The ASX200 is set to trade flat today, reflecting a mixed session on Wall Street where the Dow Jones closed at record highs while the S&P 500 and NASDAQ ended in the red. With local CPI data for July and retail sales figures due later this week, investors are keeping a close eye on economic indicators. In such an environment, growth companies with high insider ownership can be particularly attractive as they often signal confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Hartshead Resources (ASX:HHR) | 13.9% | 102.6% |

| Cettire (ASX:CTT) | 28.7% | 26.7% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 13.6% | 28.1% |

| Acrux (ASX:ACR) | 14.6% | 115.6% |

| Liontown Resources (ASX:LTR) | 16.4% | 69.7% |

| Catalyst Metals (ASX:CYL) | 17.5% | 75.7% |

| Hillgrove Resources (ASX:HGO) | 10.4% | 49.4% |

| Adveritas (ASX:AV1) | 21.1% | 103.9% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| Change Financial (ASX:CCA) | 26.6% | 77.9% |

Let's dive into some prime choices out of the screener.

Aussie Broadband (ASX:ABB)

Simply Wall St Growth Rating: ★★★★☆☆

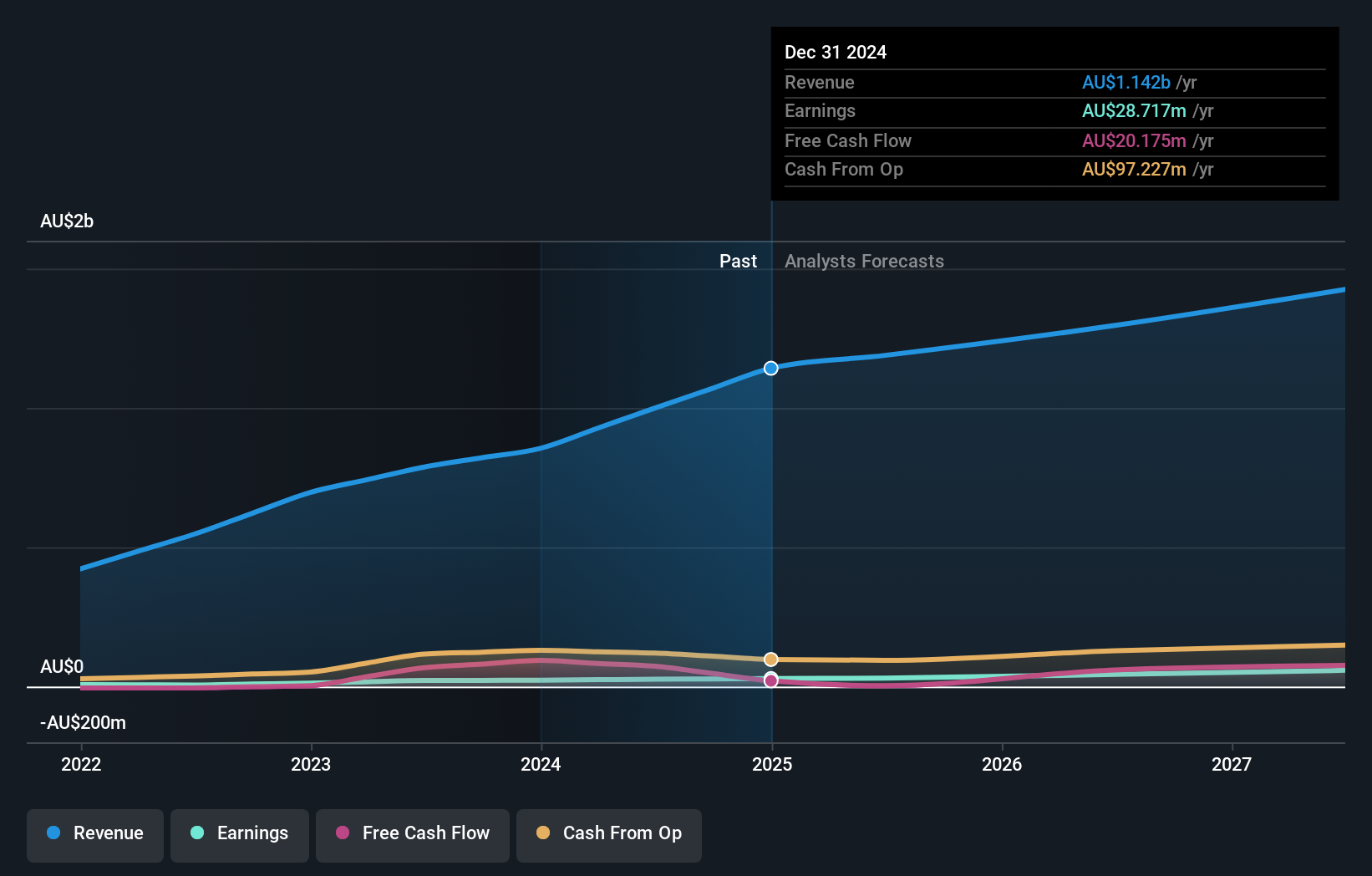

Overview: Aussie Broadband Limited provides telecommunications services to residential and business customers in Australia, with a market cap of A$1.03 billion.

Operations: Aussie Broadband's revenue segments include A$549.59 million from Residential, A$125.25 million from Wholesale, A$94.21 million from Business, and A$85.85 million from Enterprise and Government sectors.

Insider Ownership: 10.8%

Earnings Growth Forecast: 27.6% p.a.

Aussie Broadband, a growth company with high insider ownership, is forecasted to achieve annual earnings growth of 27.6%, outpacing the Australian market's 13.6%. Despite recent shareholder dilution, its earnings grew by 83.8% last year and are expected to continue growing significantly over the next three years. Trading at 71.6% below its fair value estimate, ABB reported full-year sales of A$999.75 million and net income of A$26.38 million for FY2024.

- Get an in-depth perspective on Aussie Broadband's performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential undervaluation of Aussie Broadband shares in the market.

Mineral Resources (ASX:MIN)

