- Australia

- /

- Metals and Mining

- /

- ASX:PLS

Why Pilbara Minerals (ASX:PLS) Is Up 11.7% After Lithium Market Rally Highlights Supply Chain Role

Reviewed by Sasha Jovanovic

- In recent days, Pilbara Minerals has been highlighted for its vital role in global lithium supply as renewed demand and supply disruptions sparked a rally in the lithium and critical minerals markets.

- The company’s large-scale lithium production and strong presence in the renewable energy sector underscore its importance in supporting the transition to electric vehicles and battery storage worldwide.

- We'll explore how lithium price momentum and ongoing industry supply shifts influence Pilbara Minerals' investment narrative and future prospects.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Pilbara Minerals Investment Narrative Recap

To hold Pilbara Minerals as a shareholder, you need conviction in the long-term demand for lithium, fueled by the global transition to electric vehicles and renewable energy storage. While the latest rally in spot lithium and mining shares is drawing attention, the key short-term catalyst remains the direction of lithium prices; persistent volatility here could still pose the biggest risk, as it directly impacts earnings recovery and ability to fund growth initiatives. The sharp rally on recent supply disruptions and resurgent demand does not resolve the underlying revenue pressure from prior price weakness, it only reinforces just how sensitive the business is to market swings.

Among recent company updates, Pilbara Minerals’ full-year FY 2025 results highlighted significant revenue decline and a net loss of A$195.77 million, tying financial outcomes closely to lithium price shifts. This context makes the current uplift in sentiment especially relevant when considering future prospects, as periods of higher pricing may support operational improvements but may not fully offset the company’s exposure to ongoing market risks.

Yet, if lithium prices reverse again, the impact on margins and project timelines is something investors should be fully aware of…

Read the full narrative on Pilbara Minerals (it's free!)

Pilbara Minerals' narrative projects A$1.4 billion revenue and A$247.0 million earnings by 2028. This requires 23.0% yearly revenue growth and a A$442.8 million increase in earnings from A$-195.8 million today.

Uncover how Pilbara Minerals' forecasts yield a A$2.69 fair value, a 22% downside to its current price.

Exploring Other Perspectives

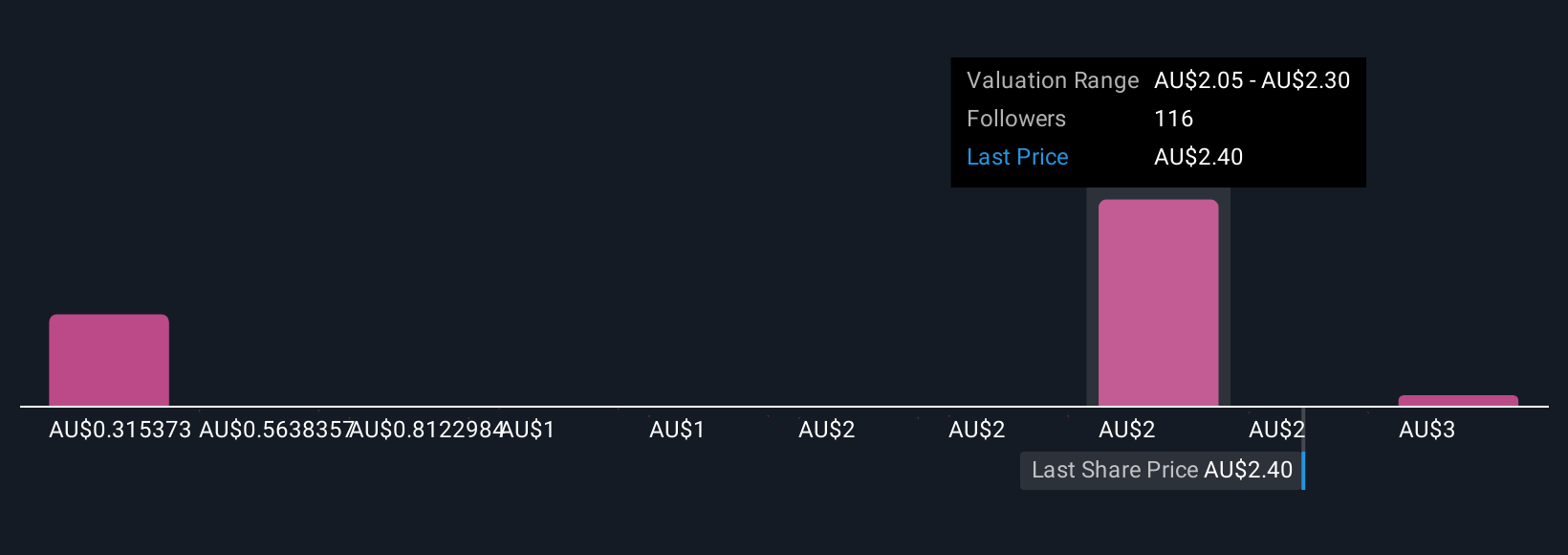

Simply Wall St Community users provided 18 fair value estimates for Pilbara Minerals, ranging from A$0.26 to A$2.80 per share. With so many distinct views, remember that the company’s sensitivity to lithium price swings highlights the importance of considering multiple opinions before making any investment decision.

Explore 18 other fair value estimates on Pilbara Minerals - why the stock might be worth as much as A$2.80!

Build Your Own Pilbara Minerals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pilbara Minerals research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Pilbara Minerals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pilbara Minerals' overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PLS

Pilbara Minerals

Engages in the exploration, development, and operation of mineral resources in Australia.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives