Stock Analysis

- Australia

- /

- Metals and Mining

- /

- ASX:VSL

Unveiling High Insider Ownership Growth Stocks On The ASX In May 2024

Reviewed by Simply Wall St

As of May 2024, the Australian Securities Exchange (ASX) is experiencing a slight downturn, with nearly all sectors showing declines except for materials. This overall market sentiment highlights the importance of cautious investment strategies. In such times, stocks with high insider ownership can be particularly appealing as they often indicate a strong belief by management and major stakeholders in the company's future prospects, which could be crucial in navigating through current market conditions.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Hartshead Resources (ASX:HHR) | 13.9% | 86.3% |

| Cettire (ASX:CTT) | 28.7% | 29.9% |

| Gratifii (ASX:GTI) | 15.6% | 112.4% |

| Acrux (ASX:ACR) | 14.6% | 115.3% |

| Doctor Care Anywhere Group (ASX:DOC) | 28.4% | 96.4% |

| Hillgrove Resources (ASX:HGO) | 10.4% | 45.4% |

| Alpha HPA (ASX:A4N) | 28.3% | 95.9% |

| Liontown Resources (ASX:LTR) | 16.4% | 63.9% |

| SiteMinder (ASX:SDR) | 11.4% | 69.4% |

| Plenti Group (ASX:PLT) | 12.6% | 68.5% |

Below we spotlight a couple of our favorites from our exclusive screener.

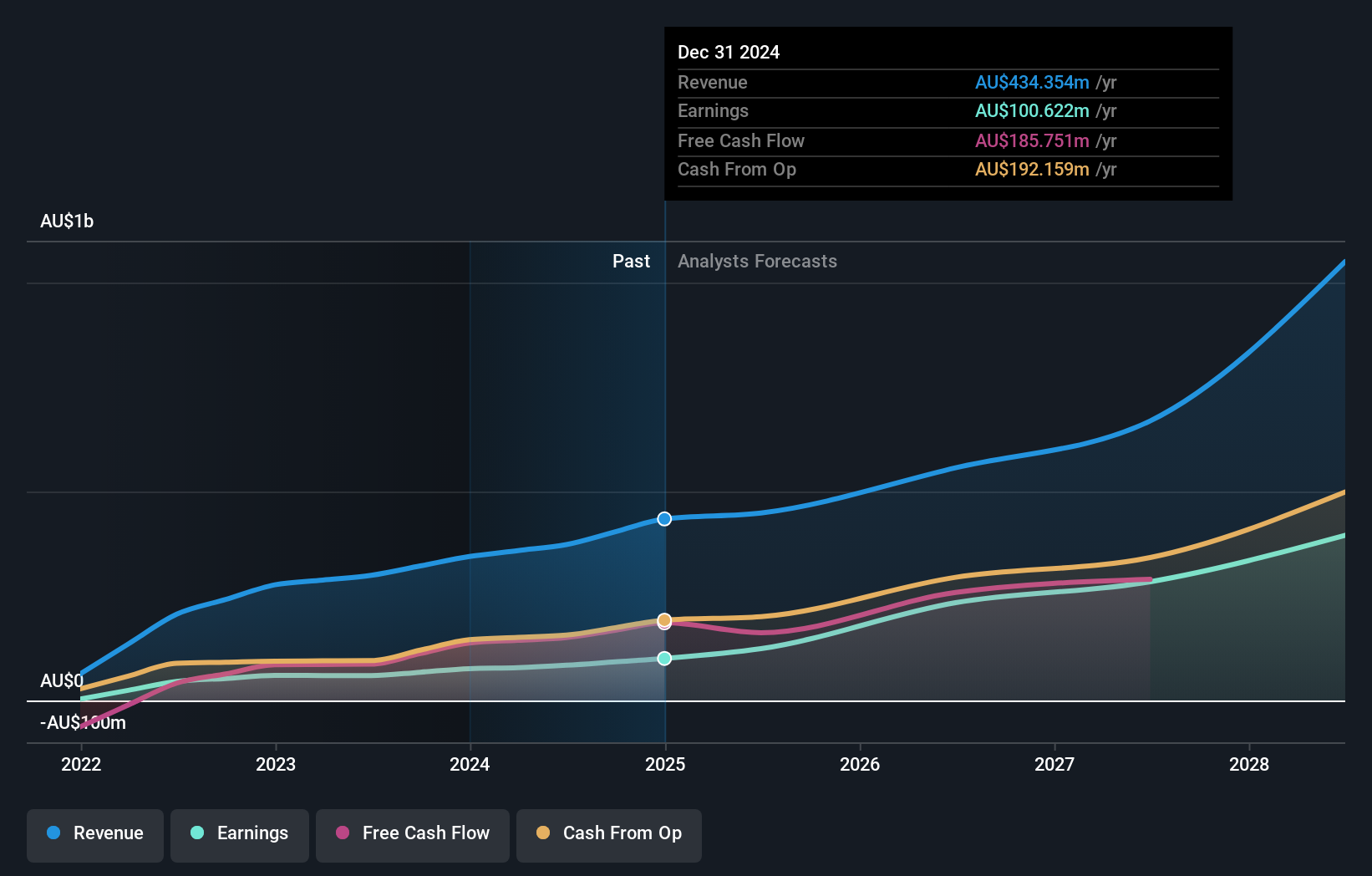

Emerald Resources (ASX:EMR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Emerald Resources NL is a company focused on the exploration and development of mineral reserves in Cambodia and Australia, with a market capitalization of approximately A$2.47 billion.

Operations: The company generates its revenue primarily from mine operations, which amounted to A$339.32 million.

Insider Ownership: 18.5%

Earnings Growth Forecast: 22.8% p.a.

Emerald Resources has demonstrated robust growth, with earnings increasing by 53.4% over the past year and expected to grow at 22.8% annually, outpacing the Australian market's average. Despite this strong performance, its trading value is significantly below estimated fair value, suggesting potential undervaluation. However, concerns include shareholder dilution in the past year and a forecasted low return on equity of 17.9%. Recent financial results show a substantial increase in sales and net income compared to the previous year, reinforcing its growth trajectory.

- Click here and access our complete growth analysis report to understand the dynamics of Emerald Resources.

- Our valuation report here indicates Emerald Resources may be undervalued.

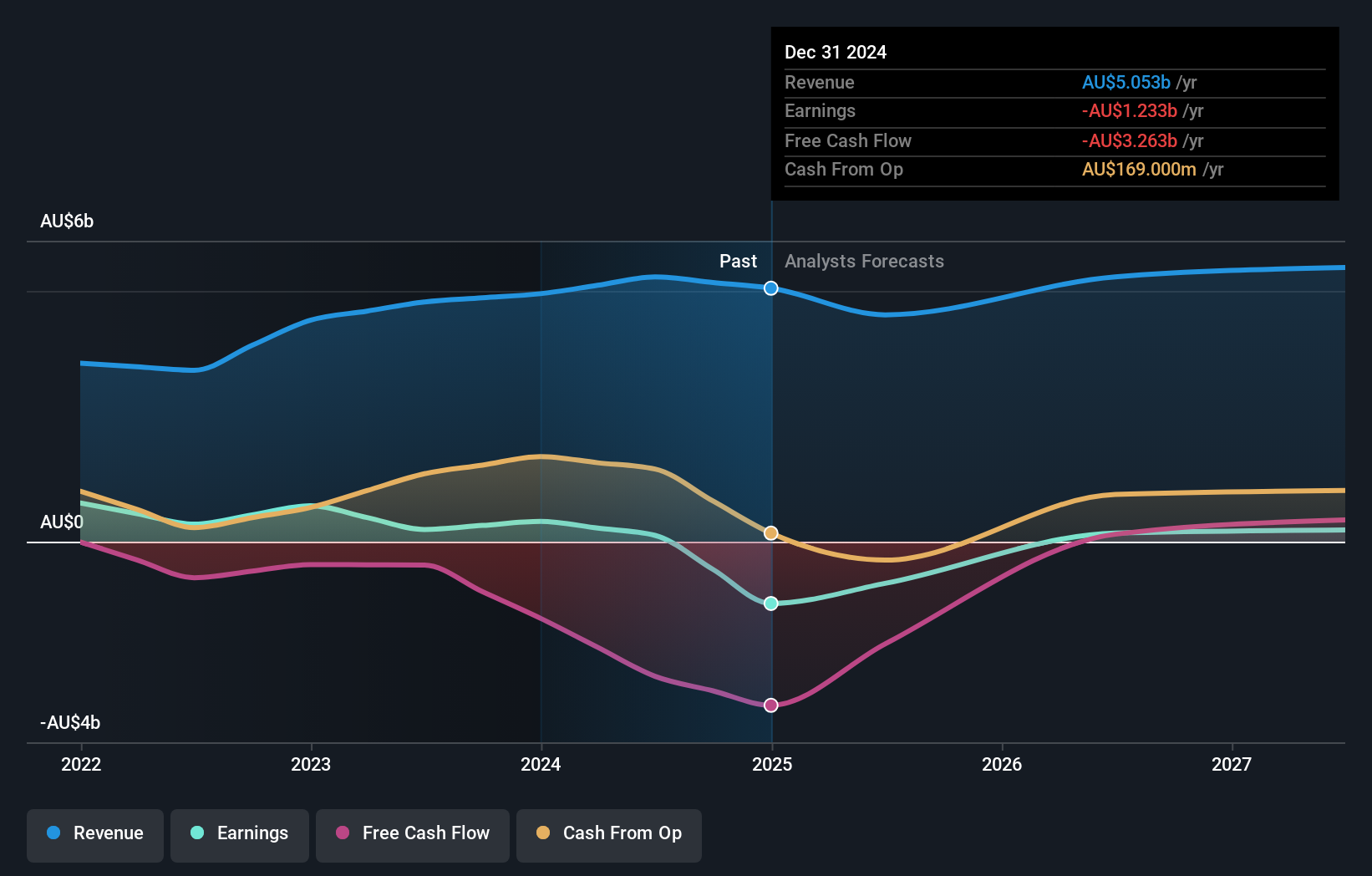

Mineral Resources (ASX:MIN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Mineral Resources Limited, along with its subsidiaries, functions as a mining services company in Australia, Asia, and globally, boasting a market capitalization of approximately A$15.21 billion.

Operations: The company generates revenue from three primary segments: lithium (A$1.60 billion), iron ore (A$2.50 billion), and mining services (A$2.82 billion).

Insider Ownership: 11.6%

Earnings Growth Forecast: 29.2% p.a.

Mineral Resources is positioned for substantial growth, with earnings projected to increase by 29.2% annually, surpassing the Australian market forecast of 13.7%. The company's revenue growth at 10.7% per year also outstrips the national average of 5%. Despite a significant drop in profit margins from last year, trading at 29.3% below its estimated fair value suggests potential undervaluation. Recent financials indicate robust half-year sales and net income improvements, though dividends have decreased to A$0.20 per share.

- Delve into the full analysis future growth report here for a deeper understanding of Mineral Resources.

- Our expertly prepared valuation report Mineral Resources implies its share price may be too high.

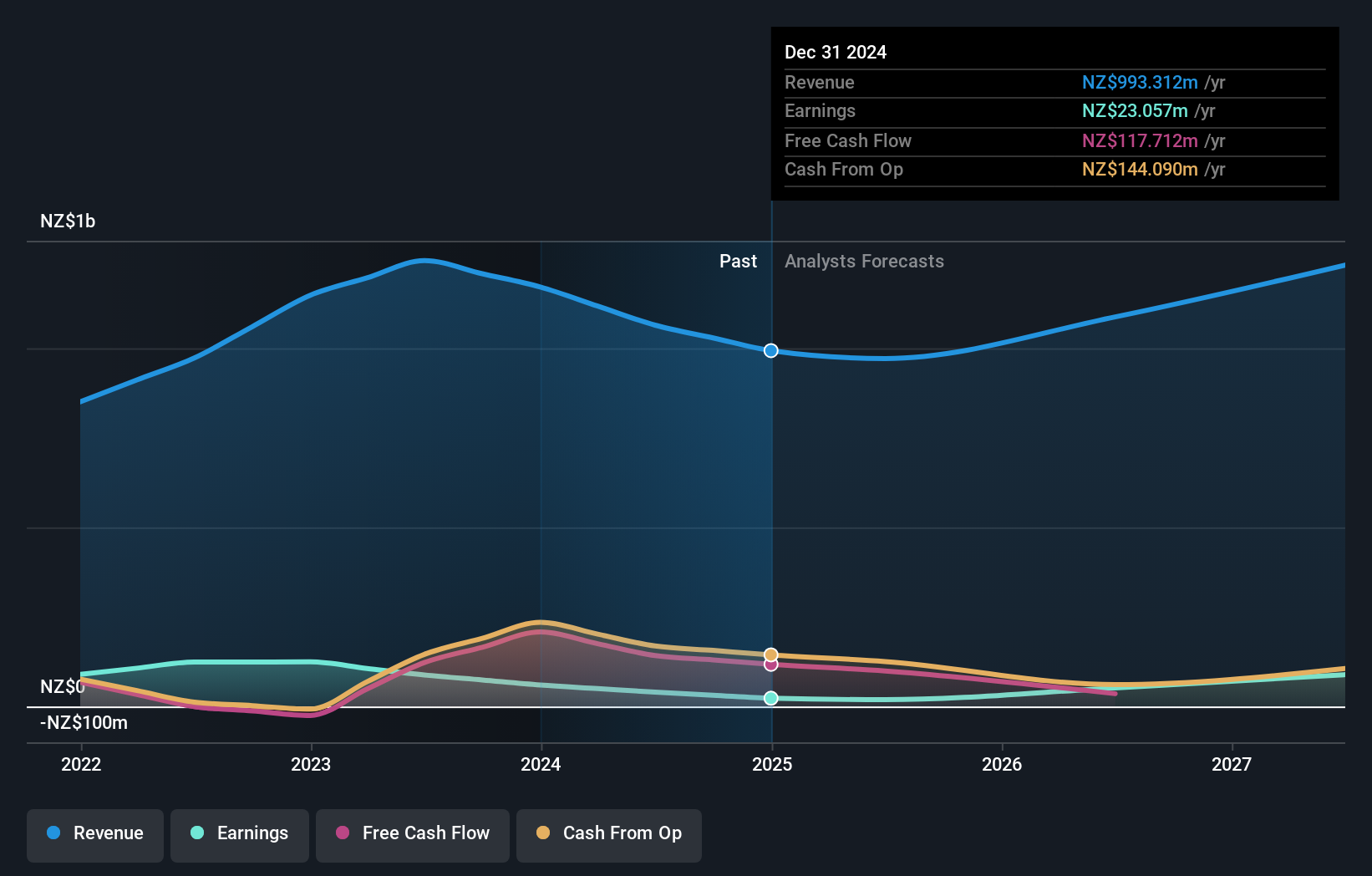

Vulcan Steel (ASX:VSL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vulcan Steel Limited operates in New Zealand and Australia, focusing on the sale and distribution of steel and metal products, with a market capitalization of approximately A$906.72 million.

Operations: The company generates revenue primarily through two segments: Metals, which brought in NZ$638.86 million, and Wholesale - Miscellaneous, contributing NZ$532.02 million.

Insider Ownership: 34.5%

Earnings Growth Forecast: 27.1% p.a.

Vulcan Steel's forecasted return on equity is impressively high at 40.1% in three years, indicating strong profitability potential. However, its revenue growth lags behind the Australian market average at 2.4% per year compared to 5%. Despite recent insider buying, volumes were not substantial and the company carries a high level of debt which could pose financial risks. Additionally, Vulcan Steel's dividend coverage by earnings is weak, suggesting potential sustainability issues for payouts to shareholders.

- Click here to discover the nuances of Vulcan Steel with our detailed analytical future growth report.

- According our valuation report, there's an indication that Vulcan Steel's share price might be on the expensive side.

Turning Ideas Into Actions

- Gain an insight into the universe of 90 Fast Growing ASX Companies With High Insider Ownership by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Vulcan Steel is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:VSL

Vulcan Steel

Engages in the sale and distribution of steel and metal products in New Zealand and Australia.

Reasonable growth potential with mediocre balance sheet.