- Australia

- /

- Metals and Mining

- /

- ASX:STK

ASX Opportunities: 3 Penny Stocks With Market Caps Over A$400M

Reviewed by Simply Wall St

The Australian market saw a flattish green day, with the ASX200 inching up by one-tenth of a percent as investors remained cautious amidst ongoing global economic uncertainties and fluctuating commodity prices. In such conditions, discerning investors often seek opportunities in lesser-known segments like penny stocks, which despite their outdated moniker, continue to offer intriguing prospects for growth. These stocks typically represent smaller or newer companies that can combine attractive price points with strong financials, potentially offering upside without the heightened risks usually associated with this investment area.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.475 | A$136.13M | ✅ 4 ⚠️ 3 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.845 | A$52.62M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$3.06 | A$470.29M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.63 | A$267.92M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$3.04 | A$3.47B | ✅ 4 ⚠️ 2 View Analysis > |

| LaserBond (ASX:LBL) | A$0.50 | A$59.04M | ✅ 4 ⚠️ 2 View Analysis > |

| Praemium (ASX:PPS) | A$0.86 | A$411.45M | ✅ 4 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.31 | A$1.42B | ✅ 3 ⚠️ 1 View Analysis > |

| Fleetwood (ASX:FWD) | A$2.74 | A$253.67M | ✅ 3 ⚠️ 2 View Analysis > |

| MaxiPARTS (ASX:MXI) | A$2.28 | A$126.64M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 416 stocks from our ASX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Race Oncology (ASX:RAC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Race Oncology Limited is a clinical stage biopharmaceutical company in Australia that focuses on developing treatments for cancer patients, with a market cap of A$598.81 million.

Operations: The company generates its revenue from the Australian market, amounting to A$6.04 million.

Market Cap: A$598.81M

Race Oncology Limited, a clinical-stage biopharmaceutical company, remains pre-revenue with earnings forecasted to decline by 1% annually over the next three years. Despite being debt-free and having short-term assets exceeding liabilities, its cash runway is less than a year if free cash flow continues to decrease. The company recently appointed Professor Laurence Hurley to its Scientific Advisory Board, enhancing its expertise in G-quadruplex targeting drugs. While Race's share price has been volatile and management lacks experience with an average tenure of 1.5 years, recent strategic developments may bolster future prospects in cancer treatment innovation.

- Take a closer look at Race Oncology's potential here in our financial health report.

- Assess Race Oncology's future earnings estimates with our detailed growth reports.

Strickland Metals (ASX:STK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Strickland Metals Limited is involved in the exploration of mineral resources in Australia and has a market capitalization of A$418.54 million.

Operations: There are no reported revenue segments for Strickland Metals Limited.