Simply Wall St Growth Rating: ★★★★★☆

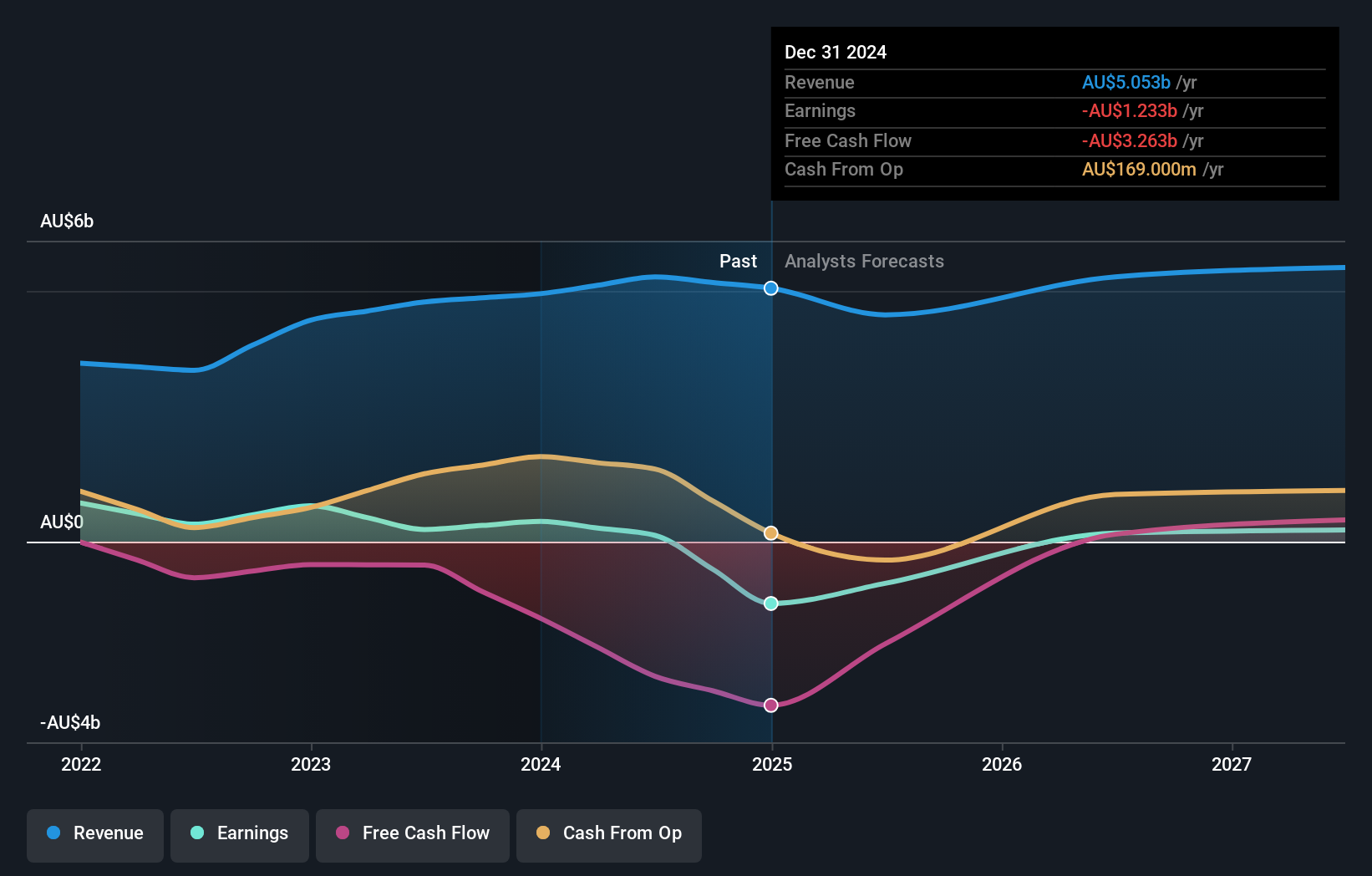

Overview: Mineral Resources Limited, with a market cap of A$8.77 billion, operates as a mining services company in Australia, Asia, and internationally through its subsidiaries.

Operations: The company's revenue segments include Lithium (A$1.60 billion), Iron Ore (A$2.50 billion), and Mining Services (A$2.82 billion).

Insider Ownership: 11.6%

Earnings Growth Forecast: 23.3% p.a.

Mineral Resources is forecasted to achieve annual earnings growth of 23.3%, surpassing the Australian market's 13.6%. Its revenue is expected to grow at 10.7% per year, faster than the market average of 5.3%. Despite a decline in profit margins from 16.3% to 7.9%, it trades at a significant discount, being valued at 65.7% below its estimated fair value and has high insider ownership with no recent substantial insider trading activity reported.

- Take a closer look at Mineral Resources' potential here in our earnings growth report.

- Our expertly prepared valuation report Mineral Resources implies its share price may be too high.

Technology One (ASX:TNE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Technology One Limited develops, markets, sells, implements, and supports integrated enterprise business software solutions in Australia and internationally with a market cap of A$7.46 billion.

Operations: The company's revenue segments include Software (A$317.24 million), Corporate (A$83.83 million), and Consulting (A$68.13 million).

Insider Ownership: 12.3%

Earnings Growth Forecast: 14.8% p.a.

Technology One's revenue is expected to grow at 11.5% annually, outpacing the Australian market's 5.3%. Its earnings are forecasted to increase by 14.8% per year, also above the market average of 13.6%. The recent appointment of Paul Robson as an independent Non-Executive Director brings valuable SaaS expertise and strategic insight, enhancing its growth trajectory and operational efficiency on a global scale. No substantial insider trading activity has been reported recently.

- Dive into the specifics of Technology One here with our thorough growth forecast report.

- Insights from our recent valuation report point to the potential overvaluation of Technology One shares in the market.

Turning Ideas Into Actions

- Dive into all 89 of the Fast Growing ASX Companies With High Insider Ownership we have identified here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Technology One might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:TNE

Technology One

Develops, markets, sells, implements, and supports integrated enterprise business software solutions in Australia and internationally.

Flawless balance sheet with reasonable growth potential.