- Australia

- /

- Metals and Mining

- /

- ASX:TSL

ASX Penny Stocks To Watch In November 2025

Reviewed by Simply Wall St

The Australian market is experiencing a cautious close to the week, with futures indicating a slight decline amid ongoing concerns about AI valuations and job cuts impacting global sentiment. In such uncertain times, investors often seek opportunities in lesser-known corners of the market where potential value can be found. Penny stocks, though an outdated term, still refer to smaller or emerging companies that might offer growth potential and affordability when backed by strong financials.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.465 | A$133.26M | ✅ 4 ⚠️ 3 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.88 | A$54.8M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.98 | A$458M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.56 | A$262.75M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$3.04 | A$3.47B | ✅ 4 ⚠️ 2 View Analysis > |

| Praemium (ASX:PPS) | A$0.87 | A$416.23M | ✅ 4 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.22 | A$1.36B | ✅ 3 ⚠️ 1 View Analysis > |

| Fleetwood (ASX:FWD) | A$2.87 | A$265.71M | ✅ 3 ⚠️ 2 View Analysis > |

| Perenti (ASX:PRN) | A$2.55 | A$2.4B | ✅ 3 ⚠️ 3 View Analysis > |

| GWA Group (ASX:GWA) | A$2.40 | A$630.63M | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 417 stocks from our ASX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Ora Banda Mining (ASX:OBM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Ora Banda Mining Limited is an Australian company focused on the exploration, operation, and development of mineral properties, with a market cap of A$2.27 billion.

Operations: The company generates revenue primarily from its gold mining operations, amounting to A$404.29 million.

Market Cap: A$2.27B

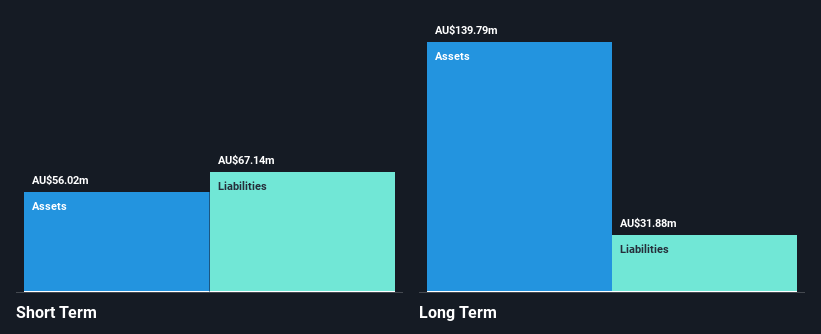

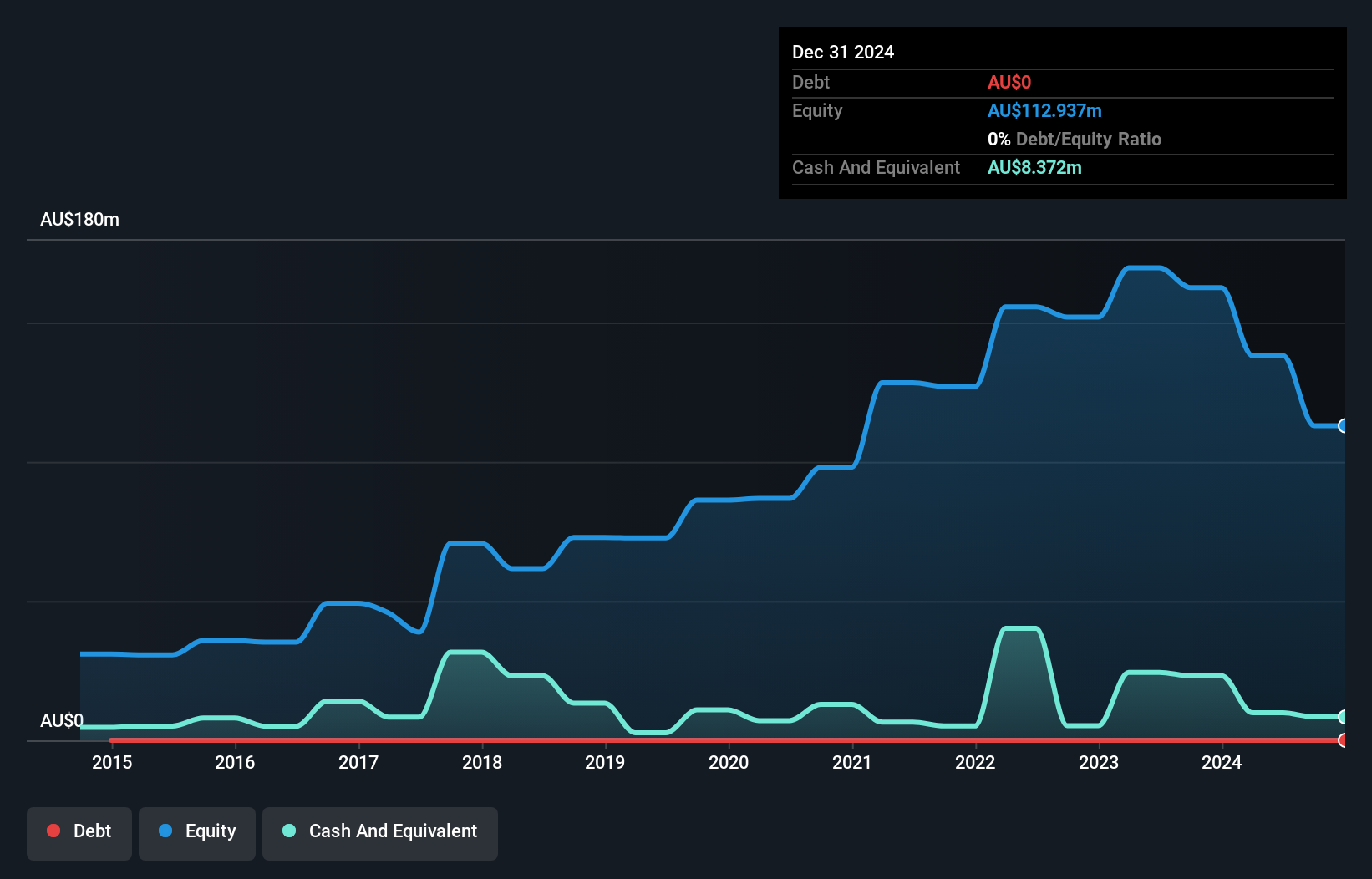

Ora Banda Mining has demonstrated significant earnings growth, with a 575% increase over the past year, surpassing both its historical average and industry peers. The company trades at a substantial discount to estimated fair value and maintains strong financial health, with short-term assets exceeding liabilities and more cash than total debt. Its net profit margin improved significantly from 12.9% to 46%, supported by high-quality earnings despite a high level of non-cash components. Recent annual results showed sales of A$404.29 million and net income rising sharply to A$186.08 million, reflecting robust operational performance in its gold mining activities.

- Click here to discover the nuances of Ora Banda Mining with our detailed analytical financial health report.

- Gain insights into Ora Banda Mining's future direction by reviewing our growth report.

Sheffield Resources (ASX:SFX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sheffield Resources Limited is involved in the evaluation and development of mineral sands in Australia, with a market cap of A$43.51 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: A$43.51M

Sheffield Resources Limited, with a market cap of A$43.51 million, is currently pre-revenue and faces challenges typical of early-stage mining ventures. Despite having no debt for the past five years and sufficient cash runway for over a year based on current free cash flow, the company reported a net loss of A$22.05 million for the year ending June 30, 2025. The stock's volatility remains high compared to most Australian stocks, and auditors have expressed doubts about its ability to continue as a going concern. However, short-term assets significantly exceed liabilities, providing some financial stability amid ongoing losses.

- Dive into the specifics of Sheffield Resources here with our thorough balance sheet health report.

- Explore Sheffield Resources' analyst forecasts in our growth report.

Titanium Sands (ASX:TSL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Titanium Sands Limited focuses on the exploration and development of mineral sands projects in Sri Lanka, with a market cap of A$23.45 million.

Operations: Titanium Sands Limited has not reported any revenue segments.

Market Cap: A$23.45M

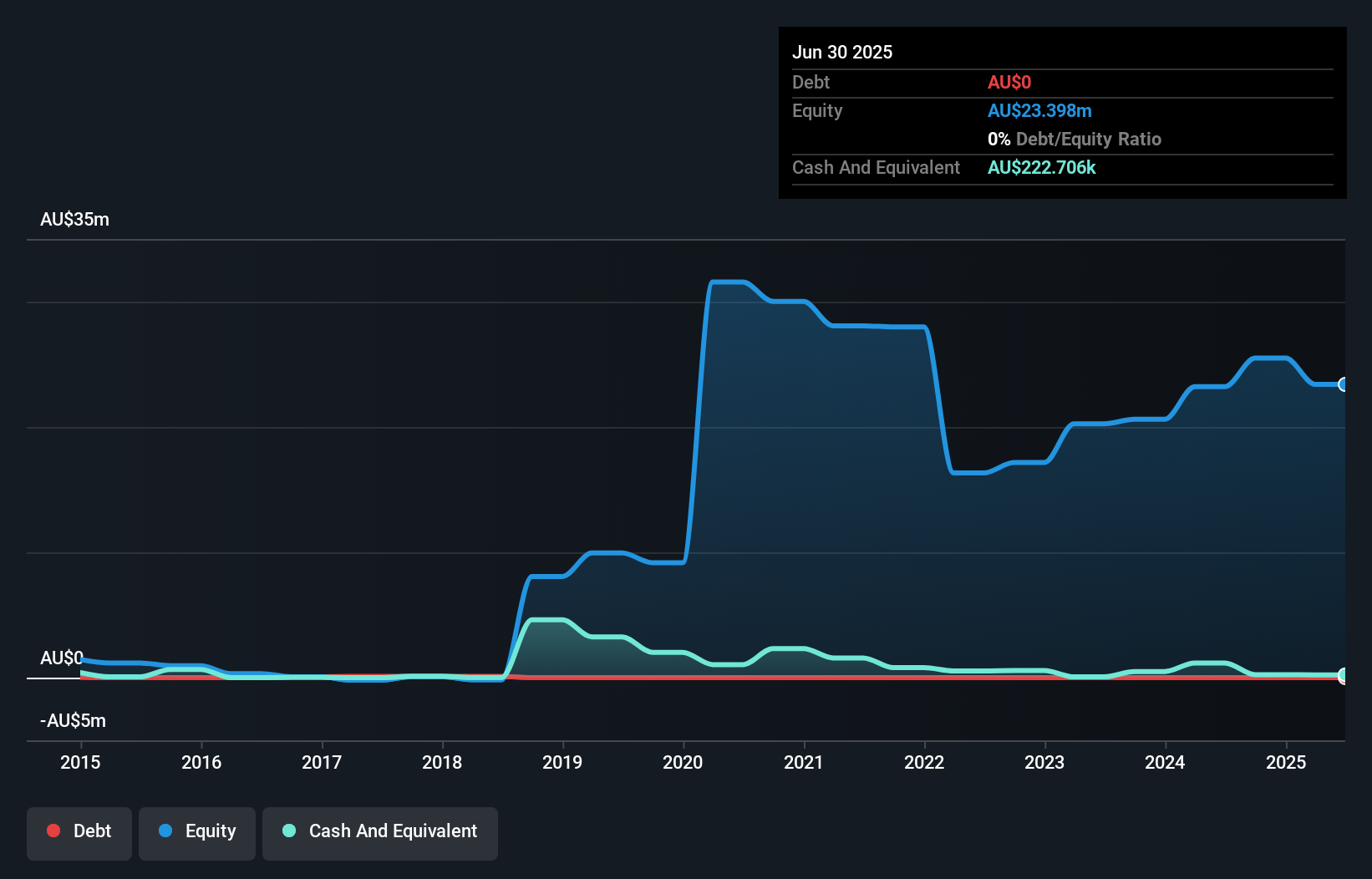

Titanium Sands Limited, with a market cap of A$23.45 million, is pre-revenue and operates in the mineral sands sector in Sri Lanka. Despite being debt-free and having short-term assets exceeding liabilities, the company faces financial challenges with less than a year of cash runway based on current free cash flow. The recent annual report highlighted a net loss of A$1.09 million for the year ending June 30, 2025, and auditors have raised concerns about its ability to continue as a going concern. Share price volatility remains high compared to most Australian stocks, reflecting investor uncertainty.

- Click to explore a detailed breakdown of our findings in Titanium Sands' financial health report.

- Gain insights into Titanium Sands' past trends and performance with our report on the company's historical track record.

Make It Happen

- Access the full spectrum of 417 ASX Penny Stocks by clicking on this link.

- Ready For A Different Approach? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Titanium Sands might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:TSL

Titanium Sands

Engages in the exploration and development of mineral sands project in Sri Lanka.

Moderate risk with adequate balance sheet.

Market Insights

Community Narratives