Market Cap: A$418.54M

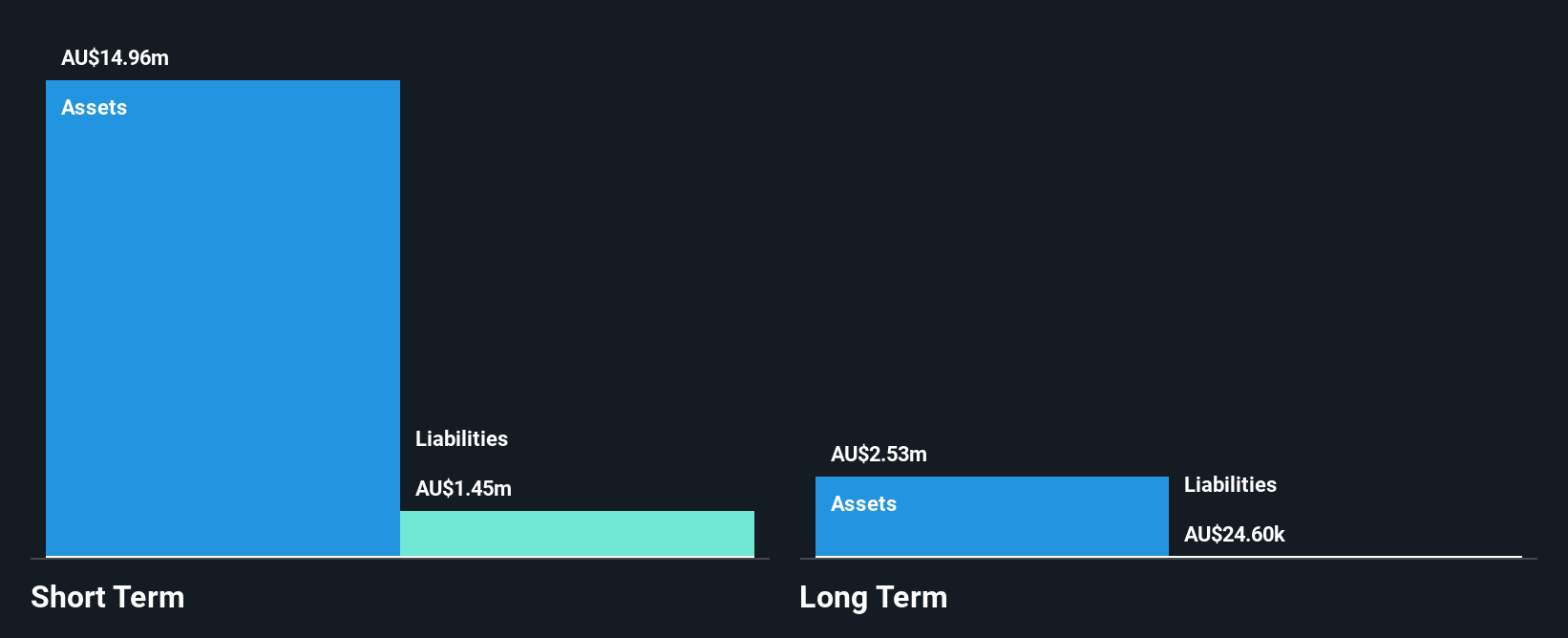

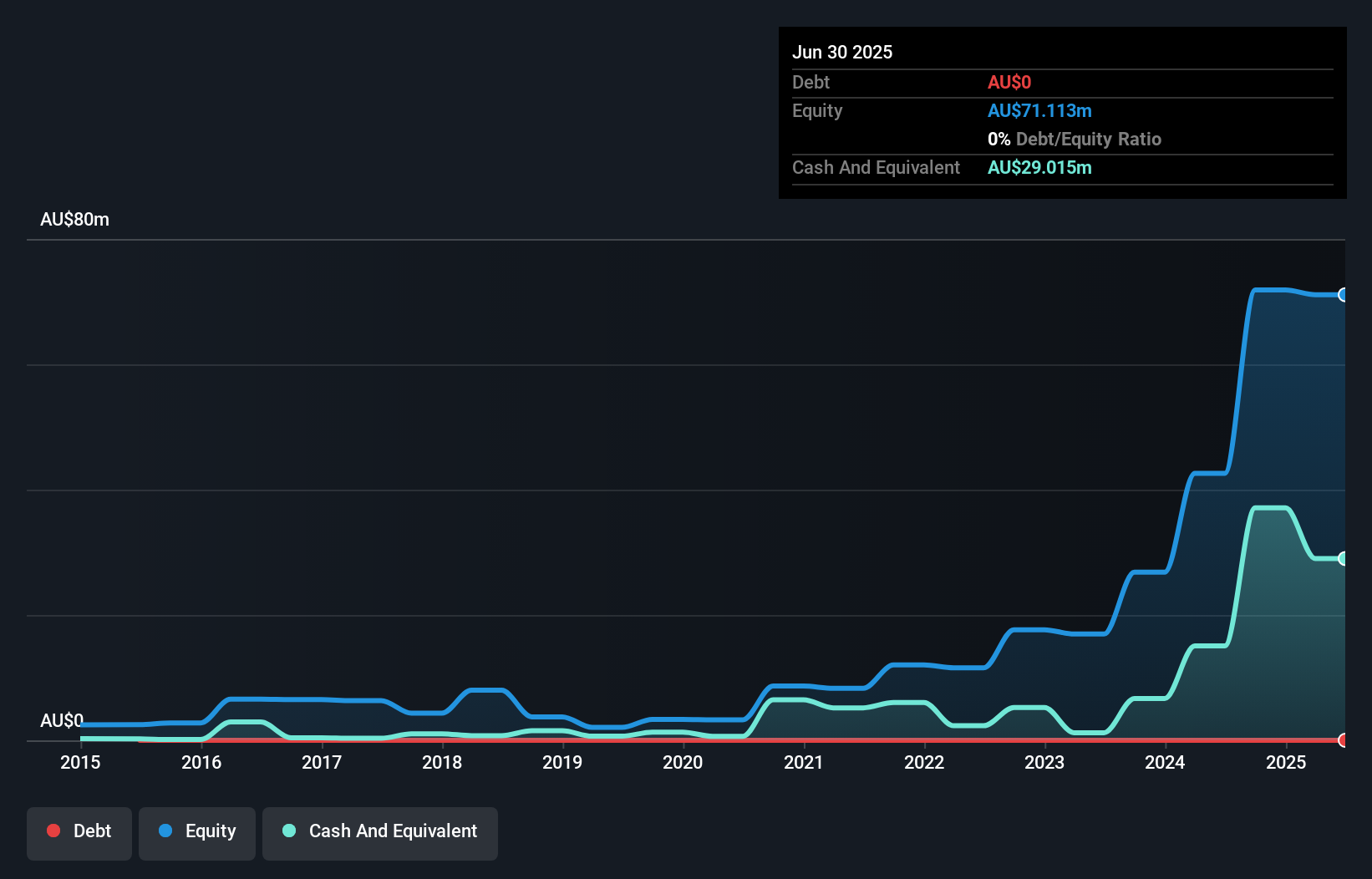

Strickland Metals Limited, a pre-revenue exploration company with a market capitalization of A$418.54 million, has recently achieved profitability but faces challenges with low return on equity at 0.3%. The company is debt-free and maintains strong liquidity with short-term assets of A$67.5 million surpassing liabilities. Recent executive changes include the appointment of James Dent as Senior Exploration Geologist, bringing significant expertise to its projects. Despite stable weekly volatility at 13%, earnings are projected to decline significantly over the next three years, posing risks for investors seeking growth in this sector.

- Get an in-depth perspective on Strickland Metals' performance by reading our balance sheet health report here.

- Gain insights into Strickland Metals' future direction by reviewing our growth report.

WIA Gold (ASX:WIA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: WIA Gold Limited, with a market cap of A$516.45 million, is involved in the exploration and evaluation of mineral properties in Namibia and Côte d’Ivoire through its subsidiaries.

Operations: There are no reported revenue segments for WIA Gold Limited.

Market Cap: A$516.45M

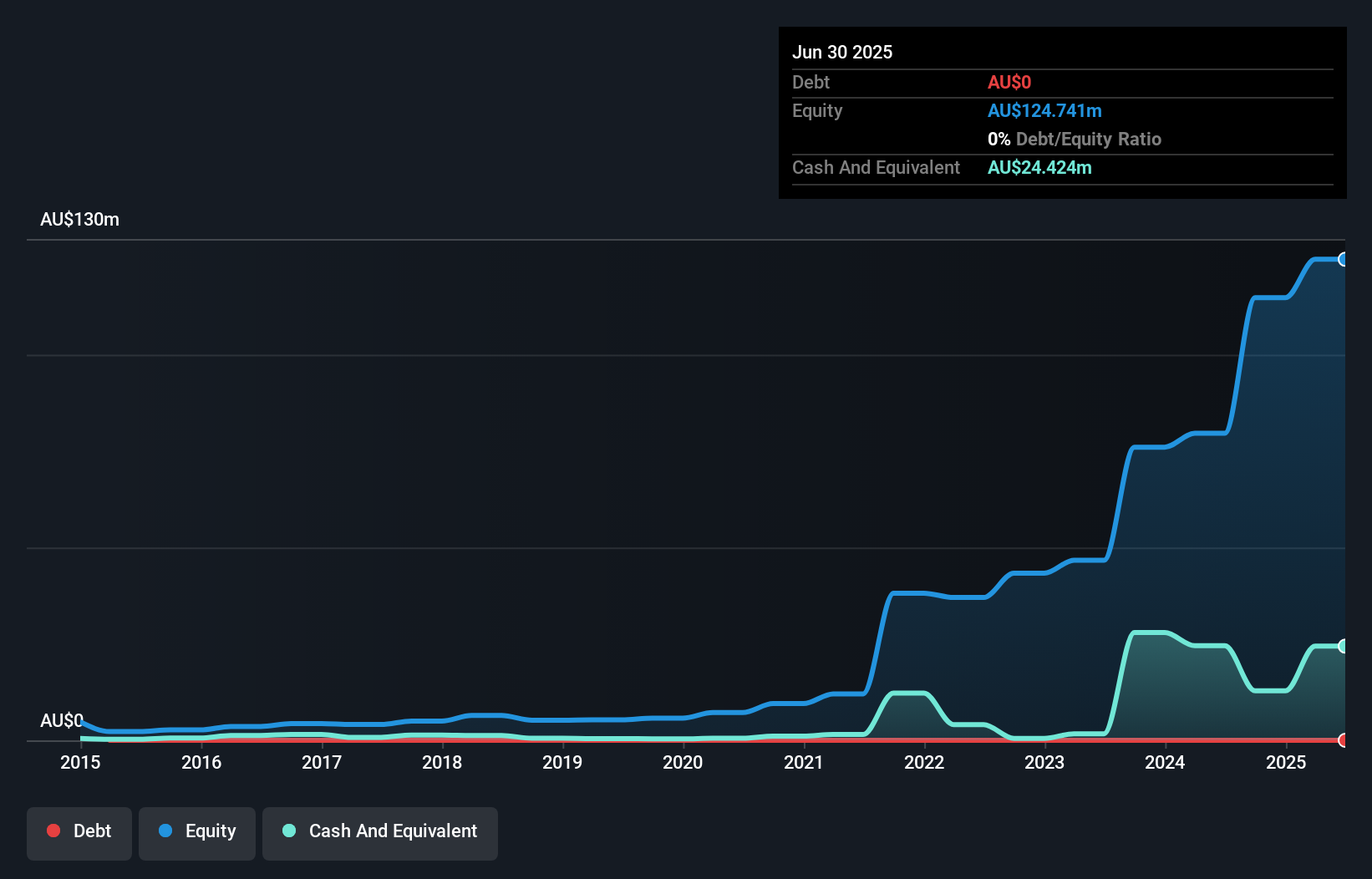

WIA Gold Limited, with a market cap of A$516.45 million, is a pre-revenue exploration company focused on mineral properties in Namibia and Côte d’Ivoire. Despite being unprofitable with increasing losses over the past five years, WIA maintains strong liquidity as its short-term assets of A$29.6 million exceed liabilities significantly. The company recently completed a follow-on equity offering raising A$30 million, which bolsters its cash runway for over a year without debt concerns. However, the management and board are relatively new with limited tenure, potentially impacting strategic direction and decision-making stability going forward.

- Dive into the specifics of WIA Gold here with our thorough balance sheet health report.

- Understand WIA Gold's track record by examining our performance history report.

Taking Advantage

- Click through to start exploring the rest of the 413 ASX Penny Stocks now.

- Want To Explore Some Alternatives? Uncover 13 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:STK

Strickland Metals

Engages in the exploration of mineral resources in Australia.

Flawless balance sheet with questionable track record.

Market Insights

Community Narratives