Investors Met With Slowing Returns on Capital At Nufarm (ASX:NUF)

If we want to find a potential multi-bagger, often there are underlying trends that can provide clues. Firstly, we'll want to see a proven return on capital employed (ROCE) that is increasing, and secondly, an expanding base of capital employed. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. However, after investigating Nufarm (ASX:NUF), we don't think it's current trends fit the mold of a multi-bagger.

Understanding Return On Capital Employed (ROCE)

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. The formula for this calculation on Nufarm is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

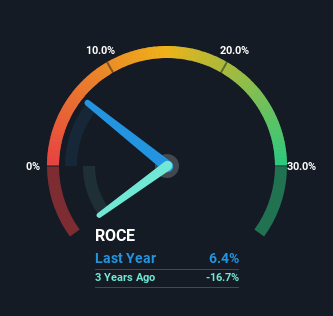

0.064 = AU$241m ÷ (AU$4.6b - AU$873m) (Based on the trailing twelve months to September 2023).

So, Nufarm has an ROCE of 6.4%. On its own, that's a low figure but it's around the 7.0% average generated by the Chemicals industry.

View our latest analysis for Nufarm

In the above chart we have measured Nufarm's prior ROCE against its prior performance, but the future is arguably more important. If you'd like, you can check out the forecasts from the analysts covering Nufarm here for free.

So How Is Nufarm's ROCE Trending?

Over the past five years, Nufarm's ROCE and capital employed have both remained mostly flat. It's not uncommon to see this when looking at a mature and stable business that isn't re-investing its earnings because it has likely passed that phase of the business cycle. With that in mind, unless investment picks up again in the future, we wouldn't expect Nufarm to be a multi-bagger going forward.

On a side note, Nufarm has done well to reduce current liabilities to 19% of total assets over the last five years. Effectively suppliers now fund less of the business, which can lower some elements of risk.

In Conclusion...

In a nutshell, Nufarm has been trudging along with the same returns from the same amount of capital over the last five years. And in the last five years, the stock has given away 17% so the market doesn't look too hopeful on these trends strengthening any time soon. Therefore based on the analysis done in this article, we don't think Nufarm has the makings of a multi-bagger.

While Nufarm doesn't shine too bright in this respect, it's still worth seeing if the company is trading at attractive prices. You can find that out with our FREE intrinsic value estimation on our platform.

While Nufarm isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

Valuation is complex, but we're here to simplify it.

Discover if Nufarm might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:NUF

Nufarm

Develops, manufactures, and sells crop protection solutions and seed technologies in Europe, the Middle East, Africa, North America, and the Asia Pacific.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives