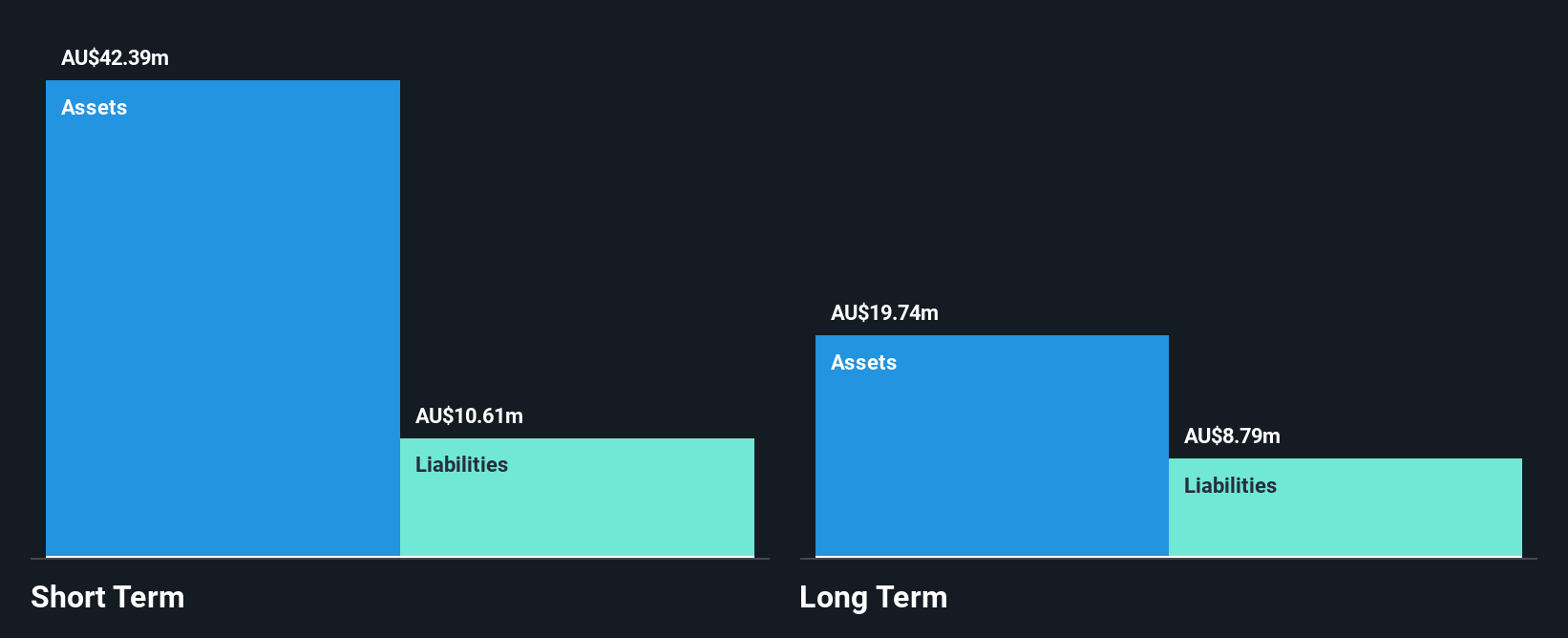

Cyclopharm Limited, with a market cap of A$123.92 million, benefits from strong financial positioning as its short-term assets (A$42.4M) exceed both short-term (A$10.6M) and long-term liabilities (A$8.8M). The company is debt-free and has an experienced management team with an average tenure of 5.8 years, contributing to operational stability despite current unprofitability and negative return on equity (-30.89%). Recent installations of Technegas® at Brooke Army Medical Center in Houston highlight strategic expansion efforts, although the firm remains challenged by increasing losses over five years at a rate of 18.7% annually amidst forecasts for substantial earnings growth ahead.

- Jump into the full analysis health report here for a deeper understanding of Cyclopharm.

- Gain insights into Cyclopharm's outlook and expected performance with our report on the company's earnings estimates.

Make It Happen

- Gain an insight into the universe of 469 ASX Penny Stocks by clicking here.

- Searching for a Fresh Perspective? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 22 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ART

Airtasker

Engages in the provision of technology-enabled online marketplaces for local services in Australia.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives